| |||

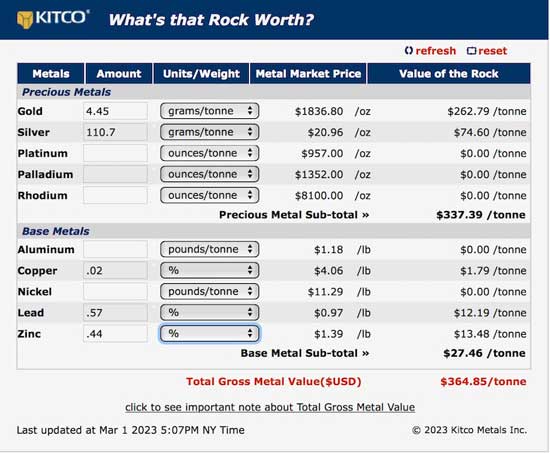

Goliath Will Get Bought Out at a Much Higher PriceBob Moriarty I have tried to make the point in my investment books on Amazon and in articles that if nothing else changes except for price that a stock going down is not a bad deal. It is a good deal. You wouldn’t have any concerns if you walked into your Corvette dealer and he told you he was slashing the price in half. After all, we all know that prices go up and prices go down. Don’t we? I have written about Goliath Resources (GOT-V) a number of times, here, here and here. The company released the final results from last year at Surebet on January 9th from 23 holes drilled during 2022. 22 of the holes hit solid intercepts of gold and silver. So the stock dropped 30%. Go figure. I don’t think I have ever seen a better case of buy the rumor and sell the news than with Goliath. Does the forest in the way blind investors looking for the trees? The press release totaled up the average intercept in fifty-six drill holes completed and reported from 2021 and 2022. The numbers were quite incredible. The average interval of the 56 holes was 6.88 meters with 4.45 g/t Au, 110.7 g/t Ag, and enough copper, lead and zinc to pay for mining. Total value of metal in the ground of $364.85 in USD or about $492 in CAD. Those numbers are wildly economic. (Click on image to enlarge) Like Eloro, New Found Gold and Lion One, investors don’t have a resource to hang a hook on so they don’t know what they are buying into. But when you have 100% of all the 24 holes drilled in 2021 and 89 out of the 92 holes drilled in 2022 reporting high-grade gold and silver numbers, you have a large system. With an average AuEq of 6.31 over 56 holes, you are going to be in the millions of ounces. It might be two million, it might go up to six million but this will be a mine at some point. Goliath released an exceptionally important news release on the 1st of March. Since I have visited a lot of mills processing gold, I will explain something about the press release that should reach out and poke you in the left eyeball. How you process gold and silver varies a lot. An open pit low-grade gold and silver heap leach might still be profitable with 70% recovery of gold and 50% recovery of silver. Since it costs just as much to provide cyanide to keep increasing the percentage of silver being recovered but the silver is far less valuable than the gold operators typically pretty much ignore the silver recovery and focus on the gold recovery. But with higher-grade values for the metals the mine operator will have some kind of flotation or cyanide recovery system. It costs far more than a heap leach operation but the metal recovery is higher. Depending on the size of the operation a gold/silver mill might cost as little as $100 million or go up to $1 billion depending on how many tonnes a day they process. But gravity recovery is really cheap. I’ve seen gravity circuits added to a mill for as little as $750,000. They don’t cost much. All the material passes through them and the gold drops out. It is melted and shipped off as a doré bar for quick payment. So in the press release when it said gravity recovery of 48.8% for gold my mouth dropped to the floor. 10 or 15% would justify installing a gravity circuit. Almost 50% makes a plant ultra efficient and cheap. Majors have to be looking at the Surebet deposit of Goliath already. The ore is too rich, the percentage of drill intercepts too high to ignore. Like me, when they read about 48.8% gravity recovery of gold, they had to sharpen their pencils. The press release continued and discussed flotation of the gravity tails. Recoveries were excellent with 92.2% of the gold, 86.5% of the silver, 94.2% of the lead and 96.9% of the zinc. The test results conducted on the Surebet ore was the best I have ever seen. Goliath Resources has a strange trading pattern that I don’t understand. The price of the shares is up and down like the nighty of a newly wed. In the past year the price went from $1.55 in April to $.78 in July to $1.74 in November to $.70 in the last week. If you understand that stocks go up and stocks go down and if nothing changes, when they go down and get cheap you should be buying. You could have made 50-100% three times this year and there was no news or significant event that had anything to do with the share price. It was all investor psychology, not the stock. The company has three million in the bank. They have extended the expiration date of 4.1 million warrants at $.86 another six months to September 5th of 2023. Those will almost certainly be exercised bringing in another $3.6 million. I don’t think the company will be doing any immediate private placement. Goliath will be taken out. They may get $200 an ounce; they might get $400 an ounce. For now, until the 43-101 planned for Q2 of 2024 it is anyone’s guess how much they have but it’s a rich system that will have the majors drooling. The majors have been consuming their young for years and M&A is just getting started. The really attractive targets will get a premium. Surebet is one of the most attractive projects I have seen. At today’s price the company is only worth $63.5 million. If you don’t think they have much, the company is an easy double or triple from here. If you really like the story and see the obvious success it has ten bagger potential. Goliath is an advertiser. I participated in the last private placement and I have bought shares in the open market. I am biased so do your own due diligence. Goliath Resources Limited ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved