| |||

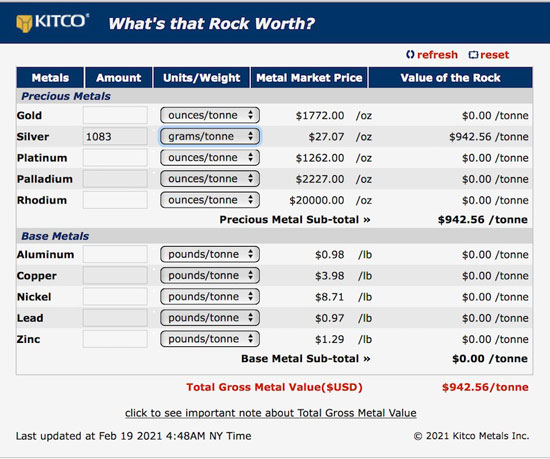

Dolly Varden hits 35 Ounce SilverBob Moriarty We are at peak stupidity in the general stock market, Tesla and the 4,506 variations of Bitcon. And we are told that they all have value because they are limited. All 4,506 of them are limited. Got it? As a joke a couple of years back someone started a new variation of bitcon and name it Dogecoin. It was a joke, pronounced Doggie Coin, and better referred to as Dogecoin now worth a couple of billion dollars. It’s up 15% TODAY. What could possibly go wrong when a joke is worth $7.5 billion and goes up 15% IN ONE FRIGGING DAY? The entire market for the limited 4,506-clipto currencies is worth about $1.5 trillion dollars. In 1720 after exiting with a nice profit, Sir Isaac Newton tossed his hat and his money back into the ring since it was so easy to make money betting on the South Sea Bubble. Everyone was doing it. What could possibly go wrong? He lost his shirt as a result when the bubble burst. When bubbles burst, there is always a well-known cheerleader encouraging the chumps. At the top of silver in April of 2011 Eric Sprott was extoling the benefits of his Silver ETF so well that when silver got close to $50 his ETF carried a 26% premium. In December of 2017 when the clipto currencies began an 82% decline it was famed software guru John McAfee doing a rain dance. The SEC did have a slight problem with him charging $110,000 per tweet but what the hell; a guy has to make a living. Now Elon Musk wants to prove he is smarter than Isaac Newton, Eric Sprott and John McAfee by tossing $1.5 billion into the electronic Beanie Babies. What could possibly go wrong? The DSI correctly called a temporary top in platinum at 91 a few days ago and the Nikkei at 93 at the beginning of the week. The DSI for the S&P and Dow are entering nosebleed territory. Soon the entire fraud we think of as a financial system is going to collapse from the weight of the massive stupidity in almost every area. Commodities are due a rest as gold and silver tap around looking for a bottom. The resource shares have been correcting since August and should catch a bid soon. There are a lot of good but cheap stories around. Dolly Varden Silver (DV-V) hit $1.17 when it peaked with the rest of the junior resource market in August of last year. It’s down some 45% since and that is a perfectly normal correction. I cannot stress enough times, if you want to make money in the market all you need to do is to buy when things are cheap and sell when they are dear. Forget the Comex defaults and Robbinghood runs on silver. All of those people lose money all of the time. Most investors want to lose money and all you have to do is do the opposite. Dolly Varden released brilliant assay results a few days ago that any silver investor should breath hard over, with Hole 222 showing 1,083 grams of silver per tonne over 2.70 meters inside a 310 g/t intercept over 6.00 meters. Hole 244 gave us 642 g/t Ag over 4.00 meters within a brilliant 304 g/t silver over 45.82 meters. (Click on image to enlarge) Dolly Varden’s 2020 drill program delivered a total of 11,397 meters in 40 drill holes. They were drilling the 100% owned Torbrit deposit in Northwest BC near tidewater. Dolly Varden is in the midst of planning their 2021 drill program on the project. Dolly Varden is an advertiser. I have participated in a private placement in the past so naturally I am biased. Do your own due diligence. Dolly Varden Silver Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved