| |||

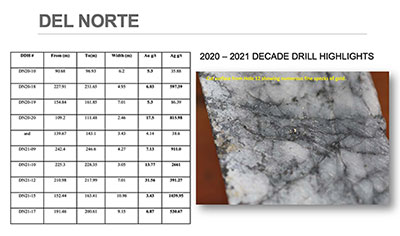

Decade Sits in the Heart of the (Silver) Golden TriangleBob Moriarty With both gold and silver hitting new all-time high prices a correction would be appropriate. However, the Daily Sentiment Indicator continues to indicate some distance to a major top. The DSI for gold is only 81 in spite of $4500 gold. Silver’s DSI hovers at 78 with the metal back to $80 per ounce. If the DSI is not part of your investment tool box you are missing access to the single most valuable indicator of tops and bottoms available to investors. If you call Jake and whine to him about how poor you are and mention 321gold, he will give you a break. It worked for me and should work for you. Few investors understand just how tiny the mining business is in terms of people. While hundreds of thousands, perhaps millions of people are employed in the industry, it’s a small world where everyone knows everyone else. There are half a dozen serious mining investors who are dealing with private placements and moving assets around like trading cards. Perhaps fifty or a hundred movers and shakers do the communicating about the industry and a few thousand serious geologists. Like every industry we have our scoundrels and liars who are constantly attempting to take either money or assets from others but we know who they are. They come and most often go but some show remarkable resilience in returning after we catch their hands in the cookie jar. As the bull market continues the interest of investors is moving down the food chain. Gold was the first mover as it blasted through all-time highs, then silver followed and it blew through all-time highs, then platinum joined the party followed by copper. The exact same thing happened with resource shares. The majors moved first followed by the mid-tier and lately the very high-quality junior lottery tickets. When the riffraff companies operated for years as life style operations join the party it will be time to head for the exits. I’ve been lucky enough to visit hundreds of projects on many continents and gotten to meet the finance guys and most of the movers and shakers. About fifteen years ago I was on a trip to northern BC and I crossed paths with Ed Kruchkowski. His name is a mouthful. I think he’s from Ireland. I was up there to visit another project owned by a company called Mountain Boy Resources. Glaciers retreating had exposed a lot of mineralization. Ed was working with them. Clearly he was the go-to guy if you wanted detailed knowledge about the area. Ed Kruchkowski is the president and a director of a tiny BC copper/silver/gold junior named Decade Resources (DEC-V). The company has a variety of projects in the heart of the Golden Triangle of BC. The area is one of the richest in the world in terms of mineral resources. In terms of past production and current resources, the Golden Triangle has 200 million ounces of gold with 569 million ounces of silver and 27 billion pounds of copper. If you want to bag an elephant, you need to be in elephant country. One of the problems holding the company back has been too much information. They have a wide variety of projects, too many for an average investor (or financial pundit) to fully comprehend. I’m going to try to talk about the top three projects. In November the company issued a total of 24,250,000 flow-through shares at $.04. That brought $9.7 million into the treasury along with some of the most experienced and savvy investors in the industry, namely Frank Giustra along with the highly respected Canadian geologist Rob McLeod. I asked Ed how they were going to spend the money because it’s hard to tell just what their direction is. One newly acquired project named the Bonaparte deposit which they optioned in late October is scheduled for drilling once the company gets the required drill permits. Don’t bother looking for information on the project on their website. The company has been remiss about keeping their website up to date and there is little information about Bonaparte there. Bonaparte does seem to have a RIRGS potential similar to that of Sitka and Snowline. A primary target is the Del Norte gold/silver property that they currently own 55% of with an option of picking up an additional 20% by taking the property to production. Del Norte has excellent potential and the company just put out a special news release to talk about the silver potential. This year brought the discovery of a new gold/silver zone with a grade of 6.78 g/t Au and 5,184 g/t Ag. (Click on image to enlarge) This past year has seen attention paid to the North Mitchell property with a press release put out a month ago showing exceptionally high grade grab samples of gold, silver, lead and zinc with grades as high as 9 g/t gold, 161 g/t Ag, 3.01% Pb (lead) and 5.6% Zn along with 73 g/t Au and 12.74 g/t Ag. I tried to get into the private placement but I was too late and couldn’t squeak through the door. I liked the story enough that I went out in the open market and bought shares. My timing was good; the shares have doubled since Christmas with 5.6 million shares trading just on Friday with a 33% gain on the day. The company is in excellent shape financially with the ability to seriously advance several projects this year, however, I would be seriously remiss if I failed to point out some potential failures. The presentation hasn’t been updated since April of 2025. The website fails to even discuss two of the most important projects, Bonaparte and North Mitchell. How about an upgrade guys? And the share structure looks like something out of an Australian or London mining scam peddling oil in a project located in EastBumFuck Nigeria. As of the last quarterly report ending October 31st, the company showed 118 million warrants. Since then, there have been a number of PPs and I can’t even figure out how many warrants are outstanding or what the real market cap of the company is. It’s one of those good news, bad news stories. Only God knows how many warrants there are outstanding but 95% of them or higher are in the money and will provide a steady source of potential cash over the future. It’s time for an overdue rollback. Ed is a brilliant geologist who is running a company with a herd of great projects but he needs to grab the reins and get communication and finance under control. Decade is an advertiser. I bought shares in the open market and while I am a happy camper, I am biased. Once the company upgrades their presentation and website, do your own due diligence. Decade Resources Ltd ### Bob Moriarty |

Copyright ©2001-2026 321gold Ltd. All Rights Reserved