The Technical Traders

Platinum vs. Palladium – What you need to know about the demand and price analysis Chris Vermeulen

Posted Mar 3, 2019 The continued rally in Palladium has prompted speculation that Platinum, Gold, and Silver will follow this trend upwards with renewed buying pressure. The one thing that many people are not considering is that Palladium is an industrial use component for many manufacturing sectors – specifically the automotive sector. As traders, we must understand that a rise in global demand for autos will increase the global demand for Palladium goes beyond traditional safe-haven demands for other metals like Platinum, Gold, and Silver. The one key aspect of the Palladium demand cycle that we feel is critical is the increase in global demand for new cars and trucks as well as the continued global push to reduce carbon emissions and pollution. The graph, below, illustrates the dramatically increased demand throughout much of the developed nations of the world. From 2003 to 2015, US demand for autos rose by more than 330% - from about 2.3 million units to over 6.5 million units. Over that same period, demand for autos in Asia more than doubled from 10 million units to nearly 26 million units annually. Within this data, we can see that US and Asian demand has continued to increase from the low 2008~09 levels. We believe this is the real reason Palladium rocketed higher over the past ten years. (Click on images to enlarge)  (Source: Marketrealist.com) The reality is that Palladium is used in many common and essential every-day components of our lives. We already know that Palladium is used heavily within the Automotive and transportation sectors, but did you know it is also extensively used in these following sectors? _ Catalytic Converters For Automobiles

_ Synthetic Biology Catalyst

_ Hydrogen Storage

_ Jewelry

_ Electronics

_ Long Lasting Photograph

_ Dentistry

_ Blood Sugar Test Strips

_ Surgical Instruments

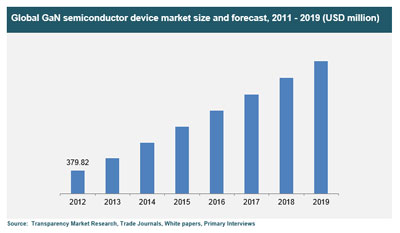

_ Carbon Monoxide Detectors When we stop to consider how many every-day components of our lives include some type of, demand for and use of a product that is likely to include Palladium and with world population growing it makes logical sense to see this growth. Pretty much every key aspect of our lives involves something that includes Palladium as a core element. Therefore, we must understand that Palladium is a component of manufacturing that is included in much of the automobile, technology, medical services/components, jewelry, and daily use products of nearly all the developed nations. Steady Technology Growth = Palladium Demand One of the biggest drivers of increased demand for Palladium has been the increased demand for technology of all types throughout the US, Asia/China and Europe. Over the past 10+ years, the demand for tablets, touch-screen devices, advanced technology and much more has driven a huge demand for Palladium vs. other metals.  (Source: RFGlobalnet.com) The Technical Analysis Price Outlook As a technical analyst, I focus mainly on the price charts to know where price is most likely to move next. But, knowing and understanding the fundamentals can significantly help in determining the type of price movement I should expect when price reverses. Both Palladium and Platinum have VERY different looking chart patterns and this comparison between the two I think paints a clear image of what is likely to happen next based on my analysis. The monthly Palladium chart below shows repeated blow off topping formations which also match Fibonacci price targets and pullback levels. The price pattern and Fibonacci targets are two of my most used analysis types for trading. There is no doubt money had been flowing into Palladium, and it has all the attention with traders/investors in what I feel is a silent bull market. But, the price is now reaching a Fibonacci price target and near vertical move up, and that to me screams PULLBACK.  Now take a look the monthly chart for Platinum in the same time frame. There had been a lack of interest in this safe-haven metal and price had faded back down to a long term support zone. This to me could be the next shining metal and could take the spotlight or have a silent bull market most never notice. It just may outperform gold, silver, and palladium in 2019.  Conclusion In short, what is hot now will eventually be replaced with the next best opportunity for investors to place their money for continued growth like in Platinum. Based on the growing demand/need for palladium I only see a somewhat minor pullback/correction in price this year before it possibly continues higher. But, keep in mind, if/when a bear market comes in stocks and we have an economic downturn expect all metals to correct in a big way. To quickly touch on gold, silver, and miners, I have a different outlook on how to trade those. I also specialize trading momentum stocks and leveraged ETS which I recently closed out winners with 30%, 17.7%, 13%, and 10.5% so be sure to visit my trade alert website for more details. ### Chris Vermeulen

email: chris@thetechnicaltraders.com

website: www.thetechnicaltraders.com Disclaimer: This material should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from this website, articles, videos, seminars or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. Our advice is not tailored to the needs of any subscriber we advise that you talk with your investment advisor before making trading decisions. This information is for educational purposes only. 321gold Ltd

|