| |||

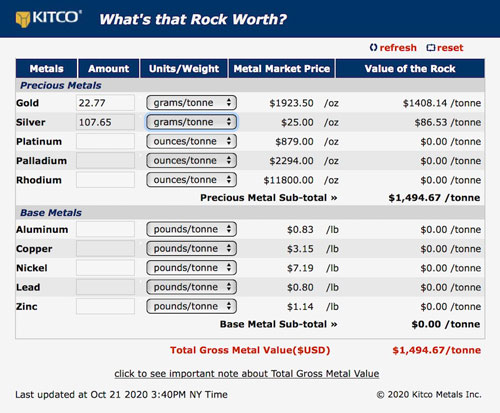

Winston Gold Needs to ProduceBob Moriarty Winston Gold went public in 2016 with the same story they have now. The shares promptly shot up to $.64 apiece. I participated in a private placement at $.40 on the basis that they would be going into production shortly. The company obviously defines shortly differently than I do. By the time I wrote about them in February of 2017 they had declined to $.13 on their way to $.025 a share. The company had about 80 million shares in early 2017. Now the company has 290 million for a 260% increase in share count. When I really like a story I will buy shares as they get cheaper and I did average down to well below $.10 a share. While the story never changed, nothing ever moved forward and at the first opportunity to dump my shares and break even, I took advantage and bailed out of all my stock in the company. Basically from 2016 until September of 2019 the company was your garden-variety disaster making promises like they were pumpkin pies at Thanksgiving but never moving forward an inch and never admitting they weren’t doing anything. In September of 2019 a former director of Newmont named Joe Carrabba took over as chairman of Winston. He comes with a resume as long as your arm. If he can light a fire under some people at Winston there is hope for the future. He is quoted, “In all my years of vetting projects for Newmont and other large cap mining companies, I’ve never seen a historic gold project that was able to go back into production for so little cash. I’ve since invested $3.1m of my own money and brought in another $2m from my friends and family.” I recently participated in another private placement with Winston far more comfortable in the thought that at least if I lose a little money, Joe and his friends lose a bundle. The company says they can produce something between 30,000 and 50,000 ounces of gold in 2021. That’s not the magic number investors really want to see. Investors don’t take real notice until a company gets up to 100,000 ounces a year but that is the number Winston is shooting for down the road in a couple of years. They have leased a mill 35 miles down the road that they say is suitable for their ore. It’s almost complete, needing only a couple of months to fix some bits. It is permitted for 150 tonnes a day. Winston has brought to surface some 4200 tonnes of rock grading an average .22 OPT or about 6.8-g/t gold. The mill should be able to gobble that up in a month providing a little over $1.6 million gross. The company believes they can increase the capacity of the mill. A couple of days ago the company released an assay result showing 5 feet of just about $1500 rock (USD). They have the rock. So if someone can figure out how to get the rock out of the mine and up to the mill to process it, they can start to accomplish what they promised four years ago. (Click on image to enlarge) Clearly Winston Gold needs to produce. I’m betting on it and I get really cranky when people under deliver and over promise. Next article I won’t be nearly so kind if they do the same thing they did last time. Winston Gold is an advertiser. I am biased. I was in the PP and I have bought shares in the open market. The last couple of excellent press releases have provided a long awaited liquidity event so pissed off and bored shareholders have an opportunity to bail out. If the company actually delivers on their promises investors will be a lot happier. Winston Gold Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved