Technical Analysis on Hot Commodities

Update: GLD, SLV, USO & UNG

Chris Vermeulen

TheGoldandOilGuy

Jun 29, 2009

Last week commodities moved

higher as investors started buying into the recent pullback in

prices. This is a healthy sign for the overall market. This is

a quick update for gold, silver, oil and natural gas short term

traders.

GLD Gold ETF Trading Chart

Gold has provided us

with two great trades this year. Both trades lasted only a few

weeks and we locked in profits on technical breakdowns. Many

of you have been asking when we will get a short signal (make

money in a down market). Well, I don't like shorting a commodity

that is in rally mode. KISS is my mentality and trading only

with the major trend is what I focus on.

For those of you who want to

short gold (DZZ Ticker) may do so at your own risk, I recommend

waiting for an extended rally of 10+ percent in price before

you start looking for a technical breakdown to short. The quicker

prices rise, the higher chance that a technical breakdown will

provide a quick shorting opportunity. Locking in profits within

a few days is crucial. In a bull market pullbacks in price are

generally quick and short lived.

***

SLV Silver ETF Trading Chart

Silver and gold generally

move in the same direction. These precious metals are looking

ripe for a low risk setup. What I am looking for is momentum

to turn up along with a reversal candle pattern. We continue

to wait.

***

USO Oil ETF Trading Chart

Oil has had a solid

move the past 2 months. This chart is starting to look a little

bearish and if what I am seeing is correct for the short term

then we could see oil slide lower this week. But in the event

prices rally we could get a buy signal within 5-10 days if all

goes well.

***

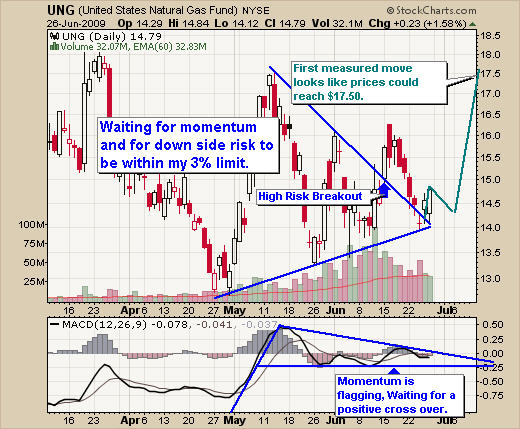

UNG Natural Gas ETF Trading Chart

Natural Gas has been

drifting sideways for over 2 months now. Everyone is excited

to catch this reversal when prices start to head north again.

Seems like most people are long UNG already from what I gather

because of the fear of missing the next big rally.

To be honest I have that fear

as well but I do not let it control my trading. As usual I follow

my simple trading model and trade when risk is low and the odds

are on my side. One thing that traders should remember is that

UNG (Nat Gas) looks to be bottoming from a very big sell off.

If in fact prices are reversing there will be plenty of opportunities

to buy it still. Even though I am really excited for this trade,

I continue to wait for my time. I would like to see the momentum

breakout and start moving higher before I buy anything.

***

Commodity Trading Conclusion:

Looks as though money

is starting to flow back into commodities. With any luck we could

have some buy signals this week. GLD and UNG have the best looking

charts for a buy signal currently.

As usual I wait for the trades

to unfold and come to use. Keeping risk low, scaling out of trades

to lock in profits where there is a technical breakdown and allowing

our core position to run for larger gains is my focus. I don't

forecast prices I just analyze prices and prepare for what two

scenarios will most likely occur within a couple days.

If you would like to receive

my Free Trading Reports or my Trading Signals please visit my

website at:

TheGoldAndOilGuy.com.

Jun 29, 2009

Chris Vermeulen

email: Chris@theGoidAndOilGuy.com

website:

www.TheGoldAndOilGuy.com website:

www.TheGoldAndOilGuy.com

Chris Vermeulen is founder of the popular

trading site TheGoldAndOilGuy.com. There he shares his

highly successful, low-risk trading method. For 6 years Chris

has been a leader in teaching others to skillfully trade in gold,

oil, and silver in both bull and bear markets. Subscribers to

his service depend on Chris' uniquely consistent investment opportunities

that carry exceptionally low risk and high return.

Subscription

Service:

Monthly Membership ($29 USD)

Quarterly Membership ($79 USD)

Yearly Membership- Save $49 + Free Crisis Investing E-Book ($299)

You can sign

up here.

This article

is intended solely for information purposes. The opinions are

those of the author only. Please conduct further research and

consult your financial advisor before making any investment/trading

decision. No responsibility can be accepted for losses that may

result as a consequence of trading on the basis of this analysis.

321gold Ltd

|