| |||

Oroco Resource Cashed up Massive Copper in MexicoBob Moriarty I first wrote about Oroco (OCO-V) back in August. Basically, nothing has changed except the price of copper has gone up a lot. The shares were $.26 back then and are $.53 today. Copper topped $6 a pound for a few days and has dropped back slightly. As I forecast in August, the Japanese bond market is imploding taking with it the $12 trillion Yen carry trade. That is going to eventually blow up the US bond market dragging the dollar down and forcing interest rates much higher. Also, as I suggested the western debt based financial system is in the midst of a giant collapse. As a result, gold shot higher, now over $4900 an ounce. Then silver rose, moving over $95 an ounce yesterday. Platinum followed hitting a new all-time high price day after day. Eventually even copper joined the party as the junior precious metal making an all-time high price over $6 a pound. (Click on image to enlarge) I laid out the pertinent facts on Oroco back in August. They have completed the two private placements they had planned and it’s time for an update. Oroco Resource Corporation owns an 87% interest in the central concessions totaling 1,173 ha of the Santo Tomas Project in Northwest Mexico. In addition, they hold an 80% interest in an additional 4,948 ha of concessions next to and surrounding Santo Tomas. Oroco reports a 43-101 resource of over 7.6 billion pounds of copper at Santo Tomas. The company finished two private placements in order to finance their upcoming PFS scheduled for release by the end of 2026. They just announced closing on the last PP for $23 million to fully fund the PFS. In August of 2024 Oroco published a PEA for Santo Tomas. The dollar amounts they use in the PEA are so out of date as to be absurd. The company used a price of copper at $4, recently $6, $1900 for gold, now near $4900 and $24 for silver, now touching $96. The PEA suggests production of copper at 4,774 pounds, 300,000 ounces of gold with 27,000 ounces of silver and 80 million pounds of moly worth $33 a pound. With gold near $5000 an ounce, that’s not cheap, silver over $96 an ounce and that’s not cheap and copper at $6, that’s not cheap, it appears the investors are pretty much out of luck. I favor buying what is cheap and selling what is dear. They are all dear, how can you invest? Let me take you on a road trip. When precious metals catch the eyes of investors, typically gold goes up first, then silver, then platinum, then palladium, then copper as prices move down the chain. And at some point they are all expensive, not necessarily in comparison to where they might go but where they came from. So, if you fear the demise of the debt based western financial system and want some real assets, what can you buy that is cheap? Resources are an obvious choice but how can you buy them rationally if they are all very expensive? The answer is simple. If you can’t buy gold because $5000 an ounce is out of your budget, buy the companies who either produce it or who intend to. The same stairstep exists in the resource stocks world as with the metals. The majors saw the first flush of new cash into their shares, then the mid-tier, then the junior lottery tickets. A project that can produce copper may not be economically feasible at $3.00 copper would be wildly profitable at $6.00 copper.

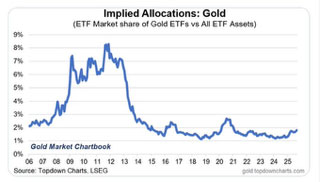

Investors just don’t understand the sea change, a lifetime opportunity to own shares of solid juniors. The following chart shows that in 2011 resource shares were five times higher than they are today. A life changing opportunity exists for those who get it.

My favorite sentiment indicator showed a reading of 88 for gold on Tuesday with a reading of 85 for silver and only 73 for copper. Gold is continuing to set new record high prices but the DSI suggests a correction would not be unwarranted while silver may have started a slight decline on Wednesday. It too, could use a rest before storming higher. At the close on Wednesday the DSI for copper was 68 with gold at 79 in spite of a new all-time high and silver at 77. Oroco Resource is an advertiser. I participated in the upcoming Canaccord private placement. Of course, that makes me biased so do your own due diligence. Copper is expensive but Oroco is still absurdly cheap. Oroco Resource Corp ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved