| |||

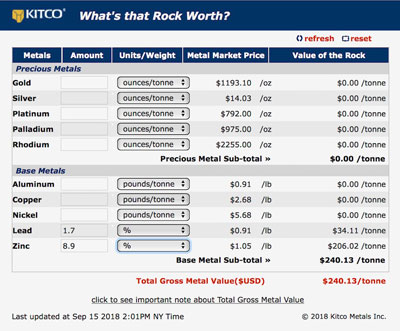

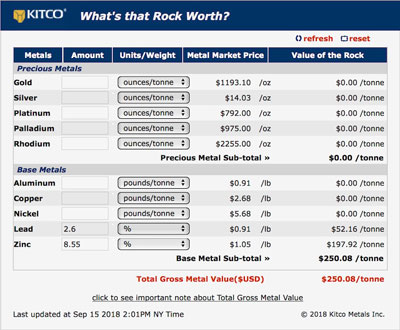

Group Eleven Thinks Zinc with Big Think in IrelandBob Moriarty Earlier this year I was calling for a rally in gold after a low in the June/July timeframe. I missed the timing by a couple of weeks, the low in gold was in mid-August and silver actually went another $.50 lower into September. Like everyone else in the industry I have been scratching my head. We usually have a late summer rally but if that was it, it was pretty tepid. However, the good news is that the deeper the decline, the steeper the advance. I’ve just posted an excellent piece by Adam Hamilton where he said that he believes the gold resource market is in the process of capitulating. If so, and I think he is right; the market is about to get very interesting. I think it’s all part of a September/October surprise based on third world currencies in a massive state of collapse. In other words, it’s a rush to liquidity and in a similar vein to 2008, investors are dumping everything. The general stock market trading now shows 50% of the trading is in the five FAANG stocks. When the market gets that narrow it’s like 1969-1974 where the only shares that traded were the Nifty Fifty. Only this time it’s the Nifty Five. In any case, resource shares have been hammered and they are as cheaply priced as they were in late 2015 early 2016 and I think a wonderful opportunity is being set up. Someone contacted me a couple of months ago about a new zinc stock based in Ireland. It’s actually a company that has been around for three years but only went public last December. It’s selling today, some nine months later at a 65% discount from the price they went public. That’s nuts. The management team at Group Eleven Resources (ZNG-V) spent three years picking up zinc projects in Ireland when majors were more concerned with cleaning up their balance sheets. They did deals on five major projects with a total of 3,200 square km or 1235 square miles. I didn’t realize it but Ireland is prime zinc territory with some of the largest deposits in the world. One of those deposits they picked up was the Ballinalack project with a historic, non-43-101 resource of 7.7 million tons with a combined zinc-lead of 7.3%. At today’s prices, that project holds a theoretical value of about $1.27 billion in the ground. Group Eleven is in a joint venture with one of the largest producers in China. Group Eleven holds 60% of the property, their partner controls 40%. Historic records indicate over $30 million has been spent drilling the project with a total of over 93,350 meters completed. Group Eleven recently released results from scout drilling at Ballinalack showing a grade of 8.9% zinc and 1.7% lead over 10.33 meters. That’s $240 rock and well worth mining. (Click on images to enlarge) In the company’s Stonepark deposit the company reports a 43-101 resource of 5.3 million tons at 11.15% zinc-lead having a value of $250 a ton in the ground in theory using today’s prices. That is a total theoretical value of $1.325 billion in the ground. Stonepark is a joint venture between Group Eleven and Connemara Mining. Group Eleven owns 76.56% and Connemara Mining owns 23.44%. If Stonepark has a value of $1.325 billion in the ground and Group Eleven owns 76.56%, that makes their rock worth $1.01 billion in theory. Added to the historic resource at Ballinalack, that makes Group Eleven’s in the ground resources worth a total of right at $2.28 billion. Stonepark is immediately next to Glencore’s 44.2 MT grading 8.4% combined zinc-lead Pallas Green zinc-lead deposit. Glencore has drilled some 407,000 meters of diamond core drilling as of 2017 to define the resource. The Stonepark project of Group Eleven is both higher grade and closer to the surface than Glencore’s Pallas Green project. It simply would not make sense for Glencore to put Pallas Green into production before trying to buy Stonepark. The numbers on Group Eleven get really interesting. At today’s price, the company has a market cap of $8 million CAD. They have about $3.5 million CAD in cash and receivables for an enterprise value of $4.5 million. You have to convert that to USD if you want to use the charts I show above because they are USD prices. That works out to an enterprise value of $3.5 million USD in a company controlling $2.8 billion dollars worth of rocks in the ground in a prime zinc mining country. Anytime you try to evaluate what a company is worth, you need to come up with some kind of metric that makes it simple to understand. It’s pretty easy to see that a company with an enterprise value of $3.5 million is cheap when they control $2.8 billion in zinc and lead. But even simpler, one share at $.135 has $46 in zinc and lead behind it. That seems absurdly cheap to me. If you contacted the US Patent office and asked them what invention they have the most applications for, it would be for mousetraps. That goes back to a misquote from Ralph Waldo Emerson that is commonly stated as “Build a better mousetrap and the world will beat a path to your door,” with 4400 patents granted and an untold number of applications for mousetraps rejected. Mining companies like to believe that if they are professional and go out and pick up a lot of prime ground for minerals, drill it until it looks like Swiss cheese and define a wonderful resource, the world will beat a path to their door. Alas, the world works that way not. A better quote and more accurate from Mr. Emerson would have stated, “Late to bed, early to rise. Work like hell and advertise.” Group Eleven has done everything right except tell the story. Now they are starting to tell the story. It’s simple. The company has assembled one of the largest land positions in Ireland since the modern mining era began in the 1950s. The projects cover the majority of several known zinc basins. For many years it was impossible for a junior to get a toehold in Ireland since the majors had all the interesting ground staked. When the commodities markets tumbled to an all time low at the end of 2015 the majors needed to clean up their balance sheets and began to let go of key ground. Group Eleven has no issues. (Other than the name that I am not a giant fan of) The company has strategic partners to share both the risk and the cost with. They have about $3.5 million cash in the bank and are starting to show drill results. Pallas Green is a major project for Glencore yet Stonepark has both higher grade and isn’t as deep. That paints a bull’s eye on them. Group Eleven is absurdly cheap when they have $46 in metal in the ground per share. I’d guess base metals projects should be worth 2-3% of their metal value. At 1% of metal value, Group Eleven would be worth $.46 a share. And that would be beyond absurdly cheap. Group Eleven is an advertiser. I have bought shares in the open market. Their presentation is excellent and anyone interested in the company should read it. Please do your own due diligence. Group Eleven Resources Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved