| |||

Gold: $6,600 or $22,000Bob Moriarty I like to read. I read fast and that helps. I can’t quite come to grips with all these guys now coming out with 25-minute videos they insist we watch instead of reading. Do they really believe that everyone has so much free time that they can pay attention to someone chattering away for 25 minutes? Most of what you read or watch will be noise, meaningless crap put out by guys who always have an agenda and certainly a bias. The majority has never had an original thought in their lives; all they do is parrot what some other fool has to say. When they want your money and that is pretty often, they figure out what you want to hear. That’s what they tell you, just like TV preachers and politicians. There are a few diamonds amongst all the coal and clutter. One of my favorites is John Rubino of the Dollar Collapse. When you read him or listen to him speak, you are not getting recycled pabulum. You get clear thinking and logical conclusions, so rare among the rest of the pack. I eagerly read what he had to say last week and he hit a home run. He wrote about a fund manager for the Equity Management Associates named Lawrence Lepard. Lawrence wrote a quarterly update and released it on March 31, 2020. It is a must read and you can email him at llepard@ema2.com and request a copy. If you are an accredited investor you may want to know that for 2019 the fund’s return was 97%. Or you can just go here. A year ago I published an easy to read book I called Basic Investing in Resource Stocks, The Idiot’s Guide. You can read the book in a couple of hours; it’s not rocket science or brain surgery. It has just about the highest rating of any book I have ever seen on Amazon. That speaks well of how readers valued it, I think. In the book one of the chapters talks about the predictions of “Experts”. In early 2011 someone approached me and asked me to forecast the price of gold. They had gone to 148 other “Experts” and each had picked a number. I’m not that smart and I don’t come equipped with crystal balls so I passed. No one can predict the future. In his quarterly report, Lawrence Lepard had some interesting thoughts about the state of the economy and what gold might do. It’s a 26-page paper so I’m going to cut and paste the pertinent bits only. QUARTERLY OVERVIEW What happened in the first quarter amounted to a global margin call, as investors rushed to sell assets and raise cash or pay off debt. It was one of the strongest deflationary impulses in the history of markets. In many ways it resembled the crash of 1929 with the differences being that this one happened much more quickly and was not quite as deep. In 1929, the initial total decrease was 45% but it took 2.5 months. This one happened in five weeks. Note that in the Great Depression that began in 1929, from top to bottom, the Dow fell by 89% but it took three years to do so (with six intermittent big rallies in the stock market of between 16% and 48% during that multi-year bear market). … gold stocks were not spared in the first quarter of 2020 and, in fact, did worse than the general market. This is similar to what happened in the 2008 GFC. Gold and gold stocks fell, only to recover quickly within the next three months. They then went up 2.8x (gold) and 4.0x (gold stocks) over the next three years. …CREDIT BUBBLE, BUSINESS CYCLES AND THE VIRUS …In the eyes of the Fed “Deflation is the Devil”; thus, it is easy to anticipate the Government’s fiscal and monetary response. They will be required to deficit spend and print money with almost no end. Perhaps, they likely will resort to other measures, as their only alternative is to watch collapsing asset values and deflation wreak havoc on the economy. This would closely be followed by massive unemployment and widespread bankruptcies (i.e., a Depression). With this current crisis, the amount of new money that needs to be created, to make up for the potential losses, is staggering. Credible analysts suggest that it could be in the range of between $10 and $40 Trillion. All to maintain the current pricing structure (i.e., no severe deflation). I believe there is some chance that it could be larger than these figures. …but the bottom line is that the Fed just agreed to back stop: the entire banking system; US government debt market; US Agency debt market; commercial paper market; money market funds; municipal bond market; foreign central banks; primary dealers (brokerage firms); student loans; car loans and other asset backed securities. In some cases the amounts involved are unlimited and in other cases there are limits which the Treasury and Fed have implied would be raised, if necessary. What you have right here is the largest open ended, coordinated money printing operation in the history of mankind. The Fed is almost nationalizing a large portion of the US securities markets in order to prevent further collapse or a deflationary melt down. By the way they are behaving and coordinating their actions, it appears that the US Treasury and the Fed have effectively merged and become one entity. …This rate of growth in the Fed balance sheet is truly staggering. But wait, there is more. In conjunction with the programs above, the US Treasury announced a plan to reimburse employers for sick pay leave in conjunction with the COVID crisis. They also delayed the 2019 income tax filing deadline from April 15 to July 15. Finally, the US Congress got involved and passed the CARES Act which provides the following:

So far I have agreed with just about everything Lawrence Lepard included in his quarterly review right up to the point he say the safety net should be much higher. First a little history. We had a depression in 1920-1921 just after WW I ended. There were no safety nets, no unemployment, no health care, no benefits to business. Governments, state and Federal, did nothing for their citizens. You were on your own. If you had savings and were responsible, you made it through ok. If you had no savings, well, you could either get a job or starve. But neighbors helped neighbors. Communities and churches helped each other. The depression lasted only 18 months. Because the government did not see itself as a cornucopia of all goodness and wisdom. If governments handed out unlimited money, someone had to provide it. There are no free lunches. Believing that governments can and should provide an unlimited supply of safety nets is like thinking that because Ted Bundy seems to like young women, he would make a great assistant for your Girl Scout troop. The government cannot be the solution; they caused the goddamn problem in the first place.

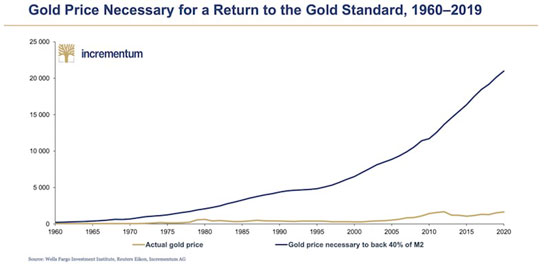

…if the US Federal Government were a household, here’s what their finances would look like assuming they earn $100,000 per year. They spend $206,000 per year. They owe ~$1.1 million on balance sheet and an additional $4.7 million in off balance sheet liabilities. Is this household bankrupt? Does this household deserve an AAA (Fitch’s) or AA+ (Moody’s) credit rating? The counter argument is that deficits have never affected the US’s ability to issue Treasury bonds in our great 200+ year history. Therefore an investor should “not fight the Fed”; rather simply have confidence in the “full faith and credit” of the Fed and their ability to monetize deficits and control inflation. I believe that faith may be misplaced. However, let us postulate that one of the important properties of a currency is that it be a store of value. The dollar and gold are substitutes for one another in the store of value category. A study of economic history conclusively shows that to the degree that a Government is profligate then the value of that government’s currency suffers in gold terms. The next chart shows that relationship nicely in the US for the past eight years. Notice how there has been a tight fit between US Government Budget Deficits and the price of gold. The last point on the chart shows a $950 billion budget deficit and a $1,600 gold price. This relationship shows that the gold price rises $500 for every $500 Billion increase in the US Budget deficit. Earlier in this report I estimated that the US Government is on its way to recording a $6 Trillion annual deficit, which would portend a gold price of $6,600 per ounce (4x from gold’s current price), should this relationship hold. Lawrence is being triple brilliant here. He is smart enough to recognize that he cannot predict either the future in general or the price of gold. What he has done that is nothing short of remarkable is to show that in the past when the deficit goes up $500 billion, gold goes up $500 an ounce. And his guess is for a $6 trillion increase in the deficit. Wow!!! I can accept that logic. It’s not a prediction. …BOND DOOM LOOP The rapid decline in stock prices that we just saw was a large deflationary impulse. The Federal Reserve’s primary purpose is to address and solve this type of problem. The Fed is tasked with providing liquidity and fighting deflation. The only thing holding it all together is the Fed and its ability to expand credit. Chairman Bernanke assured us that a determined Fed could always address and solve the issue of deflation with Helicopter money. The problem is the amount being printed will get bigger and bigger because all the new debt needs to be serviced. Furthermore, if buyers and holders of US Government debt decide they have better places to put their money other than US Treasuries, then interest rates will rise (i.e., less bond demand combined with greater US Treasuries supplied = lower bond prices & higher yields). But, this is a real problem because higher interest rates increase the deficit requiring even MORE DEBT. So, the FED will have to buy even more of the government bond market (e.g., issue more credit/print more money) in order to keep interest rates in check. Can you see where this is leading? This is a classic doom loop. Printing money leads to more inflation, which leads bond holders to sell, which leads to the need for more printing. Eventually, when the Fed is printing money so rapidly that its value is disappearing daily then they will have another problem: hyperinflation. This is why I say the Fed is trapped – it’s a pick your poison game for them of (i) doing nothing = deflation & bad recessions vs. (ii) monetizing deficits but at the risk of debasing the dollar. …If the currency debasement gets bad enough and political leaders realize that hyperinflation is a real threat they could take action to do a monetary reset and return the US to a gold standard on some old dollars converted to new dollars basis. Others have done the math and the excellent analysts at Incrementum Ag have calculated the gold price that would be necessary to return the US Dollar to the gold standard. This work is presented in the following chart: (Click on image to enlarge) This schedule was computed before the present round of monetary expansion, so the true figure might be greater, but this suggests that it would take over $20,000 per ounce to return to a 40% gold backing of the dollar. Over 10x higher than today’s $1,700 price. Of course a giant reason I think so much of Lawrence Lepard is that the conclusions he has come up with pretty much jibe with what I have been predicting for years. I’m perfectly comfortable knowing that if I happen to be dead wrong and look like an utter fool, at least I have someone I can hold hands with secure in the belief that great minds come from the same gutter. The same government that couldn’t get out of their own way to safeguard Americans against a bad flu want you to believe they are all wise and all powerful. Well, that’s bullshit. We are in this mess because those idiots not only talk to each other in an echo chamber, they listen to each other as well. The one thing they never do is actually reflect on the progress or lack of progress they are making. This depression that started just a short time ago will last for ten years if those fools have their way. They will keep trying to throw darts in a room with no light and the board is in the next room and they don’t know it. They will totally screw it up, put most Americans into poverty and continue to fail until some bright spark says, “Why don’t we just write off the debt and go to a gold standard? Then we get another chance to screw it up all over again.” Eighteen months after that the economy will be humming. The Corona Virus and the Greatest Depression are providing us with the very best argument for having only tiny governments that you can grab by the stacking swivel and toss them into the toilet so you can drown them quickly. ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved