| |||

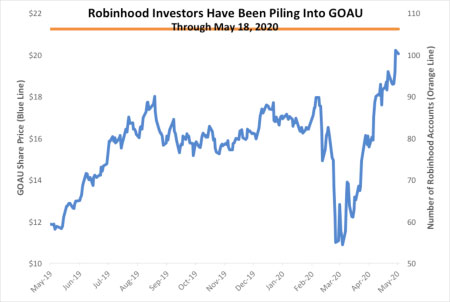

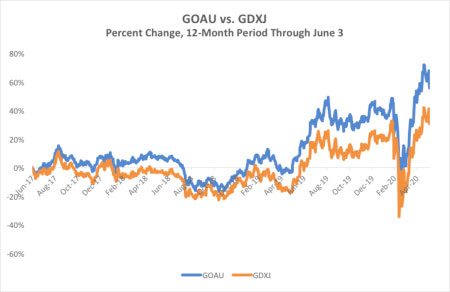

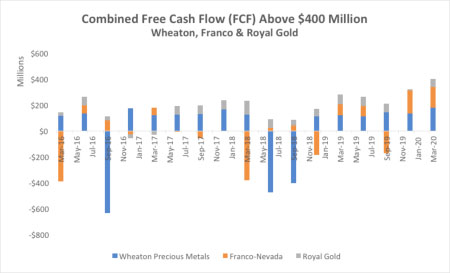

This Gold Miners ETF Hit an All-Time High. Where Are the Investors?Bob Moriarty Gold bullion is having a moment right now. The metal is trading at $1,740 an ounce, seeking to crack its 52-week high of $1,765. The next stop is its all-time high of $1,921, set in September 2011. With global central banks and finance ministers printing trillions of dollars out of thin air, investors are buying gold as a hedge against inevitable inflation and negative rates. And that’s before we factor in the trillions of dollars of helicopter money from the Fed. In other words, we’re on the same path to hyperinflation that Germany took in the 1920s and Zimbabwe in 2007. And when the same economic failure happens in the U.S., you’ll be glad that you own hard assets. I speak to money managers and advisors all the time, and what I’ve been hearing is that generalist investors are rediscovering the yellow metal and gold stocks with attractive free cash flow and dividend yields. That includes millennial investors, who until now haven’t shown a lot of excitement toward precious metals. Take a look at the chart below. The blue line is the share price of the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). The orange line is the number of Robinhood accounts that hold GOAU. Over the past 12 months, that number tripled. (Click on images to enlarge) Source: Robintrack, Bloomberg In case you’re unaware, Robinhood is a 100 percent online and commission-free broker-dealer that’s favored by younger investors. The average age of its 13 million clients is around 30, and a large percentage of them are first-time investors. In fact, many reportedly used part of their $1,200 coronavirus relief checks to invest. Despite the fact that Robinhood is geared toward millennials, it features gold investments on its homepage, right next to crypto. Robinhood features gold on its homepage, despite being geared toward millennial investors. It’s exciting to see young people discover the benefits of having exposure to gold mining, and I’m not surprised that many of them are investing in GOAU. If you recall, I recommended GOAU back in July, and then again in December. The ETF is now up 19 percent and 16 percent, respectively—and up 65 percent from its March 2020 selloff low. Since its inception in June 2017, GOAU has outperformed the $5 billion VanEck Vectors Junior Gold Miners ETF (GDXJ), 57 percent to 31 percent. It’s beaten GDXJ 90 percent of the time over any rolling 12-month period. Source: Bloomberg GOAU will be turning three years old this month, so it doesn’t yet have the track record or AUM that GDXJ does. GOAU is attracting retail and high net worth investors, pushing its share price to new all-time highs. On May 20, GOAU was trading at just under $21 per share, which is an increase of more than 85 percent from its 52-week low on March 20. There are lots of reasons why I think GOAU should be a $1 billion ETF. Unlike GDXJ, GOAU is quant-based. GOAU screens for factors such as free cash flow yield (FCFY), cash flow return on invested capital (CFROIC), revenue growth per share and more. GOAU rebalances and reconstitutes every quarter, so it has all the benefits of both a passive and active investment vehicle. It kicks out the companies that do something stupid to dilute their revenue. GDXJ hangs on to the laggards. It’s a dumb product because its only concern is liquidity, not value. It doesn’t look at factors, only market cap. That’s the exact opposite of what investors are looking for in a gold mining stock. Newmont is one of the very best performing S&P 500 stocks for the year so far not just because it’s a recognizable name, but because it has attractive fundamentals on a per-share basis. That brings me to royalty and streaming companies. Anyone who knows Frank Holmes knows that he’s a big fan of royalty and streaming companies, and he’s made sure to put his money where his mouth is. The three big precious metal streamers—Wheaton Precious Metals, Franco-Nevada and Royal Gold—make up more than 30 percent of GOAU, with Sandstorm adding an additional 4.5 percent. That’s a heavier weighting than in any other gold mining ETF that I’m aware of, and it’s a big part of the reason why GOAU has performed so well against the competition. Look at Wheaton, Franco and Royal Gold’s combined free cash flow. As of the end of the March quarter, FYF was above $400 million. It’s strong fundamentals like this that GOAU focuses on, not just market cap or liquidity. Source: Bloomberg Like many other investors, Frank likes these companies because they’re passive participants in the mining industry. They’re in the business of financing operations for the producers and explorers, and in exchange, they receive either a royalty on sales or rights to purchase the producers’ output at a fraction of the spot price. It’s just a superior model, and the best way to get exposure to it is with GOAU. Learn more about the ETF here. ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved