| |||

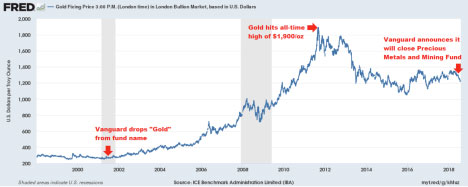

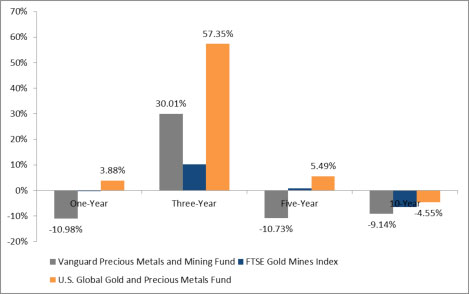

So That’s How It’s Going To Be, Vanguard?Bob Moriarty It looks like Vanguard, one of the world’s largest fund companies, is leaving gold investors up a certain creek without a paddle. Starting next month, the $2.3 billion Vanguard Precious Metals and Mining Fund (VGPMX) will change not only its name and advisor but also its investment strategy. Its position in precious metals and mining stocks will be slashed, from at least 80 percent today to only 25 percent. The firm’s July 27 press release doesn’t explain the reasoning behind the decision but I imagine it’s because VGPMX had a long history of inferior performance. The fund was unable to beat its benchmark for any period as of June 30. Vanguard liked to call attention to the fund’s low fee structure—it charges only 0.36 percent—but like everything else in life, you often get what you pay for. Walmart’s cheap, too, but I’m guessing you wouldn’t shop there to buy an outfit for an important job interview. You might not make the first impression you were hoping for. Or how about McDonald’s? In the short-term, you might save some money eating every meal off its dollar menu, but because of the risks of high blood pressure and diabetes, you could be looking at higher medical expenses later on. My point is that cheaper is not always better. In fact, cheaper often costs you more in the long run. So instead of fixing VGPMX, Vanguard’s board threw in the towel. This leaves shareholders in the Vanguard ecosystem without a way to participate in an industry that, in the U.S., produced more than $75 billion in raw materials last year. That’s bullshit, and investors deserve better, as I’ll show you in a moment. Does This Mean Gold Has Found A Bottom? There could be a silver lining here. Some analysts see Vanguard’s move as a further sign that the gold market has found a bottom—and that the metal could be teeing up for a reversal. You see, this isn’t the first time Vanguard changed the fund. In 2001, when gold was similarly near a bottom, the company removed the word “Gold” from what was then the Vanguard Gold and Precious Metals Fund. The change coincided with a decade-long precious metals bull run that saw gold rally from an average price of $271 an ounce in 2001 to an all-time high of more than $1,900 in September 2011. That’s more than a sevenfold increase. And now it’s dropping the fund altogether. (Click on images to enlarge) So could this mean another gold bull run is in the works? No one can say for sure, of course, but the timing of Vanguard’s announcement is certainly interesting. What I can say with certainty is that there are many investors—no doubt hundreds—who are in for a rude awakening when they find out their exposure to the metals and mining sector has inexplicably shrunk. Seeking a Better Gold Fund Now that Vanguard has decided to close VGPMX, it’s time for investors to look for not just “another,” but a better gold fund. A superior gold fund. After doing some digging myself, I think an excellent option is U.S. Global Investors’ Gold and Precious Metals Fund (USERX), the very first no-load gold fund in the U.S. USERX invests at least 80 percent of net assets in precious metals and mining companies. The top 10 holdings include growth-y, smaller-cap names like St. Barbara, Kirkland Lake and Wesdome Mines. You can also find precious metal royalty firms like Sandstorm Gold and Wheaton Precious Metals—both of which have among the highest revenues per employee of any company in the world. This tells me the fund’s co-managers, U.S. Global CEO Frank Holmes and Ralph Aldis, have done their homework. And the homework appears to have paid off in spades. For the one-year, three-year, five-year and 10-year periods as of July 31, USERX beat not only its benchmark, the FTSE Gold Mines Index, but also Vanguard’s $2.3 billion fund. For the three-year period, it outperformed VGPMX by more than 2,700 basis points, according to Bloomberg data. Source: Bloomberg, U.S. Bancorp The fund charges 1.66 percent, but I think it’s important to point out here that, with USERX, you’re paying for experience, expertise and—above all—performance. The returns in the chart above? Yeah, they’re computed after fees. USERX is still the leader in every time period. What’s more, USERX holds an amazing FIVE-STAR rating overall from Morningstar as of June 30 in the Equity Precious Metals category. It also holds five stars for the three-year and five-year periods, and four stars for the 10-year period. Sound too good to be true? Check out the Gold and Precious Metals Fund (USERX) for yourself by clicking here! ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved