| |||

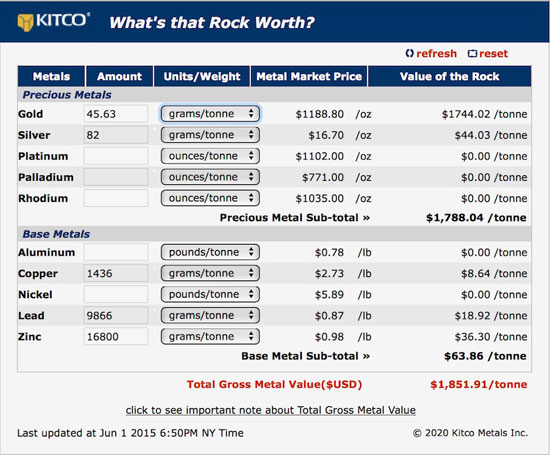

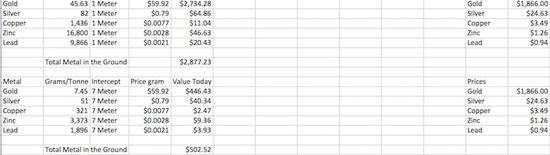

Brigadier Gold has Drilled a Gold MineBob Moriarty I got a call yesterday about something else but was told something that concerned me greatly. Along with the rest of the industry, I have believed that as the summer drill programs ended in the US and Canada that assay labs would soon catch up. Well, it is not going to happen. Like many others I was under the impression the labs had just not geared up for all the increase in drilling that took place as a result of a financing boom since March. That wasn’t the problem at all. Since governments have outdone themselves in stupidity over the whole Covid fiasco/fraud, many of the workers at the labs discovered they could make more money by not working than they could by working. The incredibly stupid government give-away programs made it possible to sit at home drinking beer and collect more in unemployment than actually going to work. So the delays in results will continue. More and more people of those still capable of coming up with an original thought of their own are realizing that the whole Covid Flu thing was a tempest in a teaspoon. Certainly many of the governors and other high ranking muckety mucks got caught ignoring their own stay at home stupidity for the masses and as soon as the cameras stopped rolling dropped the diapers off their faces. I think it was one of those “do as I say rather than do as I do” things. I would like to point one thing out that I have not heard anyone else mention. If you test positive for Covid (with the 95% false positive history) but are asymptomatic you might want to consider that being asymptomatic also means that you have no symptoms for the simple reason you don’t have the flu. If some government drone shoves a pipe cleaner up your nose until it touches your brain and promptly reports that you test positive for having a broken left leg but you don’t have any symptoms, asymptomatic means you don’t have a broken left leg. The test doesn’t work and is utterly meaningless. And the government knows it. I’m really interested in learning over the next weeks and month just how many people the vaccines are going to kill or make sterile. After all, isn’t that the real objective? Since we know from data coming from the CDC there are no excess deaths in 2020 compared to 2019 and 2018, the number will be far higher from the vaccine than from the imaginary flu. Brigadier Gold is drilling a gold mine in Sinaloa Mexico. I don’t mean that in any figurative way. They literally have drilled an existing historic gold/silver mine called the San Agustin Mine. Their Picachos project is located exactly half way between Vizsla Resources and GR Silver. Both of those companies have been heavily promoted this year and have similar grade material to Brigadier. Vizsla has a market cap of $103 million; GR Silver has a cap of $85 million. Brigadier comes in at about $10 million. Brigadier Gold recently released outstanding first results from the first hole assay in a 40-hole 5,000-meter drill program that is the first ever conducted on the mine. That’s right, it has never been drilled in history. The numbers can be a little confusing. This is a multi-element deposit with gold, silver, copper, lead and zinc all mixed in. The results were interesting to say the least. I used a great link coming from Kitco called What’s that Rock Worth? When I fed in the assays from the press release from two weeks ago, this is what I got. (Click on images to enlarge) I was quite impressed until I saw the date of the numbers. Kitco crashed a week or so back. When they came back up, no one bothered linking the What’s that Rock Worth? program to current and correct numbers. I wanted to write this piece two weeks ago. I sent an email to the Kitco technical guys and got no response and finally figured I was going to have to do the numbers in a spreadsheet of my own. So here goes. So the high grade 1 meter intercept worth $1,851 five years ago is actually worth $2877 at today’s prices. Naturally nobody will make that much from the rock, there are always losses but it gives you the ability to compare it to say GR Silver or Vizsla results. In my spreadsheet I also put in the 7-meter intercept that contained the 1-meter ultrahigh grade numbers. And I think any observer would realize that 7 meters of $500 rock is a home run. In my view Brigadier is a slam-dunk for higher prices. As of September 30 they had $2.2 million in cash. There are 14 million warrants at $.10 that are solidly in the money and in fact they may be the overhang that is making the shares so cheap today. They will bring in another $1.4 million when exercised. Two weeks ago the company had completed 18 of the 40 holes planned. The market is going to wake up to what Brigadier is sitting on sooner or later and I expect a 300-400 percent higher move when it is clear that the correction and Tax Loss Silly Season have ended. I did not participate in the latest BRG PP but I have gone into the open market and picked up a number of shares. I really like the story. The stock is cheap compared to their nearby neighbors and that isn’t about to last for long. Brigadier is an advertiser and I am biased. Do your own due diligence. Brigadier Gold Ltd ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved