Strong Nerves Required

Brian Bloom

Jun 27, 2007

The chart below (courtesy Bigcharts.com) is a weekly chart of

the $XAU up to June 27th 2007.

It is drawn on semi log scale which reflects percentage price

movements on the Y axis.

It can be seen from this chart

that the most recent price weakness brought it to rest on the

lower trendline that has been in place since 2002.

Can this trendline be penetrated on the downside? Of course it

can. It happened for a few months in mid 2005 - before pulling

back up to move within the rising channel once again.

Will it break down now?

In my view, this is the wrong question. It reflects a trader

mindset. The "right" question is: "Will the primary

uptrend of gold shares (and gold) - which has been in place since

2001, be aborted?

In a previous article, entitled "Gold

- Major Breakout Imminent" I expressed my view as clearly

as I could. The Primary Trend of the Gold Price is "Up".

I remain invested in gold and related investments, and will remain

invested until the evidence suggests a need to change my view

on the Primary Trend.

One of the problems in modern day markets is the overwhelming

presence of traders trying to second guess price movements on

a day-to-day basis using computer algorithms and other tools

of trading. With this in mind, it's probably appropriate to relate

an anecdote to illustrate the process of biofeedback.

Many years ago I landed up in hospital with Tuberculosis (Fortunately

I caught it early and it cleared up completely). But I was hospitalised

for some weeks. By some perverse twist of fate, I was admitted

to hospital on my twenty first birthday. That was a long time

ago.

One day an unusually pretty nurse came to my bedside to take

my blood pressure and monitor my heart pulse rate. She expressed

concern that all the readings were too high and she wanted to

call the doctor there and then. I prevailed on her to take the

readings a second time.

Using a de-stressing technique I had learned a few months earlier,

I 'centred' my thought processes and focused on relaxing. Taking

the readings again, she discovered to her amazement that they

were normal. (I told you she was pretty. What do you think happens

when a pretty girl approaches a young guy up close and personal?).

This process of slowing down my heart rate and lowering my blood

pressure is known as a 'bio-feedback' process. Armed with information

that was endogenous to the system, I applied an exogenous variable

which had the effect of modifying the behaviour of the entire

system.

Biofeedback is real. The above is one of many examples that I

have personally witnessed and/or experienced during my lifetime.

It's not just some esoteric concept. For this simple reason,

you can throw all the computer trading programs out of the window.

They will work until they are trusted to work and, as soon as

they are trusted to work by a sufficient number of people, this

very trust causes them not to work. How does one program "sporadic"

variables into a computer - those that manifest occasionally

and only under certain circumstances? The answer is that one

can't, as some Nobel Prize Winners discovered to their shame

and multi billion dollar cost. For this simple reason, daily

charts are interesting, but not particularly relevant.

I tend to think of daily, weekly and monthly charts in terms

of tactics, strategy and philosophy. Primary Trends are a function

of philosophy. They are driven by culturally accepted thought

paradigms. These paradigms change slowly.

Secondary trends are driven by fashionable thought paradigms

(A bit over simplistic, but there's a point to make here).

Short term trends are driven by knee jerk opportunism - which

ebb and flow for reasons that may have nothing to do with financial

variables. For example, there may be a cold snap; or there may

be trouble brewing in Iran. These are little eruptions which

have the capacity to change the larger trends if they happen

to manifest at critical points in time.

So, if we are going to talk about the Primary Trend of the price

of Gold, we need to talk philosophically.

The arguments here are well known and have been discussed ad

nauseam. Currency of last resort, inflation hedge, store of value,

medium of exchange, external discipline on Central Bank behaviour,

etc etc.

I happen to think that these reasons, whilst interesting, miss

the "core" point. It is my view that Human Society

is reaching the culmination of the Neanderthal Era in its evolution,

and we will eventually (sooner rather than later) emerge into

a new, post Neanderthal era where the Thought Paradigms of society

are fundamentally different than today. All three Abrahamic religions

talk of a Messianic Age. On a more prosaic level, it seems we

may be on the threshold of a breakthrough in humanity's knowledge

and understanding.

Because I am alert to this potential breakthrough, I am also

on the lookout for evidence, and this evidence is manifesting

in a tidal wave. It's all around us.

By way of example, I have just watched a RealPlayer video which

shows seawater "burning" at 1500 degrees Centigrade.

By exposing it to radio waves, hydrogen and oxygen are released

- both of which are flammable. Humanity's knowledge base is literally

exploding, hampered only by the barriers and blinkers being set

up by our testosteronal and/or egomaniacal political leaders.

Depending on the level of wisdom, humility and maturity manifested

by these political leaders, this process of evolutionary change

could be violent and painful - forced on us by catastrophic collapse

of the old system; or it could be slow and sure - orchestrated

by a deliberate strategy that is different from what we have

been witnessing to date. I am hopeful, but I'm not holding my

breath. My personal interest in gold is that I believe gold will

have a pivotal role to play in the coming era. Unfortunately,

the problem with this philosophical mumbo jumbo is that it doesn't

put food on the table, so we need to take a view that is more

relevant to our immediate needs.

That's why the weekly charts are important. They bring the trends

down to the here and now, but still manage to avoid the day-to-day

opportunism which sometimes serves as nothing more than static

to obscure what is really happening.

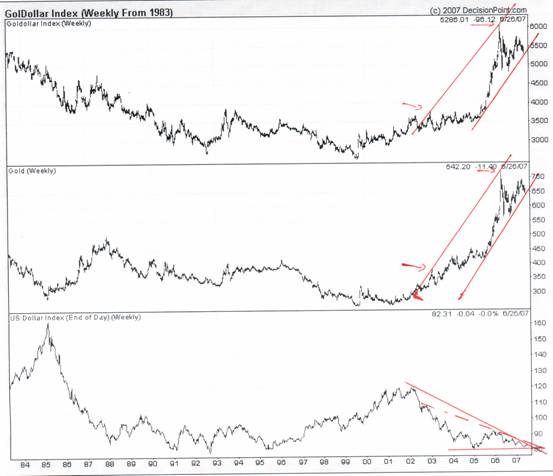

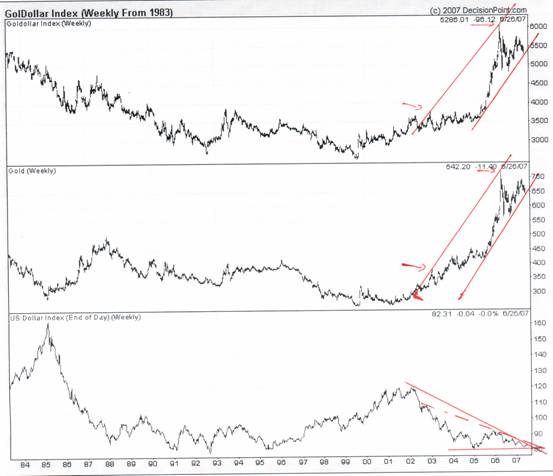

In my view, one of the most

important charts that decisionpoint.com publishes is the chart

of the goldollar index. This is derived by multiplying the gold

price by the US Dollar Index. The weekly chart is reflected below,

and I would like to draw the readers attention to several 'clues'

contained in this chart.

The points of interest flowing

from the charts above are:

1. The upper trendlines of

the channels join two spikes in the gold price and the goldollar

index

a

2. These upper trendlines represent an "angle of incline"

- which is the "rate" of increase in price on both

charts, and which is mirrored by the angle of incline of the

lower rising channel line on each chart.

a

3. The direction of travel of the US Dollar Index chart has been

pointing down since 2002 - which is the opposite direction from

that in which the gold price has been travelling. This is what

has led most "investors" to argue that the gold price

moves inversely to the US Dollar - 'Therefore' they have concluded,

'Gold is the currency of last resort'

a

4. The US Dollar is approaching the apex of a triangle which

may lead to a breakup. The concern of many investors is that

if the Dollar breaks up, that's the end of the gold bull market

Let's look at percentages:

The Dollar Index fell from 120 to 80 or 33%. By the inverse

argument, the gold price should have risen by 50%.

In fact it rose from $300 to its current level of $650, or by

116%. The inverse relationship is simply not true. We don't have

to argue about it. The conclusion is based on fact. Let's move

on.

Facts notwithstanding, which way is the Dollar likely to break?

The argument for the past few years has been something like this:

The Fed has been profligate in the way it has printed US Dollars.

The US National Debt is approaching $9 trillion. Interest on

that debt alone is $450 billion a year and rising. The US deficit

is chronic. It's a matter of time before the world's Central

Banks start to shy away from the US Dollar. A US Dollar collapse

is therefore inevitable.

The problem with this argument is that it ignores the fact that

70% (seventy percent) of all the reserves of all the world Central

banks added together is comprised of US Dollars. As a matter

of pragmatic fact, there is no alternative currency - no matter

what "public announcements" may or may not appear from

time to time about the intentions of China, Saudi Arabia or whoever

else happens to want to get their face in the news. Oh, so you

don't like the US Dollar? Okay, so what's the alternative? Euros,

Yen, Renminbi, Gold? All these added together represent the other

30%. It's a matter of simple and unarguable fact that the tail

cannot wag the dog.

So, given that this is also a fact, let's move on.

For the world's Central Bankers (acting in concert and in their

own self interests) to avoid implosion of the value of their

reserves, and contrary to popular argument, the most logical

behaviour on their part would be to support the

US Dollar, not dump it. Under no circumstances can the US Dollar

be allowed to collapse - at least not now.

But how can they justify their supportive behaviour to their

own constituencies?

Well, how about this?:

"Capital needs to be put to work. It needs to earn a return.

Investing in the US Dollar now would be smart, because the yields

in the US are at the beginning of a long term rise.

(Chart below courtesy of decisionpoint.com)

This has sinister implications

to the mega-dollar capital value of US Treasury Bonds. If yields

enter a primary rising market, hundreds of billions of dollars

will be lost in the Treasury markets (which can be hedged by

the smarter operators by forward dollar contracts). How can we

avoid a catastrophe of 1929 proportions - which led to an implosion

of debt?

Are we talking tactically, strategically or philosophically?

Philosophically, we can't. It's impossible. The US economy is

"toast".

But maybe, from a strategic perspective, we can ameliorate investor

fear for the time being by allowing the equity markets to rise

in monetary terms.

Okay, let's look at the S&P 500 (the 500 large cap stocks)

Technically, it could be argued

that the SPX is hitting a Double Top, from which it may reverse.

If it pulls back significantly, there is a high likelihood that

the Gold Shares ($XAU) will get caught in the down draught -

and that the $XAU's rising trendline will be penetrated on the

downside.

Ah! But the Central Banks are not going to sit on their hands

just waiting for the technical analysts to panic. Therefore,

this is what they might be arguing over their post dinner Cognacs.

"The Dow Jones Industrial Index only contains 30 stocks.

Using derivatives maybe we can arrange for some obfuscation which

will get us through this period of uncertainty."

Okay, so let's look at the Dow Jones Industrials:

Oh my! Will you look at that?

It's broken up through its double top. Oh yes, it could pull

back, but the technical evidence suggests a period of strong

rises ahead. Yup! If that could be orchestrated then the losses

on the Treasury Markets might be offset by the profits in the

equity markets.

So the (admittedly circumstantial) evidence suggests that the

Central Bankers believe they can arrange for the tail to wag

the dog. (Of course they can't, but they will die trying - and

they may postpone the day of reckoning for a year or two or three).

Thus, if a situation could be orchestrated whereby the S&P

breaks up, this will evidence "inflation", and money

will flow back into the property markets because everyone knows

that property (and gold) is the ultimate hedge against inflation.

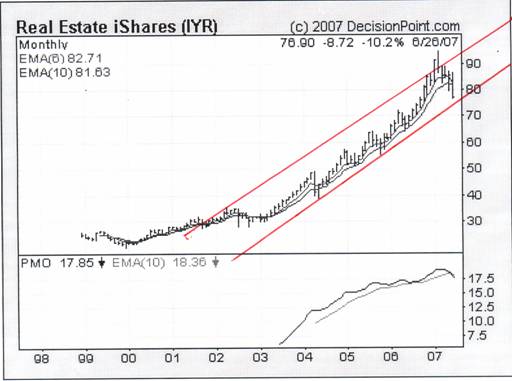

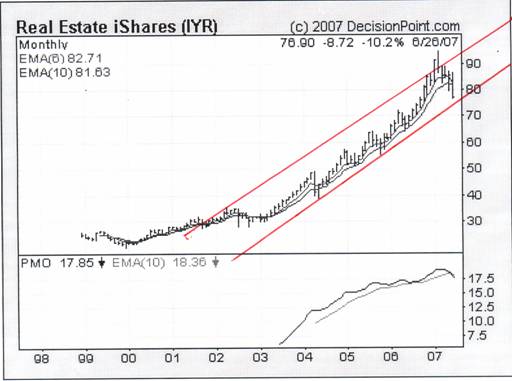

So let's look at the Real Estate indices: (Again, courtesy decisionpoint.com).

