| |||

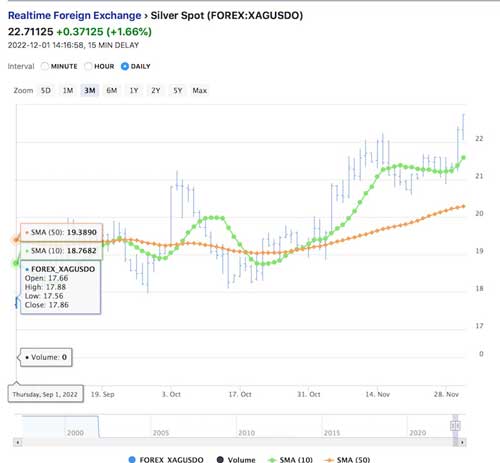

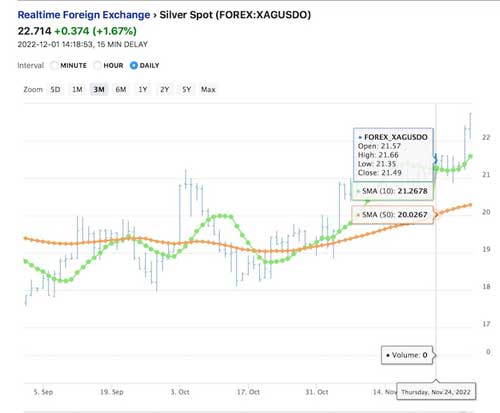

The Difference Between Signal and NoiseBob Moriarty I have no idea of how many people write professionally about investing in resource stocks and the metals. I am well aware that there are tens of thousands of punters expressing their opinions on the various chat boards. Most of them are idiots. But then many of the professional writers are idiots, too, trying to feed people’s fantasies. That’s what you get from TV preachers and all politicians (with perhaps the exception of Alberta’s Premier and Pierre Poilievre) I write books about investing and then I pretty much give them away. You can pick up Nobody Knows Anything and Basic Investing in Resource Stocks for $.99 in the electronic version. If you can’t afford the $.99 you probably are wasting my time and yours because you are too stupid to understand simple concepts. So I will go over it one more time. There is signal and there is noise. GATA, conspiracies, gold and silver manipulation, Bill Murphy, Ted Butler and all of the cliptocurrencies are noise. Nothing they say will ever put a penny in your pocket unless it is by accident. There is no time in history where any of them issued both an accurate buy signal and a sell signal that was based on either facts or logic. You can howl at the moon all you wish about how Crimex is stealing but all you are doing is whining. You can’t make money from noise. Saying that gold and silver are manipulated is akin to saying the sun rises in the east. All financial markets are manipulated and always will be. Signal on the other hand is based on both facts and logic. If you will bother learning the basics and have any ability to think for yourself you can make a lot of money from the chumps whining about Bitcon and Crimex. I go into it in detail in my two investment books and if you haven’t read them, it means you are the chump that my readers and I will profit by your stupidity. I did an interview on September 1st and talked about silver. Silver touched $17.56 as the low. (Click on images to enlarge) Fast-forward three months and now we had silver at $21.66 on November 24th where it touched a high of $21.66. Between September 1st and November 24th silver climbed 23%. That’s a great move and silver is even higher today but I wanted to show the November 24th price for a reason that I will get into. I said a month before silver and gold hit their lows that it was coming. I nailed the bottom in silver; gold drifted lower for another four weeks but clearly bottomed on September 28th. For three months I have been trying to convince my readers that low prices are an opportunity. How much simpler can it get? Stocks go up and down. When they are cheap you should buy and when they are dear you should sell. It’s in the frigging books. The only people I know who make money on a consistent basis are contrarians. All you have to do is determine what the mob is doing and do the opposite. It is so simple most people can’t come to grips with the concept. Measure the sentiment. When everyone is bullish, you should sell. When everyone is bearish, you should buy. Low prices are not a problem, they are an opportunity. My favorite sentiment indicator is the DSI that happens to be on sale until December 15th. As valuable as it is, there are other sentiment indicators that may provide other information. I like the $BPGDM chart of the Gold Miners Bullish Percentage Index. It gave a clear signal of a bottom at the end of September just in time to nail the low in gold. Another signal that I observe but rarely see a clear and convincing signal is the Premium/Discount chart of the Sprott Physical Silver Trust. I used that chart in 2011 to pick the top in silver to the day and when I looked at it recently I saw something very exciting. If you look at the two-year chart it seems that just recently the PSLV is selling at the biggest discount in over two years. In other words the traders in PSLV were highly bearish. On November 25th the PSLV was selling at the biggest discount, 5.12% since the crash of 2020. Do you remember what silver did after that signal in March of 2020 during the Covid fiasco crash? It went from well under $12 an ounce to almost $30 in the next eleven months. That’s a 150% gain in silver. You almost never see those kinds of moves in the metals. The PSLV is giving a similar signal today but from $17.56. The low point on that chart is November 25th. There are few people I track the predictions of mainly because I don’t want to confuse myself. But one of the people I have a ton of time for is Tom McClellan of The McClellan Report. Here is part of what he said just yesterday.

I did find it exceptionally interesting that one of the smartest people I know has come to exactly the same conclusion I have. If you would like to fund your retirement you can do that in the near future. You merely need to learn to think for yourself and understand how contrarian investing works. Figure out what the mob is up to and do the opposite. It’s that easy. ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved