| |||

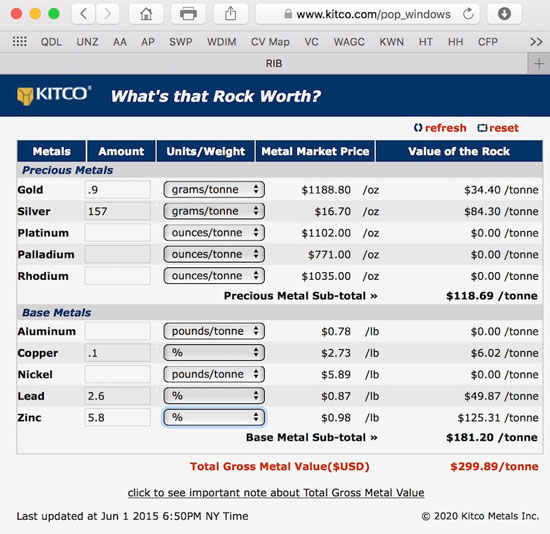

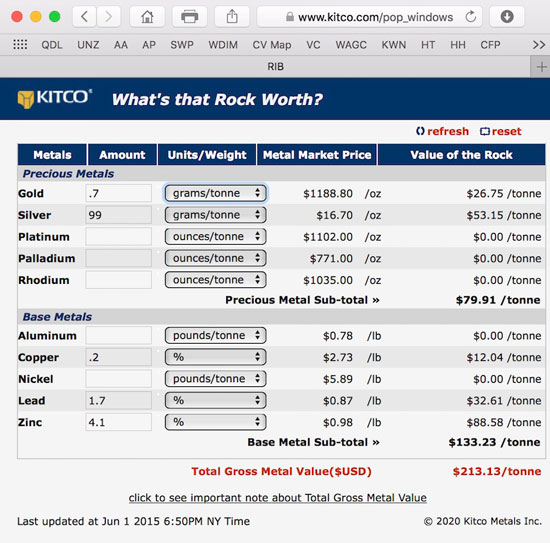

White Rock Minerals is a SleeperBob Moriarty As of last Friday, the DSI for gold was 17 and 19 for silver. We are within spitting distance of a tradeable low. Mid December marks the end of tax loss silly season. Monday November 30 is both a lunar eclipse and a full moon. The election insanity continues with most Republicans believing it was a fraudulent election and 30% of Democrats agreeing. No matter who takes office in January we have set the stage for a violent and bloody civil war/revolution. The Deep State, the giant Tech Companies and MSM have exposed their total corruption and willingness to lie about everything. Meanwhile even the CDC finally admits that 2020 has shown no more excess deaths than 2019 and 2018. The whole Wuhan/Covid fiasco was fraud. It was a bad flu that you don’t want to catch but that also happens every other year. The sheep will continue to line up for the magic cure of a vaccine because Bill Gates and Dr. Fauci told them to do so. And in a few months we will start getting numbers on just how deadly and evil the vaccine turned out to be. I have been investing for months in a sleeper from Australia with a minor gold project in Australia and two company making projects in Alaska. Quinton Hennigh turned me onto them and I have followed them closely. Matt Gill, an Australian, runs the company. White Rock has an Australian gold project called the Mt Carrington property they recently optioned to another Australian company. It came with a 352,000 gold ounce JORC resource and an amazing 23.2 million ounces of silver. Right now WRM has a market cap of about $30 million in Aussie dollars but $13 million in cash for an enterprise value of about $17 million. In US dollar terms that would be about $13 million. Gold at $40 an ounce, which is cheap, would value Mt Carrington at the same $13 million and the 23.2 million ounces of silver would be free. Or silver at $.60 an ounce in the ground would be the same total and the 352,000 ounces of gold would be free. But I did mention the interesting fact that White Rock has two company making properties in Alaska. Their Red Mountain project has a JORC resource worth about $4 billion of rock in the ground. I am going to put in two different charts showing the grade of the mineralization but I want to caution readers that it is an indication only. Kitco crashed a week ago and their very valuable link to Rocks in the Box is frozen with 2015 prices. Until Kitco can relink the current data the numbers are not correct. Red Mountain has a resource of 9.1 million tonnes in the high-grade inferred category. When you look at the chart, you are looking at five year old prices and current prices are about 50% higher but recoveries would be from 70% to 90% and all you are looking at is an indication of total value per tonne. There is 46.1 million ounces of silver alone selling for about $.30 an ounce and all the rest free. (Click on images to enlarge) That amount of rock in the ground would be worth about $2.72 billion dollars. The entire company is selling for just over about one half of one percent of that number. That’s absurd. It should be more like 1-2 percent giving White Rock a market cap 200-300% higher just for Red Mountain. But under JORC in addition to what they call the high-grade inferred resource they can put in a regular inferred category. In this case they have 16.7 million tonnes of $213 rock worth $3.5 billion in the ground or about .33 of one percent. This is for a base metal deposit in a mining friendly state. But the project I like the most is the Last Chance gold target. Initial stream samples show values similar or higher than the nearby Pogo Gold Mine with 4 million ounces discovered and produced. Obviously we are in the early stages of exploration at the Last Chance project but results so far have been encouraging. Americans and Canadians not only do not give a premium to most Australian shares, they buy them only at a great discount. I know Quinton Hennigh and his skill. I have chatted with Matt Gill at some length. I have been accumulating White Rock Minerals shares for months. They have at least one giant home run and potentially two and are selling for less than the value of the lowest value project they have. This puppy is cheap and is going to go a lot higher. I wanted to write about the company months ago but they were trying to add another project and anything I said might have messed that up. Now I can write about them. Under any reasonable view of the future for either gold or silver or copper/base metals, this company is one of the best run and cheapest stocks I know and I own. White Rock will be an advertiser. I have participated in a pp with them months ago and have been slowly picking up more shares for months. I am biased. Do your own due diligence but I love this company. Go to their great presentation for more. White Rock Minerals Ltd ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved