| |||

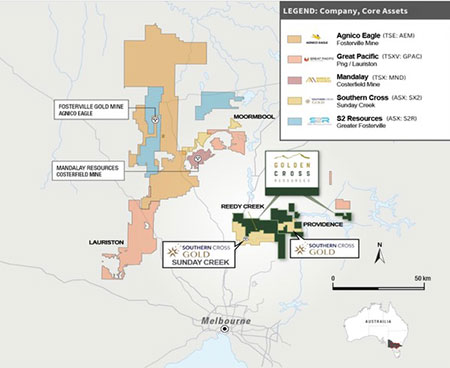

Golden Cross Has GoldBob Moriarty We are in a correction within a long-term bull market for both gold and silver. My favorite sentiment indicator, the DSI never got above 87 for gold and 88 for silver lately. Both were higher back 3-5 years ago and clearly did not cause a major top for either then. We will see 95-97 for both metals before we have a major top. And that could be years in the future. But I would have no problem seeing gold go down to the $2800-$2900 level to wash out some of the excess optimism. That bullishness never even got close to moving shares of the junior lottery tickets much higher and one day soon it will. So savvy investors who understand stocks go up and stocks go down are going to continue to have an opportunity of a lifetime to pick up shares from the bargain bin. One of the stocks I invested in as a private company years ago managed to put together some incredible properties in the historic Reedy Creek gold district in Victoria, Australia. That company, Golden Cross (AUX-V) only began trading as a public vehicle three weeks ago. Golden Cross paid six million shares in addition to a non-refundable deposit of $500,000 for the Reedy Creek property. Also, should Golden Cross establish a resource of gold in excess of one million ounces, they will pay the vendor an additional $1 million. And should AUX go into commercial production for gold, they are obligated for another $2 million to the vendor. I happen to be quite familiar with the area of the project and a junior located right next door to Golden Cross. (Click on images to enlarge) I suppose many or most junior resource investors are familiar with the Fosterville saga. After passing through three or four different mining companies without great success, the famed Eric Sprott asked Quinton Hennigh to look at the mine and tell him what he should do. Eric Sprott was a major investor in Kirkland Lake Gold at the time. Quinton visited the mine and told Eric he should buy the mine for $1 billion and put it into KLG. Many of the top management of KLG were dead set against spending that much money for a so-so gold mine. Quinton stuck to his guns, Eric told the KLG management to write a big check and the rest is history. The goodie locker was down deep as Quinton had predicted against all “professional advice” from the existing KLG management. When they did open up the deeper levels and did the first gold pour, there was so much more gold than the “professionals” had suggested that the company had to weld lips around the gold molds to hold the gold that no one believed was there. Well, two people believed the gold was there. Eric Sprott and Quinton Hennigh. I wrote about it in What Became of the Crow? Fosterville took KLG from a $3 billion company to an $18 billion company and poured an additional $3 billion into Eric Sprott’s wallet. As if he needed it. If you look at the map above, the Fosterville Gold Mine is a little over fifty km from Golden Cross. Agnico Eagle now owns Fosterville. And actually, I am invested in another company named Mawson that had a giant position in Southern Cross, the company contiguous to Golden Cross with the Reedy Creek property. Southern Cross has been drilling the crap out of what they call Sunday Creek with giant success and giant rewards to their shareholders.. Southern Cross has a $1 billion market cap. Golden Cross has a $20 million market cap but the gold trend runs from Sunday Creek of Southern Cross right into the Reedy Creek deposit of Golden Cross. Golden Cross is where Southern Cross was two years ago before it ran from $.45 to $5.15 today, up 1000%. Golden Cross has the same potential. Golden Cross is fully funded for a 6,000-meter drill program starting in early June. The company has $3 million cash in the bank. Their drill costs are in the lowest quarter, about $200-$225 per meter including assays. Golden Cross has gold. Prior drill results include 11 meters of 31.4 g/t gold and 2 meters of 174.42 g/t Au. Reedy Creek was a mine before and I believe it will be a mine again. Insiders agree, holding about 1/3rd of the outstanding shares. Since the company is brand new, trading volume has been light. The company has pretty much been invisible. But given the outstanding gold grades they already know they have, there is another kicker that is far more subtle than obvious to ordinary investors. The CEO, Matthew Roma, is also the CFO for both Snowline and Gladiator Metals. Each of those companies have been brilliant success stories for investors. I see it happening again. Drilling begins in early June and results should start to flow after late July continuing for another six months. I participated in an investment in the company that became Golden Cross. Golden Cross is an advertiser so naturally I am biased. Do your own due diligence, please. Golden Cross Resources ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved