|

|||

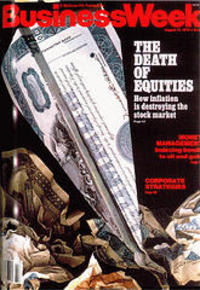

The Death of Gold?Roland Watson Contrarian investors will have some acquaintance with the concept of the "shoeshine boy" effect. This is the theory that a buy or sell is signaled for an asset class based on extreme sentiment for or against it in the media or society in general. The term is taken from an alleged story of how John F. Kennedy's father sold his stocks prior to the 1929 crash because his shoeshine boy was giving him stock tips over his shoes. Kennedy correctly deduced that this was a sign of an extremely overbought market and took it as a sell signal. On the flip side of the coin, there is also the famous "Death of Equities" cover from Business Week published in August 13th 1979. The analysis that high inflation was a dampener to stock growth may have been correct but inflation was not far off in peaking and stocks were about to begin their great 21 year bull market.  A graph of the S&P500 for that time period shows a line where the famous cover was published and we see how this turned out to be a good buy signal for equities as it plainly exemplified the extreme bearish sentiment that the public had for stocks at that time. Which brings us to the front page of the London Times that greeted my eyes on the 14th March. Gold hits $1000 and finally makes it to the front page of the major media. Is this gold's equivalent of the "Death of Equities" cover?  A week or so after that cover appeared, I had my own "shoeshine boy" experience as a friend approached me and asked the question "Should I be buying gold and silver?" I asked why and he cited the fear of bank failures. Before this point, he had never expressed an interest in the subject at all to me. Perhaps you have had similar experiences but one wonders if such personal and media events are signaling a major top in the gold market. As it turns out, gold hit a high of some note the next trading day on the 17th March and has laboured ever since. Can our Times "shoeshine boy" headline be that accurate? In other words "gold soars" but it actually will not as we take a contrarian hint from its front page. Obviously only time will tell as we watch how this current correction pans out. If gold, silver and commodities in general have reached a multi year top (for which there is mounting evidence) then this Times cover can take its place in the Pantheon of contrarian investment signals. Further analysis of silver can be had by going to our silver blog at http://silveranalyst.blogspot.com where readers can obtain a free issue of The Silver Analyst and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk. Roland Watson |