| |||

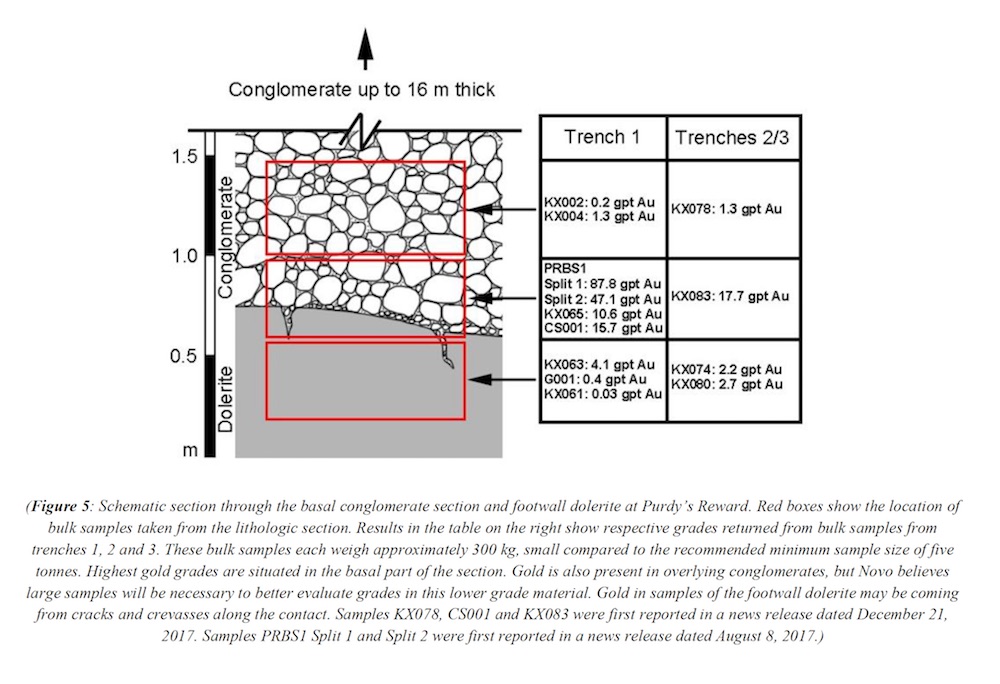

Novo is on Sale for a Little WhileBob Moriarty Novo shares are going to be on the sales rack from now until March 8th with about 3 million warrants at $.85 expiring then. It's perfectly normal for warrant holders to sell shares in order to exercise the warrants. For the past three weeks about 300,000 to 400,000 shares per day have traded on average. Selling warrant holders don't need to sell one share for each warrant held since the share price is about four times higher than the exercise price but with the lower liquidity of Novo recently any selling will tend to depress prices artificially. That overhang disappears on the 8th of March. Quinton Hennigh of Novo released more assay results and an update on Comet Well and Purdy's Reward on February 14th. It was pretty bland but it did have an important chart in it that answered a lot of questions for me. A lot of experts and non-experts have visited Karratha and seen both Comet Well and Purdy's Reward. Reactions vary a lot. When I was there with Brent Cook in July the price had just started rocketing higher. Brent Cook got his readers in cheap and when prices got carried away in October and November was wise enough to get his people out at a nice profit. His latest comments indicated a concern with mining as an open pit and what the strip ratio might be. John Kaiser came in acting as if he had been in the yardarms when Captain Cook first sighted Australia in 1770 and played an important part in the discovery. After his visit he recommended his readers buy the stock saying he believed it could be a 20 billion ounce deposit. Now given that the world has only produced maybe 6 billion ounces, he was getting a little carried away. He corrected that later in the year suggesting that he wasn't sure that Vits grade and Vits thickness at surface would be economic. Now given that they are mining almost 4 km deep in South Africa, home of the Vits, that comment by Kaiser was pretty shocking. Not quite as shocking as the 20 billion ounces comment but still right up there. I think I got it. I have been a giant supporter of Novo and Quinton Hennigh for yonks. I have believed since my first visit in 2009 that Quinton's precipitation theory was valid and Western Australia had the potential for another Witwatersrand type deposit. In an early piece this summer I predicted that the bulk of the gold would be at the lower portion of the conglomerate sequence. That turned out to be true. But the real question was, what kind of mining thickness would you have? Brent Cook had a perfectly valid concern about strip ratio but I have never believed this had a big open pit potential. The big potential is in the conglomerate under the basal cover. Novo has almost 10,000 square km of ground, much of it under cover and it will require underground mining hopefully using mechanized mining equipment. With the latest results, Novo attached a number of pictures and one important chart. The chart shows a drawing of the lower conglomerate sequence at the dolerite contact. Novo has put in all of the assays to date so a reader can visually see where the gold is. I like it a lot.

Many moons ago I said that this was an unconventional deposit and had to be approached in an unconventional way. Virtually all of the gold to date consists of large nuggets. That creates a monster problem because of the nugget effect. The larger the gold, the harder it is to measure. While both Quinton and Brent Cook believe that somewhere there will be finer gold that is easier to measure I'm not so sure I care. Gold is gold, big or small. If you have a ton of large nuggets, which works for me and clearly Karratha has a lot of gold. Everyone agrees on that. While the punters want to see that 40-50-60 g/t gold as I do, they are missing the potential of the 1-2 g/t material above and below the high-grade sequence. With $1350 or so gold today a gram is still worth about $43. With any mining, you have to consider mining width and dilution. If you have $40-$80 material for half a meter above and below $2000 material you have a mining sequence that works. Novo has realized that with nuggety gold, you have to have large samples to determine a representative grade. The diamond core drilling was useless for grade; it only reflects structure of the conglomerates as I said it would. The large diameter drilling didn't work because the gold is too dense to blow out of the hole. The best way to measure the gold is simply to mine it. And while they can call the large bulk samples, it's really just small mining. The company has arranged access with SGS in Perth to use their test plant to process 5 ton samples as compared to the 300 kg samples they have been testing. They believe the larger samples will more closely represent the real grade of the material. I agree. With each press release, investors have more information to make an intelligent decision about determining if they should buy or sell. I love Novo and Quinton Hennigh and I firmly believe the company is on track. They have serious money in the bank and are under no particular financial pressure. Quinton has assembled a brilliant team in Western Australia and progress is being made daily. I still own the shares that I paid for at $.25 in the first PP many moons ago. I wish I had been wise enough to sell a bunch and move the money into Kirkland Lake at the top in October/November. KLG is a similar bet on Karratha and the Pilbara Basin but less leveraged. In any case, Novo was cheap in July, expensive in November and back to cheap again. Any of the chat board commandos who have given up on the Novo story are going to get caught out at the airport when their ship comes in. Novo is an advertiser. It is my largest share position and I couldn't possibly be any more biased than I am. It's a great story, still in progress and they do a good job of communicating the very real value in the company. You are responsible for your own due diligence. Novo Resources ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved