| |||

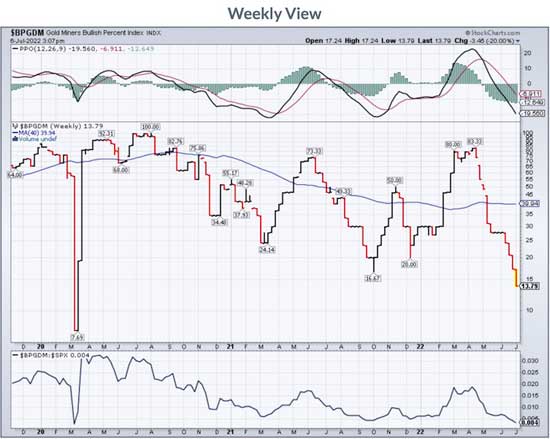

We are near a Tradeable Low for Resource StocksBob Moriarty The world seems to have reached peak insanity. As a result of Russia responding to the shelling of Donbass on the part of Ukraine starting on February 16th, as promised by President Biden, Russia invaded Ukraine on February 24th. For all those in the world shedding crocodile tears at the poor Ukrainian soldiers dying in combat, none shed even a single tear over the 14,000 innocent civilians murdered by Ukrainian forces since 2016 in Donbass. Perhaps Putin is at peak insanity. How insane is the thought that the US would honor the written commitment they made in 1990 to not expand Nato to the east, “not one inch?” Putin should have talked to some American Indians and asked them what odds they would give on the US actually honoring an agreement or treaty. And I seriously doubt even Putin in his most insane moment would have actually believed Ukraine would honor their written agreement called Minsk II to stop shelling civilians in Donbass and to sit down and discuss terms with them regarding their sovereignty. Nobody is that stupid. While Ukraine should be the most prosperous country in Europe due to their abundant natural resources, it happens to be run by very real Nazis and as a result is the most corrupt and poorest country in Europe. So the US invoked sanctions on Russia and dragged their thirty lap dogs in the Nato and EU glee clubs to go along with the intended destruction of Russia for responding to what was an attack on them by the US seventy-five years in the making. The MSM fails to mention that 2/3 of the world’s population live in countries that do not support the sanctions. But every country in the world suffers from danger of starvation or a potentially bitter winter due to the increased cost of energy and food. Actually there is one country that is not suffering. That would be Russia. The country is making money hand over fist selling fuel and food at staggering prices to the 65% of the world not supporting the sanctions. Don’t expect the US or Nato to actually understand the sanctions hurt the world but not Russia. It took the US twenty years to figure out what the “graveyard of empires” actually meant. Not a single general resigned or was fired during that twenty years of combat in Afghanistan for admitting the war was a giant mistake from the beginning. We have entered the greatest financial collapse in history where everything that went into a bubble will now regress to the mean. Bitcon and the 10,000 make believe clipto currencies have already declined from a high of $3.1 trillion to $800 billion on their way to Bitcon Heaven. This financial crash will be joined with the demise of the American Empire. It’s not enough that the US spent twenty years and $2.3 trillion fighting in Afghanistan only to be booted out by a rag tag band of sheep farmers. That was just practice for our latest insanity. The sanctions clearly hurt the world but do not hurt the target. I said that Nato, the US and the EU were committing suicide as soon as I heard about the sanctions. That was a great call. I stand by it. What we have is effectively a war between good and evil. The US, Nato and the WEF are on one side, Russia/China on the other side. But what of the leaders? Here is a typical quote from Brandon that surely will go down in the history books. Likewise, our fetterless VP has quotes of her own for posterity, “and a woman myself and the daughter of a woman and the granddaughter of a woman.” Who knew? It certainly wasn’t on her resume. While gold and silver have fallen out of bed along with every other financial market, silver is starting to show signs of a potential turn around in price based on a DSI of 15 on July 6th. Anything below 10% is a signal of an approaching reversal. Gold on the other hand is stubbornly high at 50 on July 6th. One of the important signals I use to guess when resource stocks will change direction is the Gold Miners Bullish Percent Index ($BPGDM) which gives pretty clear signals at both tops and bottoms. It is the lowest reading since the March of 2020 Covid plunge. It says the gold miners will turn shortly. If it goes down ever further from here, it will rebound like a stretched slingshot in the same way it did in early 2016 and March of 2020 climbing 202% and 189% in a few months. (Click on image to enlarge) There is only a loose relationship between the price of gold and resource stocks. Gold has plunged eleven out of the last twelve days and that rubber band is really stretched. But the gold DSI is not indicating a bottom or a turn at 50%. It is entirely possible for gold shares to anticipate the future and climb well before the price of gold wakes up. That happened in gold and gold stocks in 2000 and 2001 with the XAU bottoming in November of 2000 and jumping 36% by May of 2001. I called a bottom then. The GDXJ has dropped ten out of twelve days. That’s pretty stretched. The only time small investors ever get a break when making a bet on stocks is when junior resource stocks make a major bottom. One of the key issues on identifying a bottom is looking at volume. Lately there hasn’t been any. So if a fund wants to come in and buy up a million shares of XYZ stock at a nickel, they are out of luck. But a small investor can and should put in a stink bid for 10,000 or 20,000 shares and get it filled on a regular basis. Someone wrote me a few days ago and asked what he should be picking up if we are at a bottom. I told him to forget the fundaments and concentrate on just the price relative to the range of the last year. He should be picking up juniors with tiny market caps selling for less than $.10. Remember, in a bull market everything goes up and in a bear market everything goes down. I’m going to write about a company I have been waiting months to write about. I’m going to violate the rule I just laid out for you because I think the company is especially compelling if we are about to start a major leg higher in resource stocks. The company is named Kainantu Resources (KRL-V) and does not have a US listing just yet. Their primary projects are based in Papua New Guinea. Kainantu’s primary project surrounds the K92’s Kainantu Gold Mine which shows a resource of 4.8 million ounces of gold. K92, of course is the company that caught investor’s eyes when they bounced from $.54 a share in March of 2020 to a high of $10.52 in a little over two years. KRL recently participated in a joint venture airborne survey with K92 over 186 square km over the ground of both companies. K92 naturally didn’t share the technical details of what the survey showed over their ground adjacent to KRL but what K92 did show seems to indicate the structure where they hold 4.8 million ounces with their mine in production is similar if not identical to the ground of KRL. Naturally KRL wants to drill but that takes money. KRL is hardly a one trick pony. In April the company announced a deal with Harmony Gold to pick up a project already drilled in PNG showing 800,000 tonnes of copper, 1.8 million ounces of gold and 40,000 tonnes of molybdenum. That’s a fairly low-grade deposit but perfect for picking up when you expect increasing prices. The deal calls for KRL to pay Harmony $8 million in total and give Harmony a 1.5% NSR. Right now K92 and their 4.8 million ounces of high grade gold are worth $1.63 billion. KRL with their deal for 1.8 million ounces of low grade gold is worth $7 million. When the gold market turns, you want leverage to the price of gold. Given the stupidity of the US and the EU right now there is no ceiling for gold. KRL is an advertiser. I have bought shares in the open market and I am biased. Do your own due diligence. Their presentation is good. Read it. Kainantu Resources Ltd ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved