| |||

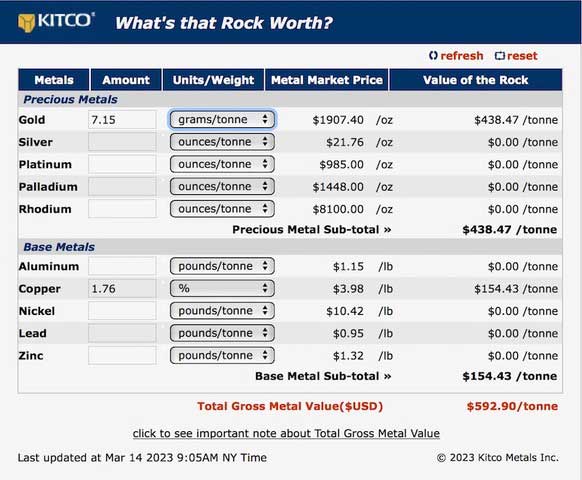

Gladiator Scores Homerun with Whitehorse Copper Project in YukonBob Moriarty There are things that go on behind the scenes that are often far more important than what is normally visible to investors. We added a new advertiser a couple of weeks ago that has the most interesting and I think significant back story I have heard in twenty some years. I wanted to share it with you. In 2006 and 2007 Jason Bontempo, now CEO and a Director of Gladiator Metals (GLAD-V), was serving back then as the CFO of Tianshan Goldfields, an Australian gold exploration company drilling a project in Xinjiang Province in Western China. The drill company they were using was named Kluane Drilling based in Whitehorse in the Yukon. The CEO of Kluane Drilling that was a family owned business under H. Coyne & Sons was named Jim Coyne. In November of 2007 the pair met at the Beijing Mining Conference and spent some time talking. Jim Coyne explained how the family company had an interest in the Whitehorse Copper Project. Between 1967 and 1982 when low prices forced the mines to close, Whitehorse Copper mined 10.2 million tonnes. 7.4 million tonnes of that total graded 1.5% most of which came from the Little Chief deposit. By this time Hudbay Mining owned the company when the 28 different mines shut in 1982. Copper was doing well in 2007. Jim Coyne explained to Jason that the family company picked up the projects from Hudbay in 1998 that amounted to about half the 32 km strike of the Whitehorse Copper Belt. The remainders were in a number of small companies and holders. The pair discussed putting together an IPO of the projects through the first half of 2008. They wanted to pick up as many of the smaller properties as possible but the high price for copper and a lot of unrealistic expectations made dealing nearly impossible and it slowed the IPO to a crawl. Then the GFC hit, shares got creamed. The price of copper got cut in half. For a long time the deal was dead in the water. In March of 2022 Jason became a Director of Gladiator. The company searched far and wide for a good project. Marcus Hayden reconnected Jason and Jim and they picked up where they had failed in 2008 in an effort to advance the Whitehorse Copper Project. By 2022 Jim had put a lot of the smaller pieces of the belt into the overall project owned by the family business, H. Coyne & Sons. But there had always been a fundamental issue. H. Coyne is a drill company, not an exploration company. While H. Coyne put together a world-class copper project, Jim Coyne is focused on the business of drilling. Not exploration. However Jason Bontempo has the perfect exploration vehicle in Gladiator Metals. The back-story behind the agreement between Gladiator and H. Coyne is even more interesting. Gladiator is picking up a 100% interest in 315 contiguous mineral claims called The Whitehorse Copper Project in the Yukon. Gladiator will pay $300,000 in cash and 15 million shares and has a $12 million work commitment. That sounds like a lot. It’s not. The entire deal is backend loaded. That means H. Coyne is effectively handing Gladiator control of 100% of the project for $25,000 cash and Gladiator has to spend $1.5 million in exploration in the first year. But it gets better and better. On February 27th Gladiator announced a private placement for $3.1 million to finance this year’s exploration program. H. Coyne is participating to the tune of $1 million of that amount. So H. Coyne is handing over the project for $25,000 in cash and a first year exploration program of at least $1.5 million and they are financing 66% of that minimum exploration. This is a deal made in heaven. H. Coyne has been using the property to train drillers for 25 years. They have 10,000 meters of core that has never been sawed or assayed but they know just what they have. They have a tonne of confidence in Gladiator and Gladiator has ten tonnes of confidence in H. Coyne. From a technical point of view, it is a wonderful project with a lot of potential. The property has thirty known prospects within the 35 km by 5 km project. The property has already produced 10 million tonnes of copper at 1.5% with silver and gold credits. Cowley Park has the most advanced near-term potential both open at depth and on strike. To date the project has never been drilled below 150 meters depth. Historic drill results include CP-144 38.57 meters of 1.76% copper with 7.15 g/t Au from 34 meters down hole. 18-CP-03 showed 9.14 meters of 2.0% Cu with 12.5 g/t Au. It won’t take a lot of $593 rock to generate a nice 43-101.

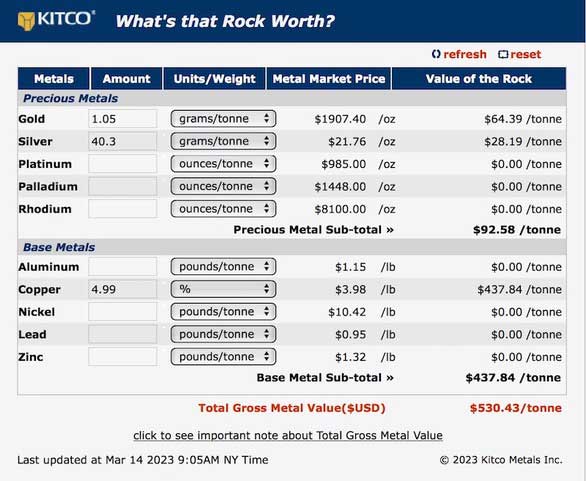

Other parts of the package show even higher potential with War Eagle generating results of 10.55 meters of 4.99% copper 1.05 g/t Au and 40.3 g/t Ag from 124 meters down hole.

Starting in April Gladiator will be focused on advancing mineralization definition and expansion with diamond drilling at Cowley Park. That project had actually advanced to feasibility study before the declining price of copper killed the project in 1982. There will be a constant flow of information. The exploration team will begin logging and sawing the 10,000 meters of core at once. Results will be released as they are received for the next six months or so. I would anticipate drilling to begin very quickly. H. Coyne has been drilling there for years so a permit should not be an issue. The company just closed on the non-brokered $3.1 million private placement. They had about $1.8 million already in the till so they are sitting on just short of $5 million in cash. As of March 15th, yesterday, they had a market cap of only $10.53 million. Given the extreme danger in the financial system today and the lack of liquidity among investors, having a big cash position puts Gladiator in the driver’s seat. When Gladiator resumed trading on February 15th after getting approval of the option agreement I began to buy shares in the open market while they were still cheap. And I participated in the private placement but only got 40% of what I really wanted. Gladiator is an advertiser so naturally I am just as biased as I can be. Do your own due diligence. Gladiator Metals ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved