|

|||

Gold/HUI Divorce?David Yu

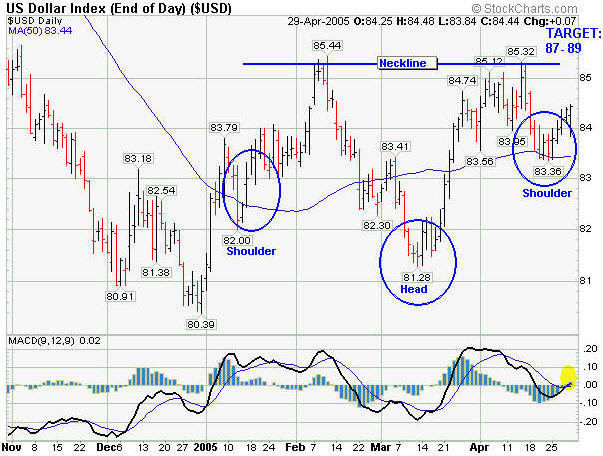

I personally don't ever worry about the price of gold, the real money, and I don't think many of us who own physical metal worry about the price fluctuation at all. In fact, I don't even think about the price of gold unless some article comes along to remind me. Holding a portion of my asset in physical gold bullion is an insurance policy more than anything else. The gold mining companies and their stocks is a different story. The difference parallels the relations between owning homes and home builder shares, owning coffee and Folgers (Procter & Gamble) stocks, and oil and oil service shares, etc. As long as they are financial assets, they're subject to financial markets' price fluctuations. It doesn't matter if Eric Hommelberg, the author of this article, feels that it "doesn't make sense" or like "pushing a car," the prices of these shares are subject to how the financial market perceives the risks and rewards factors of this sector. With due respect to Sinclair, Morrison, and Godsell that were mentioned in this article, it really doesn't matter what they have to say, the only thing matters is what the market has to say. And, right now, the way the dollar has been holding up so well, gold shares don't stand a chance of recovering any time soon. (Disclosure: I own a few of them). Dollar has been doing so well that it's actually forming a bullish inverse Head and Shoulder pattern in addition to (1) holding above 50-day moving average and (2) MACD turning positive. Let's take a look at the Dollar chart. I think it's pretty self-explanatory.

In addition, this chart shows the ratio between Amex Gold Bug Index and the price of Gold. Technically, it's not a perfect Double-Top formation because the second peak (0.562) never came close to challenging the first peak of 0.635. But, that could be due to the extreme weakness in the gold shares. If we consider this a Double Top formation, then there's still quite a way to go before the rebound. The target for that rebound point is when this ratio reaches 0.225 level. This could happen, of course, by lowering the price of gold, the price of HUI, or both. Most likely, it's the HUI that may decline further. Even if we simply ignore this formation, it's obvious that this ratio has broken the 0.445 support area. The next intermediate support area should be in the 0.300 level. If that didn't hold, then it would fall to the 0.225 target before it would rebound.

The best thing for us gold bugs is to take the time off and come back in the fall to check on them. It just may take that much time to complete this bearish technical formation. Nonetheless, the strong multi-year uptrend in Gold is not to be taken lightly. This chart shows even at well above $400 price range, the physical metal continues to be accumulated by the big money while share holders continue to unload mining company stocks that are at a fraction of the price of the physical metal. Despite the recent equity market sell-off, gold continues to hold up well. Somewhere in the world, people with money have been accumulating gold.

David Yu |