| |||

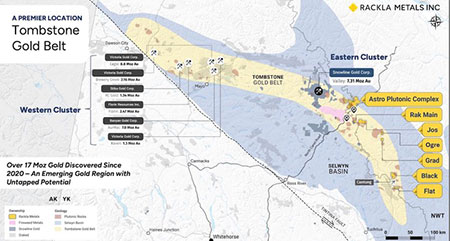

Rackla Metals lies in the Heart of the Eastern Tombstone Gold BeltBob Moriarty The direction forward changes just as rapidly in the mining business as it does in the fashion industry with women’s dresses. For a long time, Central America and some South American countries were mining basket cases. That changed. Five years ago, Colombia and Mexico were go-to places to invest. That changed and now both are back to becoming mining basket cases. Investors recognize the dangers of resource nationalism and move their chips around to where they can be safe. While there is giant and historic potential in resources in the near future there is also exceptional risk. I’m going to say something that all investors need to understand today but few financial writers have the good sense or the balls to say. Hic Sunt Dracones. Here be Dragons. We are literally sailing off the edge of the map into uncharted waters. We have a group trying to begin WW III in Ukraine, another in the genocide and carnage in Gaza, the West Bank, Syria, Lebanon and Iran. The president of France and the Chancelor of Germany get caught with cocaine paraphernalia as they discuss the planned war on Russia on a train to Ukraine. We already know the former leader of Ukraine, Zelensky starts his day with a breakfast of Cheerios and coke. Clearly the world is awash in debt. All debts get paid. Either by the borrower or by the lender. Governments can pay their debts in one of three ways. They can tax their subjects. That’s not nearly as popular as inflation as a way of extinguishing debt. The last way is through outright debt repudiation or default. The US has the world’s reserve currency as it has since 1944. Typically, countries serve as the source of the world’s reserve currency for 80-82 years or so. We are at the sell-by date. The treasury secretary is already mumbling about forcing foreign nations to extend the term of the US debt and decreasing the interest rate they receive. That’s called a default in simple English. In any rational world we would have a good correction in the price of gold after the run it has taken since the all-time high just over a month ago at $3500 an ounce. However, the west no longer determines either the demand or the price for gold. The price for gold and silver is now set in Shanghai. When you read me or hear me speak in an interview, all you are hearing is my opinion. The same is true of everyone else you pay attention to. We know the government and oligarchs lie about everything so you know just how much you should listen to what they have to say. There are a lot of rational voices in the alternative media and at least they don’t lie 100% of the time as does the government and the mainstream media. But Hic Sunt Dracones. No one, including me, can predict exactly what the near future brings. There are too many variables and vested interests. All any of us can do is guess. But I can predict with great confidence that the near-term financial future will bring changes beyond what anyone alive will believe. It's a good time to find a safe haven. I happen to believe investing in beaten down junior resources shares has the highest potential returns with reasonable downside. One of the hot areas today is the Tombstone Gold Belt in the Yukon. (Click on image to enlarge) One of the early adopters in the Tombstone Gold Belt was John McConnell who founded Victoria Gold and put the Eagle Gold mine into production in the Western cluster of the belt. The company was in production when disaster struck last June with the collapse of a heap leach pad. While unfortunate, it was also just an accident. Accidents happen and the job of management is to plan for success but also plan for when things go wrong. Based on the information released so far it looks to me as if the government over reacted. They closed the mine at once and put the company into receivership. Without question there was a technical but part of the process failed that shouldn’t have failed. Now the company is in the hands of a receiver that is not a mining company and frankly has no clue about how to fix mining project. The Eagle Mine is too big not to have someone put it back into production but the actions of the Canadian government wiped out the Victoria shareholders. Victoria Gold was sitting on about $5 billion worth of gold. They should have been given a chance to fix their screwup and weren’t. And naturally every other gold company in the belt got whacked with the same whip. Snowline Gold, the leader in the pack of juniors in the district went from about $5.20 to $4 before recovering. I will comment here that the management of Snowline is brilliant, taking the company from under $1 to almost $9 in three years. As an aside, SGD just announced an almost double in the M&I category to 7.94 million ounces of gold. Snowline is going to be bought out and bought out very soon. That is too much gold at too high a grade not to get taken out. When they get taken out the rest of the pack will be revalued. Rackla Metals (RAK-V) the subject of this piece dropped in value by 2/3 in a week but has since recovered strongly. Rackla was $.075 in January of this year but strong management and a renewed interest in the Eastern lobe of the Tombstone Gold Belt located in the NWT has shot the stock up to $.32 in just four months. The project is a Reduced Intrusion-Related Gold System (RIRGS) similar to that of Banyan, Eagle, Sitka and Snowline. Tombstone is run by one of the legends in the gold mining business, Simon Ridgeway who founded Fortuna Silver, Radius Gold and is the CEO of Volcanic Gold. I have known Simon for probably fifteen years. He is top tier in the mining business. The excellent presentation of Rackla talks about the Grad project and the BiTe zone showing values as high as 92.4 g/t gold in a 550 meter interval averaging 1.06 g/t gold. The zone is named BiTe in humor standing for Bismuth (Be) and Tellurium (Te). What the presentation doesn’t say and few writers will understand but I’ve been to dozens of projects in the Yukon, NWT and Northern BC. Bismuth in my view is a more important pathfinder for gold than gold is. Where you find bismuth, you almost always find gold. Rackla is well cashed up with $5.5 million in the till. A fully funded exploration and drilling program will start shortly. Rackla is an advertiser. I was wise enough to put my money where my heart was months back at a much lower price so naturally I am biased as a shareholder. Do your own due diligence. Rackla Metals Inc ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved