| |||

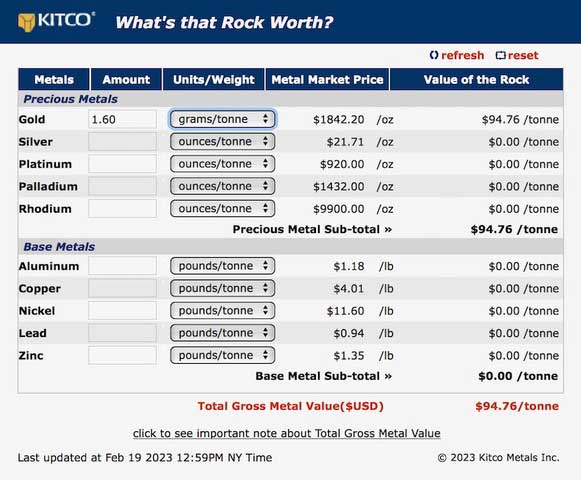

Thesis Gold Joins Benchmark To Create Gold Giant in BCBob Moriarty Recently Benchmark Metals and Thesis Gold announced plans to merge the two Northern BC gold companies into one giant company. I think it’s a good move and the whole is greater than the sum of the parts. We are in a correction for gold, silver and the resource stocks. I pretty much peg the decline in gold and silver to a perfectly normal correction that is good for the metals and investors. But I think the ongoing push higher lately in the overall stock market has been clobbering resource stocks. I have done several interviews lately and my suggestion is to move into the very highest quality and safest shares for now. Thesis Gold (TAU-V) would be one perfect example. I covered the company fourteen months ago when the shares were selling at a bargain basement price of $1.45. Last Friday you could have bought the same shares for $.66 in spite of the company completing over 35,000 meters of drilling on their 180 square KM gold property in the Golden Triangle of BC in Canada. A year ago Thesis hit a high of $3.09 and is now down in spite of generating excellent drill results. In January of this year the company announced 95.7 meters of 1.6 g/t Au. That’s $126 in CAD.

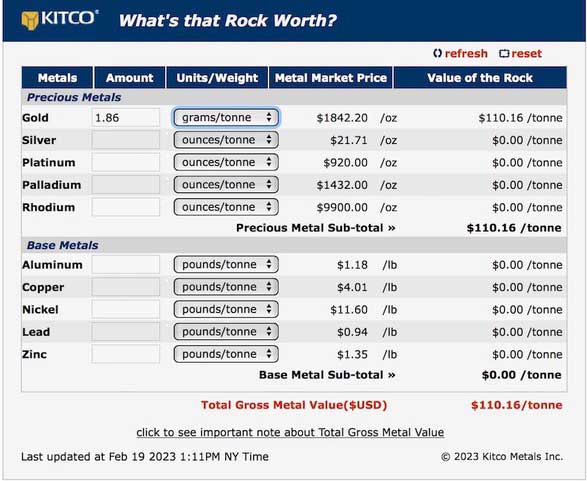

In February the company announced more excellent results including 50.3 meters of 1.86 g/t Au. That’s $147 rock in CAD. And it began near surface.

The majors have begun a series of Mergers and Acquisitions that can only continue. Since 1997 and Bre-X the majors got rid of their exploration arms while they were consuming their young at the same time. The industry is in for some interesting times in M&A if the highly predicted sharp rise in gold takes place soon. The 100% owned Ranch project of Thesis is located just north of the 3.6 million ounce Lawyers gold project of Benchmark Metals in the Golden Triangle. The drill program for 2023 calls for an additional 30,000 meters of drilling funded in total with the $15 million in cash the company holds after exercise of warrants by existing shareholders in November. That drilling will begin at once. At the same time, Benchmark will be in the midst of a 20,000-meter drill program to evaluate an underground resource potential and to expand their high grade resource. In 2024 the combined company will release an expanded Mineral Resource Estimate (MRE) for the Lawyers project and an initial 43-101 MRE for the Ranch property. Speaking of shareholders, the company is exceptionally tightly held with 65% of the shares in the hands of institutions and insiders. The company has a tiny public float. When the merger is complete the former Benchmark shareholders will own 60% of the stock. Thesis shareholders will own the remaining 40%. Thesis CEO Ewan Webster will be the head of the new combined company. I’ve made the comment in the past that juniors offer exceptional opportunity to those wise enough to buy low and sell high. I worked out once that the average stock I owned had a 290% range in twelve months. Thesis is a perfect example, the stock is down right at 75% in 13 months but nothing at all has changed with the project or the management or the price of gold. Buying in here and holding until it just regains where it was 14 months ago would reflect a four-fold increase in price. Thesis is an advertiser and I own shares. Do your own due diligence. Thesis Gold ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved