| |||

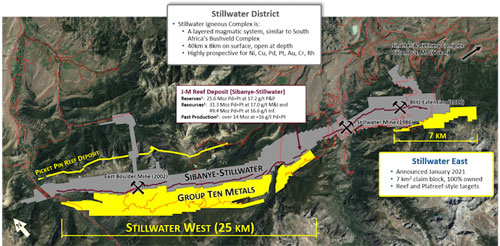

Group Ten Drills Rhodium Worth $868 a GramBob Moriarty Rhodium cost $598 a troy ounce or about $20 a gram in August of 2016, five short years ago. I was pointing out at the time it was cheap after being as high as $10,000 an ounce in 2008. It’s up 4500% in five years. That’s about what Dogecon does in an average week. Everyone comments on the metals but few actually understand them well enough to explain why something like rhodium can go up 45 times in five years. It doesn’t make a lot of sense to me either but I do understand some of the uses for the metal that no one else talks about. Rhodium melts at 1964 Celsius while platinum melts at 1768 C and palladium at 1555 C. That makes it more suitable for high temperature catalytic converters. When it was $20 a gram and cheap, jewelry manufacturers used it to plate sterling silver to make it shinier. At these prices it has long been replaced by nickel. If you wonder if your sterling silver necklace is rhodium plated or nickel-plated, put a magnet up to it. Nickel is slightly magnetic. Face it, $868 a gram for a shiny metal seems a bit over the top but we live in a world increasingly unhinged from reality. Who can justify the price of Dogecon that was started as a joke? Of course the joke is on the FOMO chumps believing that since there are a lot of fools around willing to pay up for it, why shouldn’t they? There is a bit of a flaw to that logic, fools have always heavily populated the world. Dr. Fauci spun the Wheel of Fauci a couple of days back and when the spinning needle stopped, he pronounced we no longer needed to wear a mask if we had participated in the human trials for an experimental gene therapy that the WHO and CDC haven’t had time to conduct a complete test on. Sane people realized the whole mask fiasco was theater a year ago. If air can get through, a virus can too. The CDC and Fauci confused motion for action. Israel is back bombing the shit out of women and children caught in the world’s largest open-air prison in Gaza. Technology has created the most wonderful weapons of precision accuracy where the IAF can target women and children of any age with the most costly missiles and bombs paid for, of course, by the US taxpayers under the theory Israel is such a victim that they shouldn’t have to pay for their own wars. The US could end the endless carnage in a week simply by enforcing the Symington Amendment but since the US is held captive by Israel it isn’t going to happen. Obeying domestic or international law has been utterly rejected by both the US and Israel. When the US invaded Afghanistan and Iraq they at least paid lip service to the law. When the US invaded Syria, paying attention to little things like a legal justification was totally ignored. The US no longer even makes a pretense of having a legal basis for their actions. Israel has never paid even lip service to international law or the Geneva Conventions or the Nuremberg principles. The world sleeps. The dying continues. FOMO blew up on Wednesday the 19th with the Clipto currencies crashing. They have started down the mountain seeking the very bottom. They are all eventually going to zero. As they do, a lot of money is going to flow into real assets such as gold, silver, platinum and even rhodium. A lot of the clipto currencies funds are going to Bitcon heaven. Group Ten Metals (PGE-V) is one of the hardest companies to explain that I have ever written about yet has an incredible potential that the stock market is utterly clueless about. A large part of that is because there are so few platinum group metals companies out there telling the story. Let me see what I can do. Group Ten’s primary project is the Stillwater West prospect adjoining the three Sibanye-Stillwater’s three PGE mines in Montana. If you look at the map below it will give you some idea of the relationship between the two land positions. Basically PGE has 25 km of strike of the same material as Sibanye-Stillwater. (Click on image to enlarge) The J-M Reef shown in the map has over 80 million ounces of high-grade platinum and palladium with minor rhodium credits that contribute 25% of the profit to Sibanye-Stillwater now. The company has already produced over 14 million ounces of platinum/palladium. Because PGE hasn’t come out with a resource yet, investors have nothing to hang a hook on to figure out the value of what they have. Group Ten picked up Stillwater West in 2017 just after Sibanye paid $2 billion USD for the Stillwater property and three mines. That should give investors some idea of the potential. The company pulled a massive coup in April when they announced the appointment of Gordon Toll to the board as an independent director. Gordon was Deputy Chairman of Ivanhoe Mines and Chairman of Fortescue Metals Group. He has been directly involved with raising over $5 billion USD over his fifty year career. Group Ten holds a 61 square km land position at Stillwater with 54 km in the Stillwater West project and an additional 7 square km in the Stillwater East property picked up in January of 2021. They own 100% of the project subject to a 2% NSR. There has been a total of over 31,000 meters of drilling done at Stillwater West since the 1960s. There has been 13,000 meters of drilling since 2002 that PGE has access to. They have drilled about 4,600 meters in 20 holes over the past two seasons. This year’s program calls for 2-3 drills doing a 10,000-meter drill program over the top three resource targets. The overall Stillwater Complex is a 2.7 billion year old mafic-ultramafic similar in geology and mineralogy to that of the Bushveld Complex in South Africa. Prior exploration on the part of PGE reveals eight different “Platreef-style” PGE-Ni-Cu targets with signatures similar to that of large bodies of massive to disseminated sulphides. These targets show elevated palladium, platinum, rhodium, gold, nickel, copper and chromium values in both soils and rock samples. Since the price of rhodium has shot to the moon, PGE has gone back and submitted samples for assays to determine rhodium values. Those numbers just out show that at current prices, rhodium adds significant value to the total metal contained. I’ll be really candid here. I was telling people to buy rhodium when it was $600 an ounce because it was cheap. It is not cheap at $27,000. Either platinum, palladium and gold go way up from here or rhodium drops a lot. The prices for each of the metals don’t align logically at present. But when an NFT of a fart is worth $85, who knows what anything is worth? Group Ten is especially well cashed up with about $3 million in the bank. There is another $11 million in the form of in-the-money warrants. Currently the company is in discussions with warrant holders to see if they will consider early exercise. Until the company releases the results of a 43-101 resource calculation set for July-August, there will be an overhang on the share price based on over 41 million warrants with an average exercise price of about $.27. It’s perfectly natural for many investors to want to sell shares at the market to exercise deep in the money warrants. After the warrant overhang is sorted and a 43-101 resource released, I expect much higher prices. I’m just guessing based on the assay numbers I have seen but something above 2 million ounces of Pt-Pd-Rh-Au seems reasonable along with 500 million pounds of nickel and copper in the initial 43-101. If the three mines in the Stillwater property were worth $2 billion at far lower prices for palladium and rhodium three years ago it seems reasonable to me that Group Ten should be worth a lot more than $58 million when they are only 500 meters down stratigraphy from them. I have participated in a placement with Group Ten and they are an advertiser. Please do your own due diligence. Group Ten Metals ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved