| |||

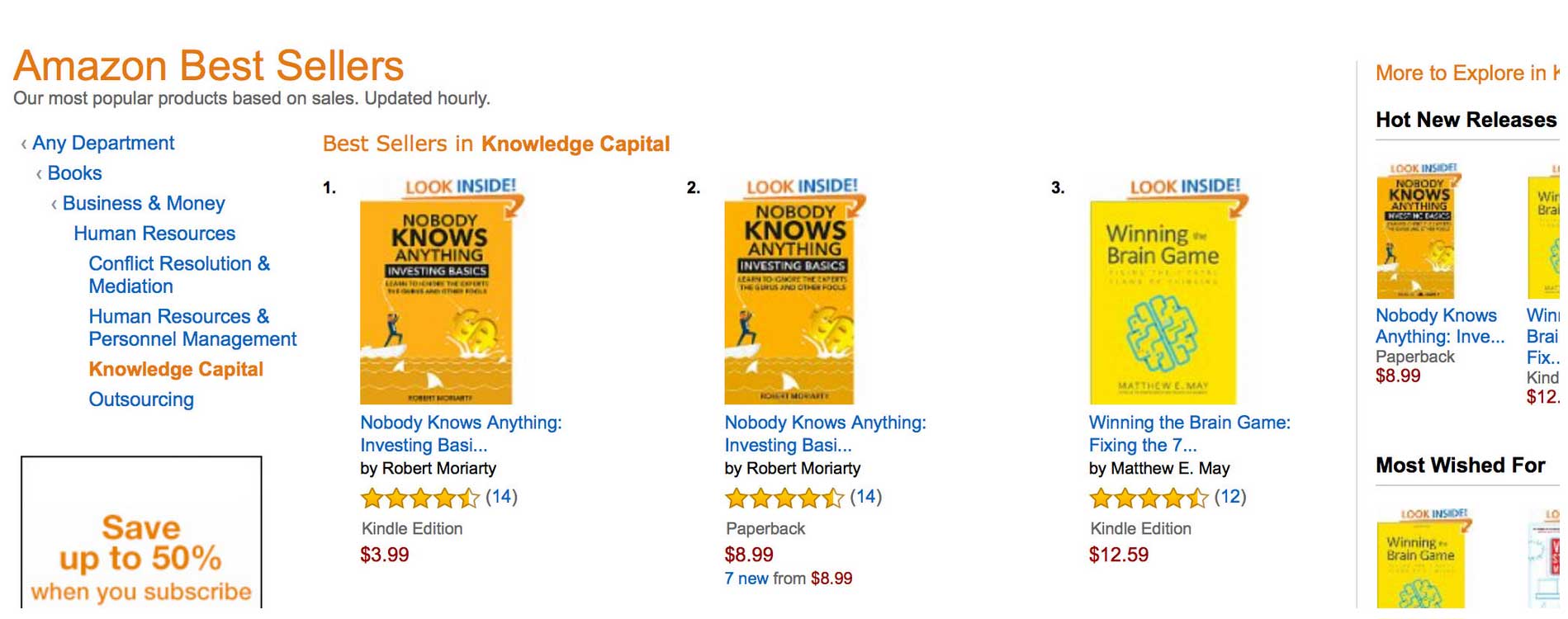

Taking Money off the TableBob Moriarty Recently I wrote a book discussing some of the basics of investing. The book is titled Nobody Knows Anything and can be bought on Amazon. I released it a little over a month ago and it has shot to number 1 in its category.

Here is a very nice review we got from a reader in Australia.

In chapter seven of the book I talk about when to sell a stock. It's an important chapter because most investors buy what they think are good stocks but don't have any plan for selling. Somehow the stock is going to go up and somehow at the very top they will get it and sell. Of course it never works out that way. If we buy a stock and it goes up ten fold, we hang on to it believing it's going to go up anther ten fold. Eventually when the lemmings have gone over the cliff and the stock crashes, we are forced to sell at half of what we paid originally and we curse the guru who mentioned it in the first place. That's why I wrote the book and it seems to have struck a cord because a lot of the reviews and emails I have gotten come from people who held on too long and ended up taking a big loss because they wouldn't sell at a profit. Everyone including me seems to have made exactly the same mistake. Guys, it's this simple. If you won't sell at a profit, you have to sell at a loss; there are no other alternatives. Think about these two examples. In September of last year I wrote about Gold Canyon. First Mining Finance had just made a bid for them two days before at $.35 a share. Gold Canyon was $.205 up from $.10 when I wrote about them in December of 2014. From that $.10 a share they went to $.33 offering shareholders a nice profit in a short time. Should they have sold? When First Mining made their $.35 a share offer, the market believed shares were only supposed to go down. You could still buy shares at a 40% discount when I wrote my piece two days after the announcement. So imagine that you bought at either $.10 the first time I talked about them or $.205 the second time I talked about them. First Finance did a one for one exchange so all of the Gold Canyon shareholders got exactly the same number of FF shares. Now after one of the biggest bull market moves in history, those $.10 and $.205 shares are worth $.80 for either a 700% profit or a 290% profit. What should you do? Go spend $3.99 and read the flipping book. If your purpose in buying shares is because you want to make money, you have to sell at a profit. Take some money off the table when you have a profit. You don't have to sell everything but sell something. Another perfect example was Silvercorp. I started talking about them when the shares were $.63 apiece and again at $.85. The stock blasted higher to $3.10 a share three months later. If you were the guy smart enough to buy at the low of $.60, are you smart enough to sell part or all at $3.10? Take some money off the table when you can. Nothing goes straight up and right now a good correction would be wonderful. It's coming sometime. You are going to start hearing about a lot more juniors that have been totally off the radar for years. While lots of people are studying the tea leaves and trying to determine why gold went down and now why it's going up, actually it's a lot simpler. Commodities peaked in 2011 and corrected. Everything went down, not just gold and silver. Gold actually went down a lot less than most commodities. The bigger the bear, the bigger the bull. I was contacted by the management of Gold Dawn Minerals (GOM-V) a couple of weeks ago who wanted me to look at the numbers for a recent option they took out on a couple of gold mines and a mill in Canada that they are in the process of raising $10 million for. The numbers seem quite convincing. The project they call Greenwood Gold mine has an NPV of $32 million, a capex of $9.5 million and an IRR of 61.5% after taxes with all in cash costs of producing gold of $820. The payback period is under 2 years, which is incredible. Golden Dawn intends to raise the $10 million via a financing consisting of a debenture paying 8% with a common share and a warrant for an additional share at $.40. The price of the unit is $.15 Canadian apiece. The debenture has a five-year maturity and is fully secured by all of the assets of the Greenwood Gold project. The debenture holders may request payment in gold at a price of $1295 per ounce USD after holding the debenture for three years. It sounds like a pretty good deal if you agree with me that after a four-year correction/crash in the price of gold we have seen the bottom. If Golden Dawn made this deal a year or two ago, it would have been a problem but it's far easier to raise money today than it has been in years. The Greenwood mill and mines originally cost $40 million. The PEA shows an all in cost of production of $820 an ounce. The shares doubled from $.07 in January to $.15 in February before making a perfectly normal correction to the current $.095. With a market cap of under $6 million Canadian and near term production in the cards, Golden Dawn offers gold bugs a cheap lottery ticket with a nice potential payoff no matter if they invest in the financing or simply buy shares near the yearly low. I don't own shares in Golden Dawn but I am biased. The company is an advertiser. Please go to their site and review their material and news releases. It's a pretty simple story and you need to be responsible for your own investment decisions. Golden Dawn Minerals Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved