| |||

Cartier Dumps the Iron and Goes Silver Big TimeBob Moriarty I have waited patiently for many months for the management of Cartier to move into a different direction than the marginal gold project they just drilled in Newfoundland. I have the utmost respect for both management in the form of Tom Larsen and technical expertise in the form of Bill Pearson and Osvaldo Acre for their Bolivian team. On the 26th of October the company announced a change of direction to where they really shine in terms of skill sets. Three years ago, Eloro (ELO-C) was $.175 a share. It ramped higher to $5.89 on the strength of impressive drill results in Bolivia where they are drilling off a massive caldera that I believe will be 2-3 billion tonnes of ore after spending a lot of money drilling. I love Bolivia and I was not a fan of the Newfie project. Turns out no one else was either. So Tom Larsen and crew have shifted their focus to Bolivia and just signed a $4.5 million USD deal with the landowner for 100% of the silver, lead zinc project located near Iska Iska, the flagship of Eloro. There are two pieces to the new property. One of them is called by the locals “pequeño Cerro Rico” or small Rich Hill. Cerro Rico, was of course the name for the mountain of silver that Potosi was built around and provided much of the wealth of the Spanish Empire. That should give you some indication of what the locals think of the project. Neither of the two parts of the project have had any modern exploration or drilling. There has been small scale artisanal mining for silver and lead on both projects.

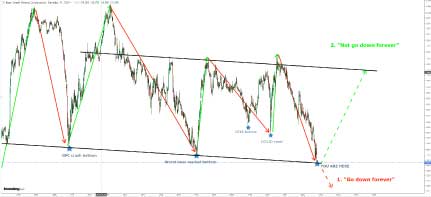

Erik Wetterling sent me this chart of the share price of Bear Creek Mining. In a bear market stocks go down. In a bull market stocks go up. The chart of Bear Creek reveals a major bottom in late 2008 during the GFC followed by a great bull move. Then another major bottom in late 2015 followed with a rocket ship higher starting in January of 2016. Then we had the Covid crash in March of 2020 that I predicted months in advance followed by another rocket launch straight up and now we are at another major bottom. All you have to do it look at what happened after every major bottom and the same thing is going to happen very soon. I think Cartier will duplicate the run of both BCM and that of ELO. I'm betting on it. At present CFE owns 2.2 million shares of Eloro worth about $7 million. With a market cap of only $11 million the company has little downside and unlimited upside. Cartier is an advertiser and I have bought a lot of shares in the open market and fully intend to participate in any future private placements. Do your own due diligence. Cartier Iron Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved