| |||

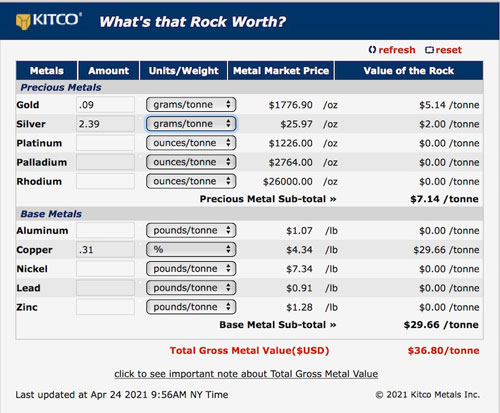

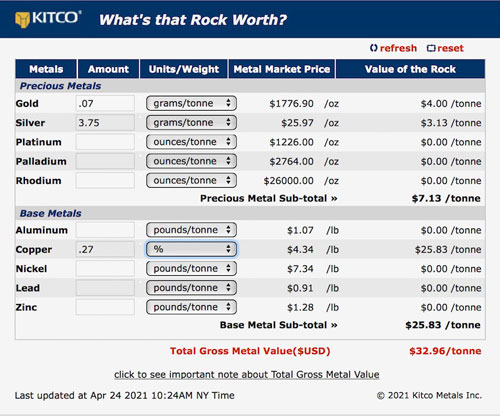

A Tale of Two Coppers; Universal and Nobel29Bob Moriarty Investors love reading recommendations on stocks they should buy for two reasons. One is they hope the stock they go buy goes up and makes money for them. The other is they have someone to blame should they not make money either because the stock went down or they failed to sell at a profit when they could. Actually I rarely recommend buying a specific stock and it’s clear when I do. Writing about a stock is hardly the same as recommending it. I would guess there are some 1,000 to 1,500 junior resource stocks in Canada alone. Frankly, potential investors should welcome the opportunity to learn anything about a stock, especially when it has been given for free. I try to give the best information I can about a stock so the potential investors can make their own mind up about the wisdom of owning the shares. Certainly no one is ever going to share their profits with me and frankly I’m not interested in sharing your losses with you. It’s your money, no one else can tell you what you should own. They don’t know your willingness to take on risk or investment timeline or what your goals are with your money. You have to make the decision. In this piece I am writing about two entirely different copper companies. I don’t totally buy into the green energy program so popular today. Frankly I think Tesla is about as close to being a scam as any big company I have ever seen. If you actually watch and listen to Elon Musk, he seems more than a little slippery to me. So I do not think copper demand is going to shoot through the roof because we are all going green tomorrow. But we definitely have a copper shortage even today and it’s getting worse. And the Fed has pretty much guaranteed hyperinflation. You can see it in the price of lumber and Dogecoin. The first company I’m going to talk about is Universal Copper (UNV-V) and I’m writing about it today because the stock is cheap at a market cap of $2.9 million with current assets of $416,000 as of December 31, 2020 with current liabilities of $200,000. The company is hanging on by the hair of their chiney chiney chin. However they have an option on a massive low-grade copper deposit in Central BC they call the Poplar copper property. The Poplar deposit has been explored since the 1970s with millions of dollars spent on exploration. There is a large historic 43-101 resource. (Click on images to enlarge) While the indicated resource is massive, it is also low grade. You couldn’t make money mining $36 rock in BC unless you had a lot more of it or the price of copper goes up much higher. Likewise the inferred is even slightly lower grade and sub-economic at today’s copper price. Even so, the size and grade of the deposit are hardly the only issues for the company. Universal has done a small rollback each year in 2019 and 2020. The terms for the option call for total payment of about $4.5 million over five years. In addition, there is a requirement for exploration to be done in the amount of $1.2 million by May of 2020 when in fact only $761,000 was spent on exploration by the end of 2020. The company says they are in the process of expanding the agreement. In some ways the project, therefore the company, would look to be a bit of a basket case with little money on hand, multiple rollbacks and having already missed terms of the agreement. At the same time, what is the company who did the option going to do with it? The rock is uneconomic today for any company, not just Universal. What alternatives does the landowner have other than to extend the agreement? When all is said and done, if you are a giant fan of copper and believe it is going much higher due to demand from electric vehicles and “going green” Universal Copper is selling for pennies now. It can’t go down much more no matter what copper does. And you do have the highest possible leverage to the price of copper of any company I have ever seen. If Universal manages to extend the option agreement and can raise enough money to do the 6,000-meter drill program they would like to conduct, they are the cheapest long-term call on copper you could find. At a market cap of $2.9 million the stock either goes up or it goes away. It “could” go up a lot with higher copper prices based on increased demand, reduced supply or hyperinflation. At the other end of the grade spectrum would be a newly listed copper company named Nobel29 (NBLC-V) that only started trading on April 20th. I should explain the strange name first. The company always intended to be called Nobel Resources. That I like a lot. At the last minute the regulators determined that the name was too close to an existing shell named Nobel Mining and made management come up with a new name. 29 is the atomic number for copper so it is now Nobel29. It will take a little time for the website and information to be updated with the new name. I liked Nobel Resources a lot more. Nobel29 has an interesting high-grade copper project in Chile 45 km from Copiapo named the Algarrobo mine first discovered in 1808 and located only 25 km from the important port of Caldera. From 1868 until 1893 the mine was in large scale production with a report from 1890 saying some 800,000 tonnes had been mined at an average grade of greater than 12% and an additional 800,000 tonnes remained in the waste dumps grading 3-4%. A property report produced by Codelco in 2016 for the landowner estimated 14 million tonnes in the main three veins grading 2.32% copper with 0.7 g/t gold. The report indicated a potential for up to 300% greater tonnage based on geophysical data. That could mean as much as 56 million tonnes worth more than $14 billion at today’s prices for copper and gold. I actually visited the project almost twenty years ago. The local artisan miners were mining these narrow veins that twisted and turned through the rock. There is a government smelter at Copiapo that will buy the ore from the miners. They require a minimum of 12% copper and do not pay anything for the gold. The smelter is operated by ENAMI, a government corporation. Terms of the acquisition seem reasonable to me but not cheap. Nobel29 is paying a total of $15 million for 100% of the project subject to a 2% NSR. 1. The Purchase Price for the acquisition of the Mining Rights shall be of US$15,000,000 (fifteen million American dollars) paid as follows:

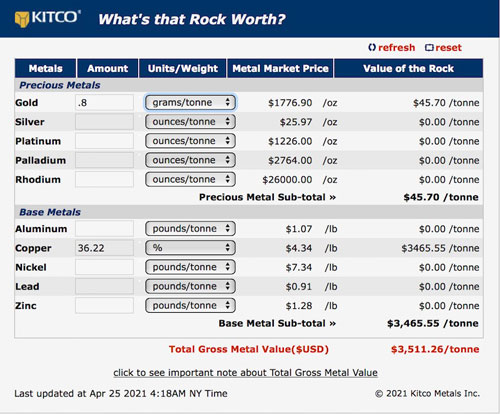

There is a final payment of $3 million required on or before August 18, 2027 based on a feasibility study having been completed. At today’s price for the shares, Nobel29 has a market cap of about $40 million CAD. The only free trading shares are those who participated in the $.40 round and I don’t see them getting carried away to make a 50% profit. The company has $8.5 million in the bank so is well positioned from a major exploration program. I spoke at length with David Gower and Lawrence Guy. They are experienced professionals who know exactly what they are doing. I think this is going to be the best copper story this year. Prior to doing the deal on the project, Nobel29 geologists took numerous channel samples from within the three primary vein structures and some of the seventy identified minor veins. Representative grades are shown on page 11 of the presentation and include a 1.2-meter width vein showing 36.22% copper and 0.8 g/t Au. That’s $3500 rock. Management of Nobel29 sees the Algarrobo copper project as a potential Candelaria lookalike IOCG. Candelaria reports 600 million tonnes of ore grading 0.95% copper. At worst, Nobel29 almost certainly has a decent size high-grade copper/gold IOCG. At best, another Candelaria. Both Universal Copper and Nobel29 are advertisers so I have to be biased. I have bought a small position in Universal in the open market. I was lucky enough to get in on the ground floor with Nobel29 in an early placement. Universal Copper Ltd (Apr 23, 2021) Nobel29 Resources Corp (Apr 23, 2021) ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved