|

||||||||

A Tale of Two ProjectsBob Moriarty The classic novel "A Tale of Two Cities" by Charles Dickens begins with the immortal words, "It was the best of times, it was the worst of times." It was the most famous opening lines of a book in history. Throughout the book, Dickens compares two cities and two characters. This piece will attempt much the same. Our goal at 321Gold is to try to support the mining industry by supporting individual companies. There is no particular "Industry" as such that you can touch and feel and see. It's a vast collection of characters and companies and projects and constantly-changing perimeters. I can't predict the price of gold tomorrow much less next week or next month but managers in mining have to guess what the price of gold or copper or moly will be five years from now. If their guess falls too far off the mark, they lose bunches of money for shareholders. Part of our

effort to support the industry and its recropical, supporting

our readers, involves traveling all over the world and writing

about projects. We hope that we can understand the often

complex story of individual projects and companies and do a successful

job of telling that story to our readers. So this piece is going to be an apology to all those readers who listened to what I had to say in 2003 and an attempt to show how I think success in the silver valley is still an alternative for some. While I helped the Sterling stock go from $.75 to $14 in a six month period, with Ray's remarkable ability to snatch defeat from the jaws of victory on a constant basis, he managed to drive the stock from $14 a share to its current $3.10 all by himself. I can only stand by in wonder and watch the remarkable panorama which continues to this day. In technical terms, all I need to say about the Silver Valley of Idaho is that it has produced a boatload of silver over the past 122 years. It is the largest silver district in North America with production of over 1 billion ounces of silver. Ignoring the lead, zinc, copper and antimony, the Sunshine mine produced over 328 million ounces of silver, the world famous Bunker Hill mine produced more ore but only 161 million ounces of silver and the lesser-known but richest mine in the valley, the Crescent mine, produced 28 million ounces of silver, often with bonanza grades of over 50 ounces of silver to the ton. In June of 2003, Ray Demotte, President and CEO of Sterling signed a deal to lease the Sunshine Mine for 15 years. His cost of silver per ounce of historic resource was about $.02 an ounce. Every year he has to issue more shares to keep the lease. He got probably $100 million dollars worth of mill thrown in for free. It was the deal of the century and he knew it. Silver was about $4.50 an ounce.

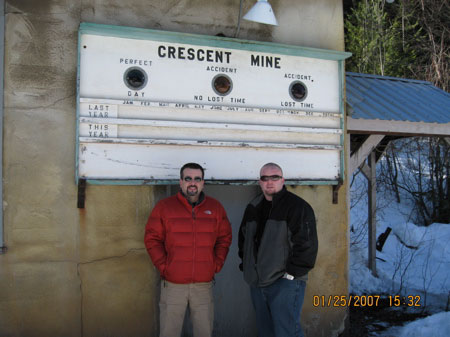

In early January of 2007, Neil Linder, President and CEO of Strategic Nevada Resources (SNS) closed the PURCHASE of the Crescent Mine for $650,000. It sits in between the Sunshine and the Bunker Hill Mine. I spoke with Brian White of the Silver Valley this week. He is the top geologist in the valley and knows the mines better than anyone else. He now works for SNS Silver (new name as of mid-February) as their head geo. He has already planned a $1 million dollar drill program with a target of about 45 million ounces in resources. That's right at $.02 an ounce. But silver is now $13. Alas, SNS did not get a free mill. When I came down to Coeur d'Alene in July of 2003, I met with Ray, with his top management guy, John Swallow and the wonderful folks at Pennaluna. When asked, Ray thought his stock might go up as high as $2-$3 in the next year. At that point he would do a major financing to get the money to get the Sunshine in production. He had 10.5 million shares. I told him he had an easy $6-$8 stock just based on the ounces in resource and the name. And that it was mandatory that he get off the pink sheets. He responded that he needed to do an audit to get off the pink sheets and the total process would take about 4 months. We were both wrong, the stock shot up to $14. By then, Ray thought he was so smart that he ran around Vancouver telling everyone the stock was worth $30. Same stock, no mining plan, nothing had changed except for the price of the stock and his ego. Even I underestimated the value of the name. It made Sterling worth twice what I believed. It took Demotte 36 months to eventurally get Sterling off the pink sheets, he's the kind of guy who confuses motion for action, he never raised any serious money when the stock was rocketing. By his actions and lack of management direction, the stock plummeted from $14 to a low of $2.60. He's up to 40 million shares outstanding and no one in the valley seriously believes the Sunshine will get into major production under his management. He cost his shareholders $150 million and for that I will never forgive him. In three weeks, Neil Linder of SNS has hired the best and most knowledgeable geo in the valley. He has the financial support of Pacific International which is Cal Everett in Vancouver who works with the smartest financial and technical guys in Canada. They have already raised $8 million dollars for exploration and development. Silver Wheaton has invested money. (and investors need to realize Silver Wheaton has no deal to buy silver at a discount) Neil's guys on the ground in Idaho have already started a refurb of the few buildings that came with the deal. They have a plan for cleaning up the tunnel so they can get in and drill and are working on planning a drill program to start in 6-9 months. It's just my opinion and I am biased in the matter but in real terms, Neil Linder and David Greenway, VP of Corporate Development for SNS have accomplished more of importance in three weeks than Ray Demotte has in 3.5 years. They have a real plan, a real management team, real financial backing (for the institutions in Vancouver who just convinced their customers to fork over $8 million to Sterling at $2.20 a share, you should have talked to a few people in the valley about Ray and his reputation. You wouldn't have invested) I was on the ground at the entrance to the Hooper Tunnel at the Crescent Mine a few days ago. You can throw a rock across the street and hit the processing plant for the Sunshine. The ore at the Crescent is literally across the street from the plant at the Sunshine. The ore Ray wants to mine is a mile away from his own mill. For Ray Demotte to not step up to the plate and even bid on the Crescent shows how little he understands. SNS literally stole the single best property in the Valley and Demotte could have bought better ore than he owns for the cost of a minor drill program. He just doesn't get it. Ray just spent about $4 million dollars buying a tailings pond from Formation Capital. The negoation for the property is the talk of the valley. Formation had no use for the property and there were environmental issues. They were real close to having to reclaim it and that costs money. While I was down there in the valley I was told Formation probably would have taken any reasonable offer and I heard numbers between $100,000 and $1 million. Ray never asked them how much they wanted, he just offered $4 million. They snapped it up before he could wake up to what he had done. I'm angry, I think you may sense that. Ray Demotte had the world on a silver platter and he couldn't handle it. I dropped them as advertisers and stopped writing anything about them when he looked me in the eye and told me that his long-awaited audit was complete. Since I knew his financial guy, I knew and he knew that it simply wasn't true. I'll deal with fools but I won't deal with those who look me in the eye and don't tell the truth. It's a new day in the Silver Valley. The Crescent Mine is the richest mine in the valley. It will be a repeat of the Sterling story but with a happy ending. There is adult management running the place, they are fully financed and every guy now working for Sterling (except perhaps for one) will be putting in his application soon to work at a real mine with real miners. Brian White understands the valley and where the ore is. He's looking for good help and is thinking about how and where to drill even now. The team is coming together and it's a flipping good team. Tom Fudge is a director and he has deep roots in the valley, he's first rate. I like thinking of it as the Dream Team. It will be the most interesting silver project to work on in the world. The Crescent Mine under its current management and supporters is aiming at being both the biggest and best silver mine in the valley and maybe the world. With only three weeks under their belt after the closing, it's easy to see they are on track. The race is not always to the swift nor the battle to the brave, but that is the way to bet. I almost always shudder when I see mining websites. Many of them are a disaster but I don't mind all that much because I'd rather see them good at mining. The SNS website is a model of brilliance. You can read it and understand just who they are and what they have in mind to do. SNS hasn't succeeded just yet and Sterling hasn't failed just yet. But I know where I want to put my money and I have. Ray has blown out the last of his authorized 40 million shares and one day soon he will have to hold a shareholder's meeting to get permission to print more shares. If Sterling shareholders ever want to see a return, they need to be asking hard questions of management. It's long since time for a change. I'd rather be going to the SNS shareholders meeting. It will be the one with all the smiling faces. Strategic Nevada Resources is an advertiser. We have bought shares both on the open market and participated in the recent placement. I have visited the property and I like it. I like silver and mining in the Silver Valley. I even like some of the chain-smoking old coots I met there who know all that there is to know about mining in the valley and who have left an enduring legacy for future generations. I am biased so before investing in anything do your own due diligence and take some responsibility for your own decisions. I'd like to see one of the silver juniors become a 10 million ounce silver per year producer and my money is on SNS to do it first. They will stumble and make the odd decision now and again but I believe they will not be making the same bad decisions again and again for 3.5 years. I am still on the road, and won't hit home for another 4 (four) weeks many of which will be spent in the boondocks of Tanzania, so please hold off sending email until the end of February. Strategic Nevada Resources

Corp Bob Moriarty |