| |||

Canuc Delivers 10 Meters of 210 g/t Ag and 5 g/t AuBob Moriarty

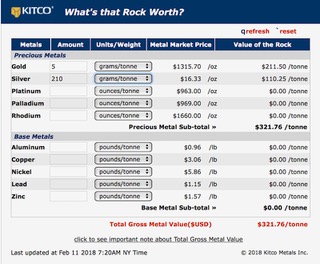

We have just gone through an interesting two weeks in the markets. I tried to predict it in a piece I wrote back in January. I talked about how twelve commodities I track via the DSI were showing extremes of emotion. That's when markets tend to turn. Of the dozen commodities I said would turn, every single one did. I know of no other indicator that has ever showed those sorts of results. All I did was put it together and say it was related. There were no opinions in my piece, only facts available to anyone who understands the basics of investing. The next time your "GURU" starts mumbling about conspiracies or manipulation, ask him the last time he predicted any market with accuracy much less twelve out of twelve. Ask him if he has ever said anything that could make money for you. Saying markets are manipulated is about as meaningful as saying the sun rises in the morning. In some cases billions of dollars were lost by single hedge funds in the VIX in a couple of days as they got caught short. While being short the VIX was one of the safest and most profitable investments you could make for the past couple of years, all things change. The firm that got caught with their shorts down should have sprung for a subscription to the DSI. Driving using only your rear view mirror is guaranteed to lead to a crash. A crash where the DOW was down a record number of points costing investors a trillion dollars in a day is one you may want to avoid. We have way too many bulls in gold and silver. The COTs say it. The DSI says it. Until the DSI goes below 10 for both gold and silver, we are not going to have a bottom. There are dozens of parrot sites around that can fill you in on their bizarre manipulation, price suppression and conspiracies in order to fill all your fantasies. We don't do that. I do my very best to give information that you can review and invest on to make a profit. I'm going to make it clear. I suppose you could accuse me of being a wallflower and spending a lot of time beating about the bush. If you watched silver go from $4 in November of 2001 to $50 in April of 2011 and gold go from $252 in August of 1999 to $1923 in September of 2011 and you still believe they were suppressed you are too fucking dumb to waste my bandwidth. I spend hundreds of dollars a month having my webmaster provide the bandwidth for the 50,000 or so daily readers. I don't want to waste that money on idiots. If you think manipulation is important, either give me a single example where anyone anywhere has made even a single dime off an investment based on such a belief or go away and visit these doors no more. I've had a lot of readers write and ask me why, if resource shares have already crashed, and they have, why did my favorite, best-loved shares go down last week? One of my favorite resource stocks is Kirkland Lake Gold. They have wonderful management and a great project in Fosterville and are the biggest investors in Novo Resources. They plunged from $16.82 in January to $13.29 last Friday. When markets crash every margin clerk in the business goes on overtime making margin calls. In a crash, even the best stocks go down because they have liquidity. Every investment that is liquid gets sold; it has nothing to do with quality or value. So knowing that is true, it's like a store closing. Everything gets sold off and there may be some real bargains. But the bargain bin is going to stay open until the perma bulls give in. Gold goes up, gold goes down. They can't stand it but markets are all about the same. Gold is going to be the only safe asset as the financial system tumbles into the abyss but everything corrects and it's gold's time. Canuc Resources (CDA-V) is a work in progress. I wrote about them in November. They just released a press release detailing their latest surface samples. The company is testing a 40-meter wide breccia zone. One ten-meter line showed an average of 210 g/t Ag and 5.0 g/t Au. Another line of nine meters but forty meters apart showed 173 g/t Ag and 0.78 g/t Au. Those are all good numbers. The company believes they have located high-grade silver and gold over 800 meters along strike. The entire property covers the high grade San Javier vein system that extends over the full length of the 4 km trend. Compared to similar companies at about the same level located in Mexico such as SilverCrest Metals (SIL-V), they are valued up to ten times higher than Canuc. Drill results supporting the surface samples will reduce the difference in market value to something that more closely reflects the real value of Canuc. I happen to be a fan of silver right now. Not because it's in shortage because it's not. Not because it's the most valuable war material because it's not. I like silver because like platinum, it's cheap compared to both gold and palladium. There may be a better reason for buying things than just because they are cheap but I've never found one. Canuc needs drilling. The shares are more liquid now than they were a few months ago but the market wants to hear what the truth detector has to say about the project. Solid numbers could make this one of the good Mexican silver companies. Canuc is an advertiser. I own shares bought in the open market and in their last pp. Please do your own due diligence. Canuc Resources Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved