| |||

Funds Give Westhaven Away for Free or Nearly FreeBob Moriarty I’ve been doing a lot of interviews lately. I don’t make any money out of it and frankly don’t care about the publicity. I’m the guy who flew a guy across the Atlantic on top of an Islander and also flew through the Eiffel Tower for fun. What would I do with publicity? But there is so much stupidity running around lately that I felt I needed to stand up and speak out. But seriously speaking for a bit, I see the general stock market on the edge of a precipice and tittering. When it falls, the sound of the crash will be heard on Mars. And I think it’s coming soon. While junior resource stocks have been hammered for a couple of years, many will be trading at new lows. You see, when the markets takes a dive, the resource funds get redemption calls from all the folks who want to buy at tops and sell at bottoms. So the funds sell the most liquid stocks they own. It has nothing to do with quality. It only has to do with generating cash to meet redemptions. Bob Hoye thinks the time to buy the juniors will come in October but I am seeing a few high-quality shares begin to breath. Westhaven Gold (WHN-V) has been cut in half from $.46 a year ago to a new low of $.22 lately. While nothing has changed for the worst, except a major fund needed cash. Their loss is your gain if you act quickly. I wrote about Westhaven in May of 2018 with the stock at $.19. The story was timely and the shares shot for the moon, climbing from a low of $.15 to $1.35 in about three months. You only need to do that once or twice in a career and you have made your retirement. If you look at a five-year chart of Westhaven you may realize that this is a wonderful stock to be trading. It went from $.15 in mid-2018 to $1.43 in seven months. Then it dropped from $1.43 to $.52 in six months before shooting higher to $1.25 in another six months.

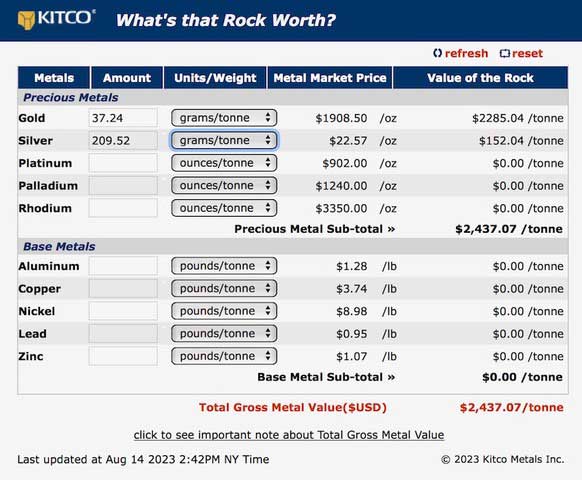

The shares of junior resource companies are like baseball trading cards. You only make money if you trade them on a regular basis. Most investors think you can buy and sit on a good stock for five years and make your fortune. You can’t. I wrote about it at $.19 over five years ago, they have had excellent results including some of the highest-grade holes in the entire Spences Bridge gold belt. If you bought and held for just over five years you would have made a total of $.05 a share. But if you had bought in May of 2018 and sold at the start of January 2019 you would have made $1.28 a share in profit. I have written two good books on investing available for $.99 each in the Kindle version on Amazon. Nobody Knows Anything and Basic Investing in Resource Stocks. If you haven’t read them, you should. Investing is not rocket science. When junior resource stocks can move an average of 190% up and down in a year’s time you can make money if you are a bear or a bull. Westhaven has four projects in the Spences Bridge gold belt. Their primary project is the Shovelnose gold project that has delivered a number of wonderful, Great Bear type, gold/silver intercepts. In April of 2022 the company hit a 23.03-meter sample grading 37.24 g/t Au. Obviously they are on to something with major potential. That is why the shares have been up and down so much. That is over $2400 rock in USD per tonne. But without news on a regular basis investors get nervous and dump great stocks such as Westhaven.

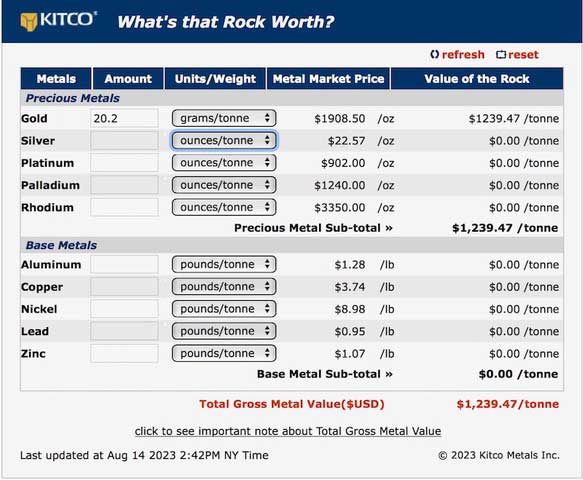

The company counts another good gold property in the same belt they call the Skoonka gold deposit located about 50km to the Northwest of Shovelnose. The project was drilled between 2005 and 2007 returning some bonanza gold numbers including 12.80 meters of 20.2 g/t Au worth over $1200 USD per tonne.

Westhaven recently completed a financing deal with Franco-Nevada for $5.5 million CAD so they are well financed for major drill programs at both Shovelnose and Skoonka for 2023. With a 43-101 in hand from 2022 for over 1 million ounces of gold and 4.9 million ounces of silver at Shovelnose the company needs to add more high-grade tonnage to get the same sort of respect investors had for them five years ago. About a month ago WHN released a PEA for Shovelnose giving an AISC cost of $752 USD and an after tax NPV of $222 CAD with about $150 million CAD to get into production. The PEA calls for average production of about 56,000 ounces of gold a year. They will be aiming a lot higher than that with the upcoming drill program and a revised PEA because gold projects are like diamonds. Below 1 carat or 100,000 ounces a year the value goes way down. Management has skin in the game so they have like interests with investors. They hold 24% of the shares. Westhaven is an advertiser so naturally I am biased. I own shares I bought in the open market. Do your own due diligence. Westhaven Gold Corp

### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved