Alpha Trend Analysis of Gold

Futures

Erich K. Soltes

Sep 13, 2005

This report will examine Gold

Futures on a daily, weekly and monthly basis. A technical analysis

for each chart will be presented with explanation on where the

security is currently and what needs to occur to maintain the

current position. Additionally, long term and short term support

and resistance price will be provided.

First a little background information on the Alpha Trend Analysis

system. This system has been in development for almost 15 years.

The Alpha Trend is the primary trend line that I created. It

is an adaptive moving average using trigonometric functions.

It is from this primary trend line from which all other formulas

are derived. There are six moving average trend lines that are

used to analyze a security. The short term indicators are upper

and lower bands; these are 2 days in length. The mid term indicator

is the Alpha Trend, indicated by the bold red line, which is

several weeks in length. Lastly are, the one year moving average

which is red colored, the five year moving average which is bright

green colored and the ten year moving average which is black

colored, of the Alpha Trend. In addition to the moving averages

there are six wave bands.

These wave bands are called

Alpha Trend Wave bands they are Fibonacci advance and retracement

of the Alpha Trend. The chart contains two windows. The

top window indicates whether the current position is long, short

or neutral. A long position is indicated by one (1), a short

position is indicated by a negative one (-1) and a neutral position

is indicated by a zero (0). The bottom window contains the securities

information along with the six moving averages. At the very bottom

of the chart the primary trend of either bullish or bearish is

indicated.

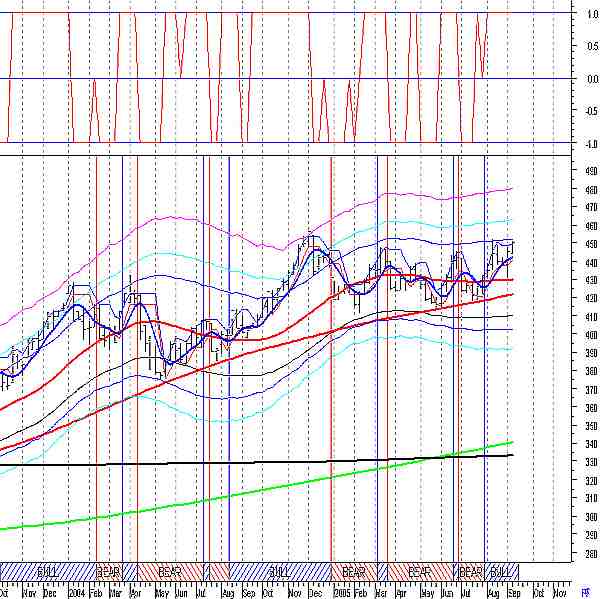

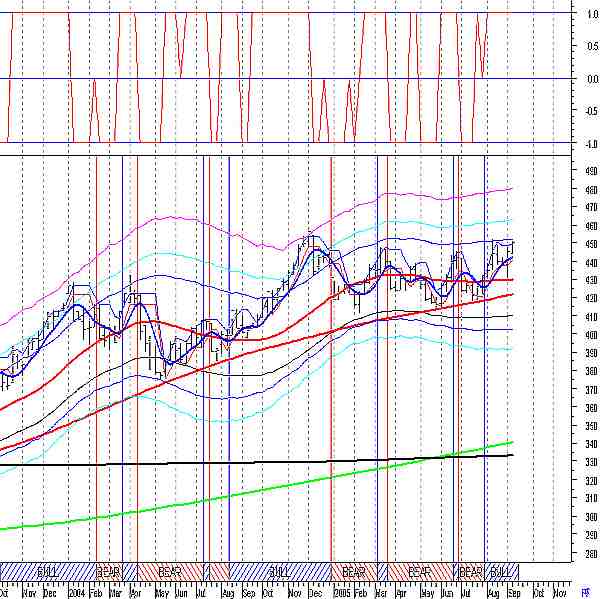

Above is the Daily chart for

Gold Futures.

The current position for gold is long with a current sell price

of 450.31. The current trend of Gold is bullish with the Alpha

Trend trending up. Friday's closing price is 1.8719 percent above

the Alpha Trend Support price of 441.7312. The one year moving

average of the Alpha Trend is trending up. Friday's closing price

is 4.9046 percent above the one year moving average of the Alpha

Trend support price of 428.9613. For the last few days Gold has

been approaching the upper band of the 1st Alpha Trend Wave resistance

price of $452.12. The 1st Alpha Trend Wave is rolling over if

Gold can not break through this resistance price we should see

a pullback to the Alpha Trend support price of 441.7312.

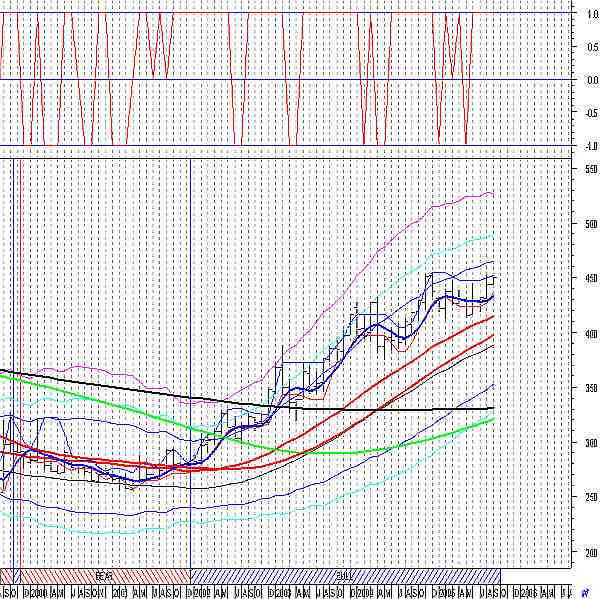

Above is the Weekly chart for

Gold Futures.

The current position for Gold is long and the current trend for

Gold is bullish. The Alpha Trend is trending up with Friday's

closing price 4.6451 percent the Alpha Trend Support price of

430.0247. The one year moving average of the Alpha Trend is trending

up with Friday's closing price 6.6401 percent above the one year

moving average of the Alpha Trend support price of 421.9800.

On the weekly chart Gold is approaching the 1st Alpha Trend Wave

resistance price of 452.225. Just as on the daily chart Gold

should be topping out at this resistance price and Gold should

pullback to the Alpha Trend support price 430.02. On the weekly

chart gold has held above the one year moving average of the

Alpha Trend since mid - August of 2001. This trend line is a

major support line currently at 421.98. If Gold is topping out

and the Alpha Trend doesn't hold Gold should hold above 421.98

support price.

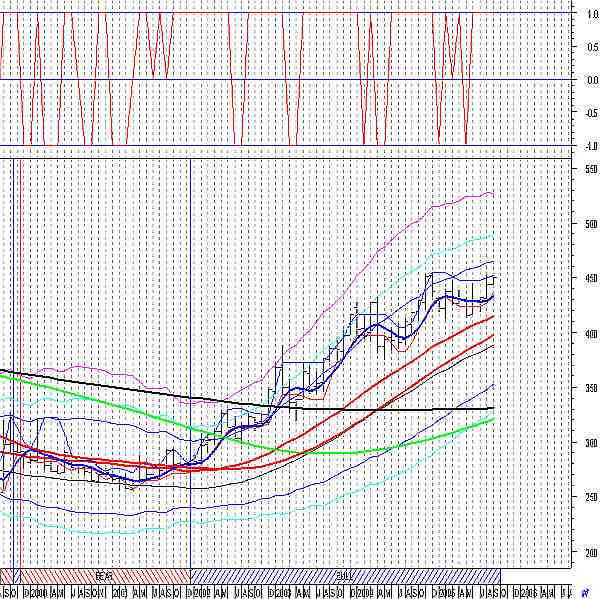

Above is the Monthly chart

for Gold Futures.

The current position is long and the current trend is bullish.

The Alpha Trend is trending up with Friday's closing price 8.4361

percent above the Alpha Trend Support price of 414.9908. The

one year moving average of the Alpha Trend is trending up with

Friday's closing price, 13.1797 percent above the support price

of the one year moving average of the Alpha Trend of 397.5978.

Gold has held above the Alpha Trend since December 31, 2001 this

trend line is a major support line currently at 414.99.

In conclusion, Gold has been in a major bull market since the

end of 2001. For those who watch Gold on a daily basis it has

been a madding slow bull market, however this does imply that

this market has much far to go. When the Gold market is viewed

on a weekly and monthly chart the bull market is apparent and

the support prices have held for years. Gold does appear to be

topping in the short term, the first support price is 441.73

after that next support price range is 421.98 - 430.02 this price

range is from both the daily and weekly charts.

Erich K. Soltes

email: erich@alphatrendanalysis.com

Alpha Trend Analysis

About Erich

Soltes

A graduate of

Brookfield High School in Brookfield CT and an Eagle Scout, Erich

went on to graduate from SUNY Maritime College in New York City

in 1988, with a BS in Marine Transportation and a minor in Economics.

For the next ten years he was a Navel Reserve officer and a Merchant

Marine officer. In 1998 he went to work on Wall Street obtaining

his series 7, 63 and 65 licenses. He worked both as a stockbroker

and a financial planner helping clients obtain their financial

goals. In 2004 he was able to finally reach his goal of developing

a mathematical trading model that could beat the "buy and

hold" method of investing. In mid 2005 the Alpha Trend Analysis

website was created.

For more information

on the Alpha Trend System and the daily newsletter please

go to alphatrendanalysis.com.

DISCLOSURE: Erich K. Soltes is

the Owner of Alpha Trend Analysis, which contains the opinions

of E. K. Soltes, and is provided for informational purposes only.

Neither Erich Soltes nor Alpha Trend Analysis, provide individual

investment advice and will not advise you personally concerning

the nature, potential, or value of any particular stock or investment

strategy. To the extent that any of the information contained

in this article may be deemed investment advice, such information

is impersonal and not tailored to the investment needs of any

specific person. Past results of Alpha Trend Analysis, or E. K.

Soltes are not necessarily indicative of future performance. Erich

Soltes, entities that he controls, family, and associates, may

have positions in securities mentioned in this article and may

close them at any time.

Alpha Trend

Analysis does not represent the accuracy, nor does it warranty

the accuracy, completeness or timeliness of the statements made

on its web site or in its email alerts. The information provided

should therefore be used as a basis for continued, independent

research into a security referenced in this article so that the

Subscriber forms his or her own opinion regarding any investment

in a security mentioned in it. The Subscriber therefore agrees

that he or she alone bears complete responsibility for his or

her own investment research and decisions. We are not and do not

represent ourselves to be a registered investment adviser, or

advisory firm or company. You should consult a qualified financial

advisor or broker before making any investment decision and to

help you evaluate any information you may receive from this article.

Consequently,

the Subscriber understands and agrees that by using any of Alpha

Trend Analysis services, either directly or indirectly, Alpha

Trend Analysis shall not be liable to anyone for any loss, injury

or damage resulting from the use of, or information attained from

Alpha Trend Analysis or any of its services.

Recent Gold/Silver/$$$ essays at 321gold:

Feb 20 Silver North Hits Best Hole in Their History in Yukon Bob Moriarty 321gold

Feb 20 The Next Gold Stocks Rally Hot Juniors Morris Hubbartt 321gold

Feb 20 Gold Chinese New Year Adam Hamilton 321gold

Feb 19 ESGold Moves to Production Alongside Exploration Bob Moriarty 321gold

Feb 17 A Bull Era: Robots & Gold Stewart Thomson 321gold

Feb 15 Bitcoin, Stock Market & Gold captainewave 321gold

|

321gold Inc

|