Fascinating! Again, the rising

trend is still intact - notwithstanding the recent strong price

falls.

So, when we put all the pieces of the jigsaw puzzle together,

we see a picture emerging:

Prices generally have been rising within identifiable channels.

Prices have been pulling back within these channel. Investor

confidence is being severely tested, because a breakdown below

the long term rising channel lines could lead to catastrophe.

This situation needs to be managed. How can the Central Banks

do this?

By protect the US Dollar, and by "ramping" the Down

Jones Industrials in the hope that it will spill over into the

other equity markets.

Will they succeed? Philosophically? Not a snowball's hope in

hell! Strategically? Yes, I think they might pull it off

for a year or two - in the hope that the centre of gravity of

the world's economy can be shifted to Asia. When that has been

achieved, the US consumers will have served their purpose and

they can be sacrificed. Oh well. For a few years there

they had it good. Now its someone else's turn.

Personally, morality aside, I have a problem with this strategy

because it relies on Neanderthal Fire as the primary energy input

across the planet. There is no way that Nuclear Fission

is ever going to replace Neanderthal Fire. My problem is that

if you treat the symptoms and ignore the cause, the patient will

inevitably drop down dead. His systems will become overloaded

and collapse.

But let's look at what is likely to happen in the medium term.

If the US Dollar breaks up, then this will

cause significant (short term) consternation in the gold camp

because "everyone knows" that Gold moves inversely

to the US Dollar.

But investors are pretty smart nowadays. It won't take them long

to work out that the rules of the game have changed. If the rising

dollar and rising interest rates do not give rise to a collapse

in equity prices then it will become obvious to Blind Freddy

that we are facing an era of inflation.

Inflation hedge assets will boom.

At the point that recognition dawns generally that we are facing

an era of inflation, the gold price will sever its historical

linkage with the US Dollar and will break up. The break up will

be "major".

And what if the Central Banks fail? What if the double top on

the SPX is a true double top? What if the DJIA tail can't in

fact wag the economic dog - even in the short term?

Well then, we have to go back to fundamentals.

Fundamentally, the cause of the world's economic problems is

not debt or fiat currency. It is that we are stuck in a Neanderthal

Energy Paradigm. For many reasons Fossil Fuels need to be replaced

with more appropriate and far more powerful energy paradigms.

Why we are stuck here is a function of Neanderthal attitudes

towards the very concept of "control". Think of the

cartoon picture of Neanderthal Man - carrying a club in one hand

and dragging his woman by her heir behind him. Neanderthal man

was the ultimate control freak. Our solutions lie in the era

which, in turn, lies Beyond Neanderthal. (see www.beyondneanderthal.com)

After twenty years, I have concluded that there are at least

three energy technologies which, together, could facilitate a

new Energy Paradigm. They all appear practical from the perspective

that they can be perfected and commercialised within a decade.

One of these will be 'fuelled' by gold.

Gold is therefore a three way bet for me.

1.

If the Central Banks are successful in their game playing, inflation

will be upon us and the gold price will soar

a

2. If they are unsuccessful, the

dollar will collapse and the gold price will hold its value and

maybe even soar upwards - because it is an insurance policy against

systemic failure

a

3. In time, if the system does

fail, gold will form a foundational cornerstone in a new era.

If we still have an affinity to the concept of amassing riches,

then the gold price will soar.

Short term, the gold price

may weaken further. Long term, the Primary Trend is UP. Nowadays,

the short term is very short indeed.

Jun 27, 2007

Brian Bloom

Australia

website: www.beyondneanderthal.com

email: info@beyondneanderthal.com

Since 1987, when Brian

Bloom became involved in the Venture Capital Industry, he has

been constantly on the lookout for alternative energy technologies

to replace fossil fuels. Since 1987, when Brian

Bloom became involved in the Venture Capital Industry, he has

been constantly on the lookout for alternative energy technologies

to replace fossil fuels.

Beyond Neanderthal

Brian Bloom's novel Beyond Neanderthal is a factional work

which took over twenty years to research.

Via the medium

of its light hearted storyline, it examines how the world has

gotten itself into the horrific quagmire of economic and social

problems with which we are now faced - and puts forward one possible

course of action on which we might embark to dig ourselves out.

It may be ordered

over the internet via www.beyondneanderthal.com. Or purchased from

Amazon.

321gold Ltd

|