| |||

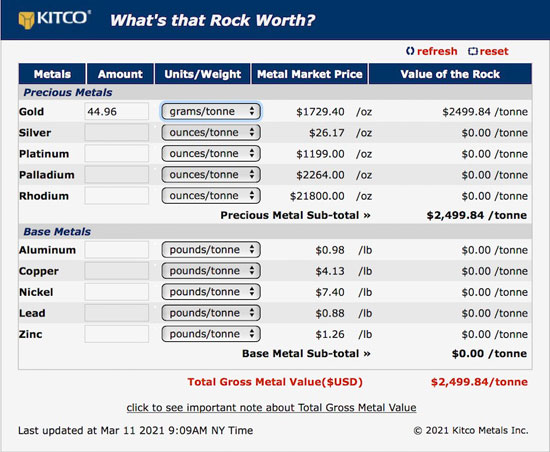

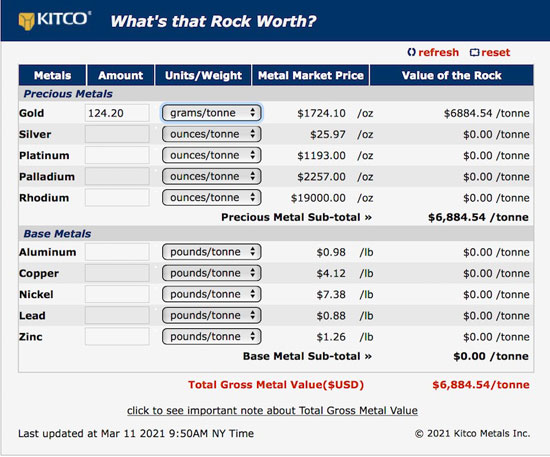

Sokoman is hot in NewfoundlandBob Moriarty The hottest flavor in gold resource stocks today has to be in Newfoundland. New Found Gold lit the fire in 2019 as a private company with their first hole registering 19 meters of 92.9 g/t gold. NFG is in the midst of a 200,000 meter drill program that continues to deliver world-class results every couple of weeks. But just to the west of NFG is a much smaller company named Sokoman Minerals (SIC-V) with similar outstanding results but lacking in visibility. In 2018 Sokoman had their own discovery hole at their 100% owned Moosehead gold property in Central Newfoundland showing 44.96 g/t gold over 11.9 meters. To give you an idea of how robust that hole was, NFG has only drilled five holes with a higher gram thickness out of about thirty holes. Their discovery hole not only showed bonanza grade, when you show drill results of 11.9 meters in thickness you are adding ounces in a hurry. (Click on images to enlarge) That’s right at $2500 gold to the tonne. Continuing results show consistency in high-grade intercepts. In phase two drilling SIC reported a 5.1 meter intercept at 124.20 g/t gold in hole MH-18-39. That’s almost $7,000 rock even at today’s depressed prices. Phase three had another 124.15 g/t hole in MH-19-26. The company is up to Phase Six now with an ongoing 20,000 meter drill program that began in Q3 or 2020. The great drill results continue with hole MH-20-115 showing 8.10 meters of 68.7 g/t gold. That is only $3,680 to the tonne. While the Moosehead property is the flagship of Sokoman, the company is hardly a one trick pony. A week ago SIC announced it has picked up a total of 1,891 claims with 47,275 ha in what they call the Fleur de Lys Project in Northwest Newfoundland. They own 100% of 98% of the land through staking and option agreements. There has been a total of one drill hole in the property for gold with no exploration in the last twenty years. For now it is a work in progress as they continue to advance the Moosehead deposit. At today’s stock price Sokoman has a market cap of right at $30 million. With more holes reported and far higher visibility NFG has a market cap of $600 million. I am not suggesting that SIC has a deposit as large as New Found Gold but is it really only worth 3.30% of the value of NFG with similar grade and thickness intercepts? I put it all down to a lack of telling the story. If you don’t tell your story, you don’t have a story. Sokoman is a hidden gem but sooner or later the market is going to wake up to what is a series of outstanding drill holes. Many times I have said that you should make investments for no other reason than they are cheap. Sokoman is cheap. There intercepts are as good as those from New Found Gold and Great Bear but they are a fraction of the cost. Sokoman is an advertiser. I have bought shares in the open market. Do your own due diligence. Sokoman Minerals Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved