|

|||

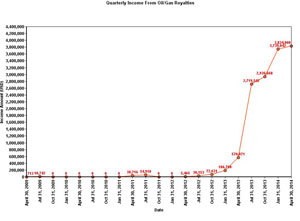

Newport Exploration rapes own investorsBob Moriarty In 13 years running this website and visiting dozens of projects yearly I have run into every sort of charlatan, crack addict, drunk and all-round scam artists among the legions of fools who believe they can run a mining company successfully. In most cases, they have been lucky enough to collect absurd salaries long enough before the abused shareholders toss the bastards out. Write these names down and keep them handy. If you ever see them associated with any company you are considering buying, prepare yourself to be raped. Ian Rozier, President of Newport Exploration, Barbara Dunfield, CFO of Newport and David Cohen, Director of Newport. What they pulled on Newport Exploration wasn’t just your typical screwing shareholders that we all expect on a regular basis, they raped Newport shareholders on a continuing basis. I would describe Newport Exploration as pretty much a shell company. In November of 2010 they entered into a JV with another pretty much shell company named Reva Resources. This action can be considered one of the first examples of rape since two significant shareholders of Reva are directors of the Company. So in essence, directors of a shell company with enough cash in the bank to pay salaries to people for doing nearly nothing does a JV with another shell company that they just happen to own much of. If you are kind you can think of it as a sweetheart deal. Newport thinks so much of the project that they call it, “This page is under construction.” Reva thought so much of the project that they called it, “There are no "Photo Gallery" items released on this web site at this time.” Newport had a couple of aces up their sleeves. They did cash up prior to the crash in resource companies. For their year end 2010 their company had just under $7 million in cash assets or over $.12 a share and were selling for $.12 a share. The 2nd ace up their sleeves was a 2.5% royalty on some obscure oil/gas projects in Australia. That royalty contributed $10,742 in their 2009 results but none in 2010. It became obvious to shareholders that perhaps the royalty was a pretty good deal when Newport announced on April 29, 2014 that the royalty from Australia had rocketed from none in 2010 to over $1 million per month or $.015 per share per month in the first quarter of 2014. Actually the royalty probably became material by the end of the April 30 quarter 2013 when it went up to $570,000 for the quarter. There was no press release talking about it then. That’s interesting because as of April 30, 2013, the company had $.11 a share in cash and was selling for $.04. (Click on image to enlarge) In the 2nd quarter of 2013, royalties were up to $2.7 million for the quarter ended July 31. Newport reported $.14 a share in cash while the shares were humming along at $.04. There was no press release announcing the windfall then. If you looked long enough and hard enough in the annual report you could come up with the numbers. Evidently the only people who understood what was going on were the directors of Newport. Ian Rozier began to add to his share position buying at least 300,000 shares between $.04 and $.045 in August, long before shareholders figured out what was going on. During August, the slowest month of the trading year, a stock that had been moribund all of a sudden woke up. Some 2.5 million shares traded when only the directors knew the royalty payments were up to $900,000 per month and the company was selling for less than $.29 on the dollar. The company had $.14 a share in cash yet was selling for $.04 a share. No press release was issued. Perhaps they didn’t think it material except it was material enough for them to load up the boat on their own behalf. The self-dealing on the part of Newport “management” continued. On October 3, 2013 Newport announced closing the deal on their Beanie Baby project in BC. The Newport directors paid Reva, (two of their own directors) some $1.5 million in cash and 5,436,000 shares of Newport. I can only say that took some balls. As a result of the unannounced press releases detailing the royalty payments, Newport shares were trading on the open market for $.04 a share while management knew that they had $.17 in cash at the end of October. In effect, company A paid themselves in company B shares worth four times as much in cash as in the open market because nobody reads quarterly reports from companies not doing anything. So the real issue is, was this a conflict of interest between the interests of management and the interests of shareholders and what exactly is a material disclosure? I think both questions are easy to answer. The ongoing rape really gets interesting with their press release of December 19, 2013. Ms. Barbara Dunfield announced the company was granting just over 6 million options to directors and officers at a price of $.05 good for five years. What Ms. Barbara Dunfield didn’t bother announcing was that on December 18, 2013, the day before, some 5,450,000 options granted to directors and officers at $.10 expired worthless. After all, who in their right mind would pay $.10 a share for a stock that had $.20 a share in cash and the cash was going up by $.015 a month? I don’t think it’s coincidence only that in October Newport paid Reva 5.436 million shares and in December the same directors let 5.45 million options expire worthless. But it takes really big brass balls to let options at $.10 expire worthless so you can pick up options at $.05 when you know the company has $.20 in cash but management is hiding that fact as much as they can. No one at Newport is overworked but they may be overpaid. Ian Rozier was making $180,000 a year for running a company that wasn’t doing much. Barbara Dunfield was getting $120,000 when it seems her biggest job was signing the back of royalty checks and making sure shareholders didn’t find out about the royalty. Things really got interesting in February of 2014 when even all the diligent efforts of management to hide the royalty income was starting to fail. Using words I can only describe as “weasel words” Ian began to come clean. This is an all time classic. Only a weasel could come up with something like this, “Beach reports production from Bauer field is currently in excess of 13,000 barrels per day (gross) being produced from eight wells, with three more wells yet to come on line.” Ian does bother to mention the 2.5% royalty that has been so insignificant before, not worth talking about, when a company with a $2 million dollar market cap is bringing in $1 million a month in revenue for doing nothing at all except signing the back of a check and depositing it. Actually all the information you need to know is in the press release. Newport gets 2.5% royalty on 13,000 barrels per day. So multiply 13,000 times .025 times $100 and you get about $32,500 in US or about $35,000 in Canadian dollars. A day. Now if I weren’t using weasel words, I’d call an income of $1,072,500 a month a good deal for a company worth $8.4 million in total. I’d even think that’s material and indeed, Ian suggests, “all royalty payments received by the company will continue to be reported in its financial statements.” You know, the ones nobody reads or understands because the company has buried the information as deep as they can. The rape not only continues, Ian is now stretching the limits of rape under the “never give a sucker an even break” rule. According to Stockwatch, Rozier released enough material information at 09:18 ET on February 18th for investors to figure out the company was bringing in over $1 million a month in cash. At 15:07 ET on the same day, according to Stockwatch, the company announces a private placement of 20 million shares, wait for this, at $.11 a share with a full warrant good for two years at $.14. “Management” knew that the company was sitting on $.21 a share in cash but wanted to dilute the company by 65% at $.11 and $.14 so they could, “act in a timely manner on new opportunities that may arise.” Gag me with a spoon. Take a stupid wild-assed guess as to who bought the shares? I’ve never heard of anything so outrageous. You have to believe the TSX didn’t understand what Rozier was pulling or they would have never approved the deal. It’s simply the worst deal I have seen in 13 years. The way this company has been run for most of the last year pretty much defines management raping their own shareholders. It was a deliberate decision on the part of management to not announce the explosion in royalties received. The royalty became material either in the second or third quarter of 2013 and was never reported in a manner that an average investor could or would understand. Yes, the information was buried in the financials. But buried is the operative word. Management buried the information. I went to Canadian Insider and paid $20 to see just how much the insiders and management had at risk in the company. Prior to August of 2013 when the royalty increased to over $1 million a month, the CEO Ian Rozier only owned just under 3 million shares. He bought 300,000 shares in August when only the insiders knew about the windfall income increase. He let his 1.8 million options expire at $.10 on December 18, 2013 so he could pick up 1.8 million options on December 19, 2013 at $.05. When he announced the PP, he loaded up the boat with 2 million shares at $.11 and 2 million warrants at $.14 with cash in the company of $.21 a share. CFO Barbara Dunfield owned the magnificent sum of 348,000 shares prior to December 18, 2013 when she passed on buying 1.25 million shares in an option at $.10. But Santa was good to Ms. Dunfield as she picked up 1.6 million options at $.05 on December 19th. She made the investment of a lifetime in March as she leaped on 2 million shares at $.11 and 2 million warrants at $.14 with a $.14 share price and $.21 a share in cash. As CFO you have to wonder if she actually understood she was buying stock at a 50% discount? David Cowan didn’t own any shares prior to December 19th when he was awarded 550,000 options. He could only afford to buy 50,000 shares at the 50% discount in the private placement in February. David Cohen (different David) owned 450,000 shares but did not buy any shares in the private placement. He did however pick up 1.5 million options at $.05 during the December 19, 2013 fiasco. This company is going to give the BCSC or the TSX the opportunity to prove if they actually give a damn about the interests of investors. Let me be perfectly clear, Newport shareholders got repeatedly raped.

If the BCSC and TSX ignore what is on its face outright misrepresentation and malfeasance, shareholders of any Canadian company have no rights and certainly no protection. At the very least the BCSC and TSX should reverse the private placement and approval of the obviously mispriced options. If they don’t act in the interests of shareholders, they may as well close their doors and stop pretending they actually act in the interests of shareholders. We will know shareholders are at the mercy of management and there are no limits on what they can do to feather their own nests. I wouldn’t touch a company with any of these clowns associated with it with a ten-foot pole. Newport Exploration ### Bob Moriarty |