MoundReport.com's Monthly

Gold Report

Gold's Pending Collapse

James Mound

JMTG's Head Analyst

Apr 4, 2005

My gold customers must be quite

upset with me at the moment. I have been a gold bull for over

two years, but recently the merging of short, intermediate and

long term technical views have indicated a large increase in

the potential for a bear break in gold. Moreover, the dollar

supported out at a critical fundamental and technical price point

and appears prime to correct in the near term. With the upcoming

Employment Report this Friday one must look at this as a potential

catalyst to determine the near term trend in the dollar and in

turn metals. I cannot help but be a metals bear and owe my readers

what I always provide - an honest view. Gold will be well below

$400 by mid-summer and here's why:

THE US DOLLAR

Because gold is priced in US

dollars, and because the US dollar is the focal point of the

economic trend shift on a global level, we have recently witnessed

an impressive run in metals as the dollar has retraced 33% in

less than 3 years. But the trend in the dollar has changed. We

are in the midst of a rebound in the US dollar - perhaps to par

if not higher. Just look back to my comments back in late November.

The signs were all over the place - even then.

To recap November's article,

I called for a currency intervention of epic proportions over

an extended period of time from multiple parties. In 1995, backed

by powerful statements from Mr. Rubin and US government bigwigs,

the US declared a strong dollar policy that set in motion a 7

year bull run from 80 to 120 on the index. In less than 3 years

we have eliminated the entire move as the US tries to counter

balance numerous economic worries by increasing our export abilities.

Over this time we have seen gold go from relative modern day

lows to break historical price levels as we cleared $400 and

then the all important $430 as the dollar went to these extreme

lows. This time the European Union stands out as the glaring

difference between present day and 1995. No longer does US dollar

policy rule the global trading environment. We share this rule

with a growing power in the European currency structure and in

turn the bulk of European nations are at the same export disadvantage

the US had just under 3 years ago.

After the article, Treasury

Secretary Snow and a crowd of others came out and basically said

the dollar did what 'we' needed it to do and the plunge is over.

Technically speaking this spurred the run through critical resistance

at 8485 and the market ultimately leveled off in the mid-85 area,

only to test the lows again. The recent support, which incidentally

was above the double bottom support, shows the biggest technical

sign of all - the market was not willing to set fresh lows. So

a technical analyst would look at this and make one of two conclusions

- we are setting a narrowing channel (long term pennant) or the

market developed bottom support and is heading higher. Either

way, the dollar has seen its lows for a while, and if the market

breaks to 86 watch out.

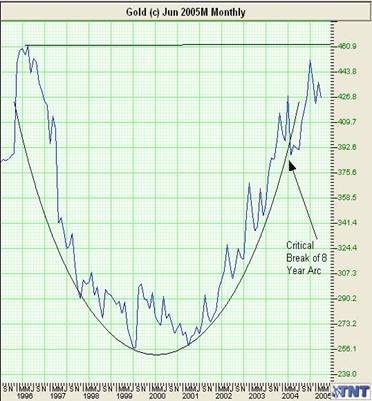

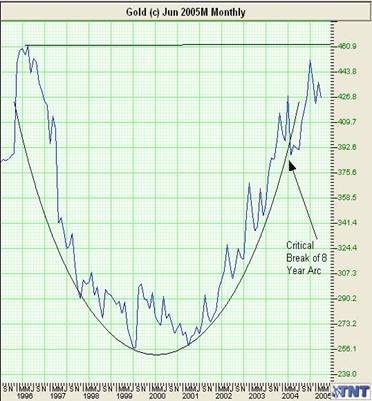

THE GOLDEN ARC

Followers of my newsletters

know that I am big on having proper macro perspectives on a market.

Perhaps, this is no more relevant than in gold analysis. On a

monthly chart, one sees what is possibly the most perfect and

true saucer formation I have ever come across, suggesting increasing

upward trend line support in gold for several years. But true

technicians know that saucers ultimately fail, and fail in a

fairly unpredictable fashion. Recent breaking of the tightest

arch you could effectively draw on the monthly chart suggests

a weakening in the fortitude of the pattern, and the recent strong

support in the dollar and 'life raft' pause by the gold market

suggests the writing is on the wall for a full on break of this

long term pattern.

The bottom line is a move to

360 doesn't change the long term bullishness of the market. In

fact it's a blip on the screen if you are a true gold

bull. Even if the dollar is in a dead cat bounce it is still

enough to see that type of retracment. Face it. The dollar is

set to move higher, and metals are long overdue for a small spec

shakeout. Get out of the way and thank me later.

March 30th, 2005

James Mound

JMTG's Head

Analyst

email: info@Moundreport.com

Open a commodity trading account

with JMTG Brokerage, the firm that brings you the MoundReport.

Contact a customer service representative

at 888-744-8866 or by email at info@Moundreport.com

for more information.

Charts Courtesy

of Gecko Software's TracknTrade

Disclaimer: There is risk of loss

in all commodities trading. Please consult a James Mound Trading

Group Broker before you trade for the first time. Losses can exceed

your account size and/or margin requirements. Commodities trading

can be extremely risky and is not for everyone. Some option strategies

have unlimited risk. Educate yourself on the risks and rewards

of such investing prior to trading. James Mound Trading Group,

or anyone associated with JMTG or moundreport.com, do not guarantee

profits or pre-determined loss points, and are not held monetarily

responsible for the trading losses of others (clients or otherwise).

Past results are by no means indicative of potential future returns.

Information provided are compiled by sources believed to be reliable.

JMTG or its principals assume no responsibility for any errors

or omissions as the information may not be complete or events

may have been cancelled or rescheduled. Any copy, reprint, broadcast

or distribution of this report of any kind is prohibited without

the express written consent of James Mound Trading Group LLC.

Recent Gold/Silver/$$$ essays at 321gold:

Feb 13 Gold Stock Cash Cows: Buy The Dip Morris Hubbartt 321gold

Feb 13 Silver Crashes Adam Hamilton 321gold

Feb 13 FYI US/Canada holiday market trading schedule for Monday 321gold

Feb 10 Surging Metals: Not Too Late To Buy Stewart Thomson 321gold

Feb 06 Wild Metals & Mellow Miners Morris Hubbartt 321gold

Feb 06 Gold Extremes' Drawdowns Adam Hamilton 321gold

|

321gold Inc

|