|

|||

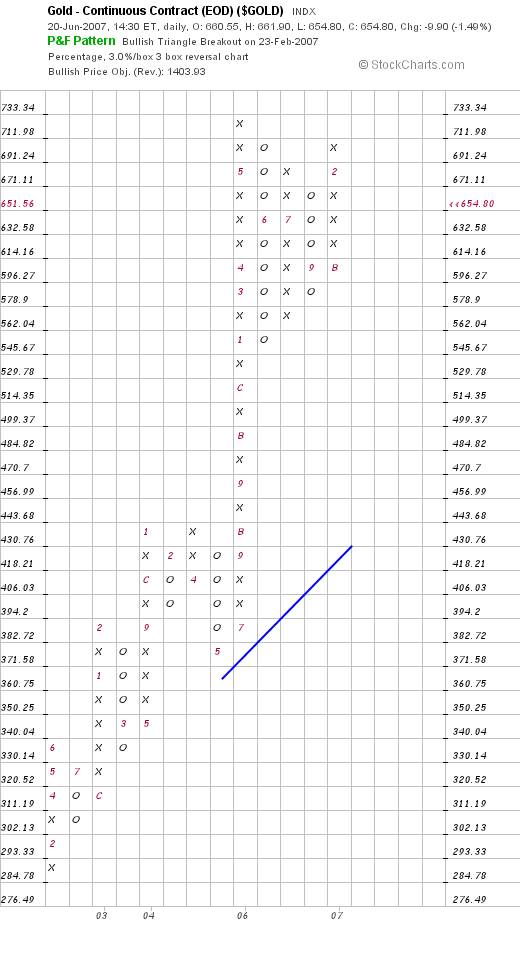

Gold - Major Breakout ImminentBrian Bloom  In light of this waning capability,

and despite their predisposition to prevent the gold price from

reaching new highs, the longer term technical evidence is suggesting

that upside pressures are building at a deeper level within the

gold and related markets.  From the high point of 171.71

in the week May 7th 2006, three descending fan lines can be drawn

in. Slowly, but surely, the price has been trending towards the

apex of a triangle which has been in the making for over a year.  The weekly goldollar index chart (derived by multiplying the gold price by the US$ Index) is still climbing its rising trendline - with the context of a US$ Index that appears to have bottomed (chart courtesy decisonpoint.com)  If the gold price breaks up

in context of a US Dollar which does not break down, then the

gold price will finally break free of the spurious shackles that

it is an alternate currency to the United States Dollar. Gold

is not now, never was and never will be a "currency"

in the strict meaning of the word. Yes, Gold is a store of value.

Yes, Gold may one day again be a medium of exchange for Balance

Sheet (as opposed to P&L) transaction purposes. Above all,

gold is a commodity. In context of some in-depth research I did

for the recently completed manuscript of my novel, Beyond

Neanderthal (see www.beyondneanderthal.com),

I am able to argue fairly convincingly that gold is almost priceless

in its value to humanity. I am also able to argue that gold became

the world's preferred medium of exchange precisely because it

has this inherent value.  Note also how the distance

between 20,50 and 200 MA's on the price chart have been flattening

out relative to one another as the indecision period draws to

a close and as the coiled spring winds ever tighter. (Of course,

the price could break down, but the longer term evidence suggests

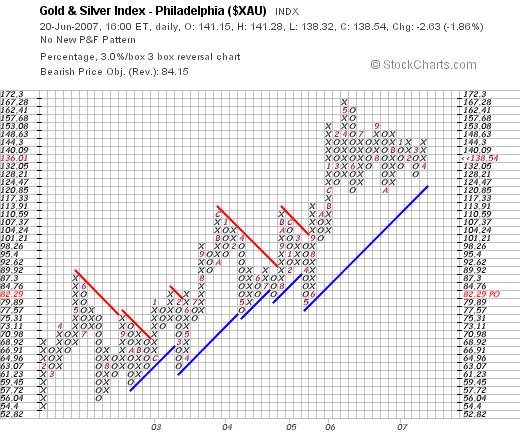

that the break will be to the upside)  The 3% X 3 Box reversal chart of the $XAU below shows a significant consolidation and, should the price break up, a target (based on horizontal count technique) of 180 and a target (based on vertical count technique) of 200 may be anticipated i.e. a 28% to 42% rise may be expected from these levels.  Summary Jun 19, 2007 The novel has been drafted on three levels: As a vehicle for communication it tells the light hearted, romantic story of four heroes in search of alternative energy technologies which can fully replace Neanderthal Fire. On that level, its storyline and language have been crafted to be understood and enjoyed by everyone with a high school education. The second level of the novel explores the intricacies of the processes involved and stimulates thinking about their development. None of the three new energy technologies which it introduces is yet on commercial radar. Gold, the element, (Au) will power one of them. On the third level, it examines why these technologies have not yet been commercialised. The answer: We've got our priorities wrong. Beyond Neanderthal also provides a roughly quantified strategic plan to commercialise at least two of these technologies within a decade - across the planet. In context of our incorrect priorities, this cannot be achieved by Private Enterprise. Tragically, Governments will not act unless there is pressure from voters. It is therefore necessary to generate a juggernaut tidal wave of that pressure. The cost will be 'peppercorn' relative to what is being currently considered by some Governments. Together, these three technologies have the power to lift humanity to a new level of evolution. Within a decade, Carbon emissions will plummet but, as you will discover, they are an irrelevancy. Please register your interest to acquire a copy of this novel at www.beyondneanderthal.com . Please also inform all your friends and associates. The more people who read the novel, the greater will be the pressure for Governments to act. |