| |||

Lion One Hits BiglyBob Moriarty I have been waiting for a couple of years to write this story. For years Lion One has been my biggest holding because the story is so simple to understand. I’ve written half a dozen pieces on the company and the last one I wrote was seven months ago. I called it, Buying Lion One is like Stealing. And few listened. The shares were $.97 at the time. Between then and now the stock has barely edged higher in spite of excellent results such as their May 31 press release showing 584 grams of gold per tonne over 0.30 meters. I love the chat boards. You get to see just how stupid some people can be in their failed attempts to look smart. Here is what someone said on the CEO.CA Lion One board in response on May 31st.

Someone wrote me privately and asked what I thought about the comment. Here is how he posted my response.

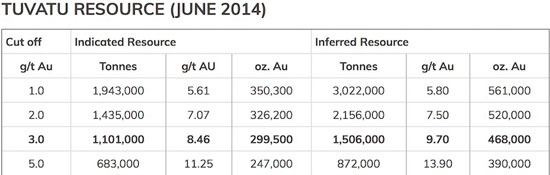

Investing in Lion One at a profit is about as difficult as learning how to fall off a bike. If you can handle that, you can make money on Lion One, because there is an identical age and grade alkaline deposit located about 40 km to the Northeast called the Vatukoula Gold mine. In production from 1932 the Vatukoula mine has produced over seven million ounces of gold and shows a resource of an additional four million ounces. The deposits are identical in age, grade and type of deposit. So anyone saying you can’t mine a 584-gram intercept of gold over 0.30 meters is blowing smoke. Alkaline deposits tend to be big. Lion One’s Tuvatu project can easily be as big as Vatukoula. But to satisfy the doubting Thomas of the world Lion One released a world class intercept on June 6, 2022 showing 75.9 meters of 20.86 g/t gold. That’s a 1583 gram/meter hole similar to the home run first hole of Newfound Gold in 2020 with 19.0 meters of 92.86 g/t gold giving a 1764 gram/meter hole. Lion One is fully permitted to go into production. They built their own assay lab and it is run to industry standards so assays that might take 2-3 months in Canada take 2-3 days in Fiji. Lion One plans on production to begin in Q3/Q4 of 2023. Lion One has a current 43-101 showing just over 910,000 ounces of gold at an average of 5.61 g/t to 5.8 g/t. I had a short conversation with Wally Berukoff about the production plans. He is shooting for annual numbers of around 100,000 ounces of gold. That is pretty much the magic number. The market will not take any company seriously below that number. Because of silly Covid restrictions put in by the government of Australia and Fiji, Lion One has been pretty much delayed for two years. The stock hit a high of $2.67 in July of 2020 based on excellent results before drifting lower to a low a month ago of $.88. I’ll stand by every word I said in my piece from November of last year. Buying Lion One is like stealing. They have the goods. Wally realized the project could not be run remotely from Perth so last year he put in a brilliant on site team in Fiji. If you watch this video, I think you will agree with me in saying that this is one of the most professional teams I have ever seen in twenty years. Currently the company has about $34 million in cash in the treasury. They have six drills turning with two more on order. The incredible latest hole shows they have tapped into a feeder pipe. They will continue to drill to upgrade and increase the near surface gold resource for near term production but I expect them to pincushion the feeder to determine all its limits. The worst thing that can happen to any stock is for shareholders to become bored. Once they do, they bail out at the first opportunity to break even. While the stock going up 17.5% on the news with over two million shares trading on the news, I suspect that was a lot of weak hands selling. Look for a couple of quiet days without a lot of price movement and then for the shares to go higher, perhaps much higher. The incredible results of the past two years tell me the high of $2.67 will be revisited soon. Lion One is still cheap. Until the news of the incredible latest intercept hit the market my personal shares have been underwater for most of the last two years. My average price was $1.18 and it took this news to bring me into profit. But I have believed this story since I first heard it and continued to add to my position as the price dropped. I have never sold a single share and right now I am really glad. Lion One is an advertiser. I love the company; I love the management and the team that Wally has put together. It will be a mine. It will be profitable and it will be a hell of a lot bigger than anyone imagines today. I expect majors will be sniffing around soon wanting to pick up a piece of it while it’s still cheap. That isn’t going to last long. As with the case of Newfound Gold, intercepts similar to this do not occur in a vacuum. There will be more record-breaking hits in the future. I own shares and have participated in PPs in the past and will in the future. I am biased so do your own due diligence. Lion One Metals ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved