| |||

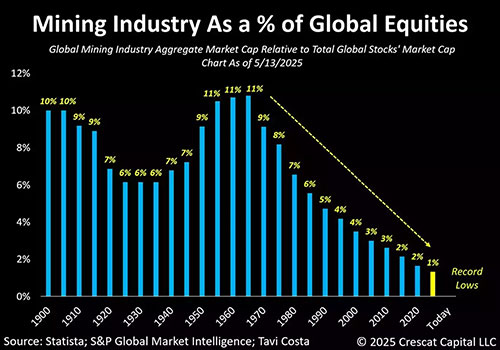

ESGold Moves to Production Alongside ExplorationBob Moriarty While in a rational world gold and silver would be in an ongoing correction after the parabolic move higher ending in late January. Confusion is tossed into the mix with conflicting sentiment indicators alongside a ten-day lack of participation on the part of the Chinese due to the Lunar New Year holiday. Meanwhile the DSI limps along with gold at 57 and silver at 52 indicating neither a top pending nor a bottom. I came across an interesting chart recently in an email from Jay Taylor. Actually, I stole the chart from Jay but he stole it from Lukas Ekwueme on X so I don’t feel all that guilty especially since I see that it originally was produced by Crescat. So, Lukas may have stolen it from Crescat Capital and Jay stole it from him but I just recycled it from Jay. (Click on image to enlarge) If you feel that your mining stocks are absurdly cheap relative to everything else in the world part of the reason might be because they are absurdly cheap relative to shares worldwide. Crescat points out that if mining shares just returned to the percentage of the total investment market in 1970 they would have to go up 1000%. Naturally many will go up more. We may be in a correction but this bull has a long way to run. A company approached me recently with an interesting value proposition. They intend to go into production processing the tailings from a prior mining period from 1910 to 1990 at the Montauban lead/zinc/gold mine located in Quebec. A former study from the mining period showed a resource of 12,000 ounces of gold with an additional million ounces of silver in the tailings. In addition, the resource showed 57,200 tonnes of mica also capable of being recovered. Using a figure of $400 per tonne for the mica, ESGold suggests a potential just from the mica of about $22.8 million in revenue. A further 43-101 dating back to a resource dated 2010 showed 47,198 ounces of gold and 481,000 ounces of silver located in the hard rock source from both the North Zone and the South Zone. Modern exploration conducted by the ESGold technical team has indicated Montauban appears to be a multi-lenses VMS deposit with the potential of having multiple stacked layers of VMS mineralization not recognized in past mining work. Management plans on advancing the fully permitted low capex tailings reprocessing plant for cash flow and conducting advanced exploration into the hard rock potential at the same time, thus avoiding the dip in share price prior to actually going into hard rock production. With $4900 gold and $75 silver the economics supports their plan. The company appears to be in good shape financially with completion of a C$4.5 million placement in December and a C$9 million line of credit from Ocean Partners in November of 2025. In addition ESGold is working on a plan for conducting an additional tailings project in Colombia at what they call the Bolivar tailings project. With continuing news and some management changes made in the middle of last year, the share price shot higher from $.45 at the end of May into early July advancing by 200%. Shares have settled down since then but have utterly failed to recognize the rocket ship higher advance of both gold and silver. Production is anticipated to commence in 2026 at Monaauban. ESGold is an advertiser so naturally I am biased. Please do your own due diligence. Do visit the company’s website and go through their corporate presentation. It is excellent. ESGold Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved