The Inflation Mystery! The Inflation Mystery!

Puru Saxena

15 August, 2005

Have you ever wondered why

your savings keep losing value over time? Why is it that the

cash you saved ten years ago, buys significantly less today?

It is a fact that most people

accept inflation as a part of life. To the masses, inflation

is as natural as the rising sun!

We live in an era where inflation

is widely accepted yet only a few seem to understand it.

As the public remains asleep,

central bankers around the world continue to destroy the purchasing

power of money by steadily increasing its quantity. Inflation

is not a mystical residue of an economic or business cycle. It

is simply manufactured by central bankers at their own "sweet"

will. You do not believe me? Then, consider the following fact-

During the entire 19th century,

there was zero inflation! Zip! Nada! In fact, we witnessed mild

deflation (contraction of money supply) during that entire century.

To put it simply, cash saved in 1800 bought roughly the same

amount of goods one hundred years later! In today's world, this

is unimaginable, almost absurd! But wasn't money supposed to

be a store of value? Obviously not, if Mr. Helicopter Bernanke

drops dollar bills from the sky!

Things changed radically when

the Federal Reserve came into power in 1913. Its official agenda

was to "manage" inflation in the US. But since the

Fed came into power, the US dollar has actually lost 95% of its

value! Thanks to the Fed's huge success in "managing"

inflation, the dollar your ancestors saved for you in 1913 is

now only worth 5 cents!

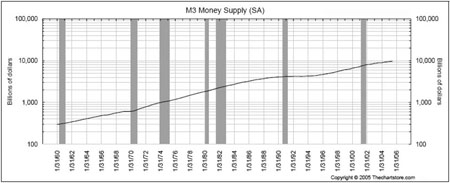

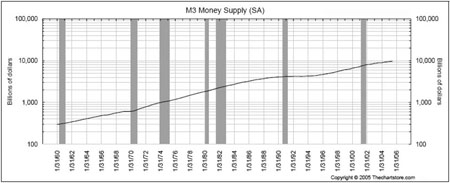

This destruction of wealth

occurred due to Fed-sponsored monetary inflation, especially

after gold was removed from the monetary system in 1971. Take

a look at Figure 1, which shows that the money supply grew from

$300 billion in 1960 to roughly $10 trillion today! That is an

astounding growth rate of 3,300% or a 33-fold increase! This

huge rise in the supply of money has caused money to lose its

value (purchasing power).

So, with such an unbelievable

growth rate, you can clearly see that the supply of money has

in fact been the best performing item over the past 45 years!

Forget stocks, bonds, housing and commodities. Let's just "invest"

in the money supply! Unfortunately, the "money supply"

contract does not trade on any exchange! Otherwise, everyone

would become mega wealthy, simply by "buying & holding"

for the long-term!

[Editor's note: Ace idea, Puru. If we can trade contracts of

stuff like the Weather & Cheese, heck, we absolutely

ought to be able to trade contracts of the Money Supply].

With such a consistent track-record,

it would be safe to say that going forward we can expect

this trend to continue. Therefore, as more money is introduced

into the system by the Fed, the value of paper money will continue

to evaporate in real-terms.

Make no mistake; inflation

(increase in money supply) is robbery pure and simple. Inflation

is the confiscation of your hard earned savings!

Figure 1: Destruction

of the value of your money!

(click image to see

large chart)

Source: www.thechartstore.com

Source: www.thechartstore.com

In the 1970's, expanding liquidity

caused paper money to lose its purchasing power through commodity

and consumer price surges as natural resources went through the

roof! Meanwhile, in the 1980's and 1990's, paper money lost its

purchasing power through booms in asset-prices. Over the past

25 years, bonds, stocks and real-estate rose exponentially. In

each case, whether through consumer price or asset price surges,

the purchasing power of money ultimately got destroyed.

In the years to come, I anticipate

that commodity prices will (once again) soar and consumer prices

will rise significantly. On the other hand, I expect financial

asset-prices to decline as stocks and bonds tend to perform poorly

when commodities rise.

At the moment, it is really

quite hard to find genuine value as all the financial assets

(stocks, bonds and housing) are grossly overpriced from a historical

viewpoint.

Every investor ought to take

positions in gold and silver as paper money will probably lose

value against tangibles over the period ahead. Gold has spent

the last few months consolidating within its ongoing bull-market,

which has a long way to go both in terms of price and time. A

few months ago, I had stated that the US dollar was likely to

rally against major foreign currencies. As expected, the US dollar

did rally but gold came through as the real winner. Despite a

strengthening US dollar, gold refused to decline and the yellow

metal is now trading at a multi-year high when measured in Euros

and the Yen.

In my opinion, gold is one

of the cheapest assets paper "money" can buy these

days. No, let me correct this - in fact, around $435/ounce, gold

is literally being "given" away!

A lot more follows for subscribers...

15 Aug, 2005

Puru Saxena

Saxena Archives Saxena Archives

email: puru@purusaxena.com

website: www.purusaxena.com Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive "Weekly Updates" covering the recent market action. Money Matters is available by subscription from www.purusaxena.com. Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs. Copyright ©2005-2015 Puru Saxena Limited. All rights reserved.

Recent Gold/Silver/$$$ essays at 321gold:

Feb 20 Silver North Hits Best Hole in Their History in Yukon Bob Moriarty 321gold

Feb 20 The Next Gold Stocks Rally Hot Juniors Morris Hubbartt 321gold

Feb 20 Gold Chinese New Year Adam Hamilton 321gold

Feb 19 ESGold Moves to Production Alongside Exploration Bob Moriarty 321gold

Feb 17 A Bull Era: Robots & Gold Stewart Thomson 321gold

Feb 15 Bitcoin, Stock Market & Gold captainewave 321gold

|

321gold Inc

|

The Inflation Mystery!

The Inflation Mystery!