Gold Technicals: Avoid the Jitterbug Dance Gold Technicals: Avoid the Jitterbug Dance

[for gold

Nervous Nellies]

Stewart Thomson

email: s2p3t4@sympatico.ca

Sep 21, 2009

1. Gold market participants

are starting to dance the jitterbug. According to Wikipedia the

term jitterbug comes from an early 20th-century slang term used

to describe alcoholics who suffered from the "jitters."

The term became associated with swing dancers who danced without

any control or knowledge of the dance.

2. The gold community has just

contracted a bad case of the nerves. I see this as a repeat of

the bond market in the early 1980s, as US T-bonds broke out of

one of the most spectacular head and shouldering situations of

all time. Head and shouldering is a term I use to describe a

technical situation where one head and shoulders pattern becomes

the head of another larger pattern, which in turn does the same

thing several more times, "growing" into a massive

head and shoulders formation.

3. The measured move of the

H&S pattern in the bonds was to about 104. Bonds had bottomed

at 44. The move featured most players either booking micro profits

or actually going short because the market was "overbought".

4. Most of the technical indicators

on the daily gold chart are now overbought. But the weekly indicators

are in a state similar to September of 2007. I would actually

say the situation is nearly identical to that time frame. What

happened in Sept 2007? The gold price was about $725. It fell

to about 715 and then shot to 825, while the technical condition

became even more overbought.

5. From 775 the market made

its way to 1030, with no more than approx. $50 sell offs

along the way. The bottom line is this: I'm a profit-booker into

this strength, with an eye to the largest profits in the 1200-1300

area, should we arrive there on this move.

6. If we do not arrive there?

Then I'm a buyer into any and all price weakness.

7. If you think you may be

dancing the gold jitterbug dance, you may be correct, and it

is a dance that can cost you money. Large money. You may feel

gold is due for a fall, so you have sold a lot of gold. The bankers

don't care about you. You are small potatoes. They want to create

a major jitterbug situation, one that features across the board

bailing in the gold community. 980 is the gold line in the sand.

If 980 fails, technicians will believe the technical condition

of the gold market has been damaged, and they will begin selling.

Here's daily and weekly gold charts.

::: :::

8. On the other side of the

dance floor, the gold bull jitterbugs are also dancing up a storm.

Perhaps you believe gold is in liftoff mode, so you have either

rebought more than you sold into 905, or simply just added to

your already huge gold positions, perhaps using leverage.

9. The correct approach to

the market, I believe, is to remain as calm as possible and stay

away from the jitterbug dancefloor. Respond to price as opposed

to anticipating it. I think those selling and shorting gold that

claim they will be selling up to 1200 are pulling a bit of a

Pinocchio.

10. The same thing occurred

in Natural Gas on the buy side, as many investors thought

they had ahold of the Holy Grail. What they had ahold of is perhaps

the most volatile commodity in the world, Natural Gas. As investors

averaged down into price weakness that was far below their

plans, eventually the pain became overwhelming and mass liquidation

began. NG then soared about 50% in a week as the guard was changed

from weak hands to strong.

11. So, if you are shorting

gold here as a means to book profit on your physical gold, which

is a strategy I use and one employed on a massive scale by the

banksters, make sure you look in the mirror, look hard and ensure

you are not telling yourself the fantasy that you know

gold can't go any higher.

12. Gold can go higher, a lot

higher. If you told people you sold 10% of your gold position,

but really you shorted 200% of it, "to get in cheaper at

950", you could be in big trouble.

13. The same type of trouble

occurred in the 905-930 area. Investors were sure gold was going

lower, shorted it, and were obliterated.

14. This is a time to hold

the bulk of your positions intact. When I sell I'm generally

offloading approx. 2-5% of my positions into each $50 of strength.

The sells get incrementally bigger every $10 higher. If you are

offloading in chunks like 25% or 50%, you are not using correct

market tactics and risk being obliterated by the new era of gold

price volatility.

15. The banksters want to see

the gold community dance the jitterbug. That is the dance music

they selected for the ride to $1200 gold.

16. When you build wealth,

you are building holdings in assets. Rather than shorting gold,

my suggestion for most investors is that you buy US dollars as

gold soars, but in a very modest way.

17. My goal for this current

week is to see investors start this week in a rational and calm

mental and emotional state, and maintain it right thru Friday.

18. A dollar rally gives you

profits on your dollar positions. If you are booking profits

your focus moves away from the declining numbers on your gold

positions. Such actions build a positive mental condition, making

you far less likely to engage in panic selling into price weakness.

19. If you look at Friday's

volume on the UUP-n, the bull US dollar ETF, you can see the

absolutely monstrous volume on the daily chart. If you get a

rally in the US dollar and you own it, as I do, you are going

to feel good as the dollar rallies and book profit. I own the

dollar and I feel good this morning as I ring the USD cash register.

Profits exist to be booked, not blabbed about on the golf course.

Gold isn't on my mind as I book USD profits, even though my gold

positions are vastly larger than my USD profits. Here is the

chart for the etf UUP-n:

20. I often speak of the absolute

importance of monthly charts, but I don't show them that often,

because they give very few signals. Gold is giving BUY signals

on the monthly chart. Here is the monthly chart. Note in particular

the 3 series of MACD I have drawn in:

21. The current situation in

the gold market is totally different from the Spring 2008 peak.

First, the fall is the strong season for gold, the exact opposite

of the spring of 2008. Not the weak season. Second, at the 2008

peak, the monthly technical indicators like MACDE were giving

massive sell signals. Now they are giving buy signals!

22. The bottom line is that

those "warning" you about gold's technical condition

are: Gold Jitterbug Dancers. They are dead wrong. They are terrified

bailers of gold. Plain and simple, they are afraid. Booking profit

into strength and selling because you think gold will fall are

two entirely different sets of tactics, totally unrelated. I'm

not booking profit because I think gold will fall. Maybe it does,

maybe it doesn't.

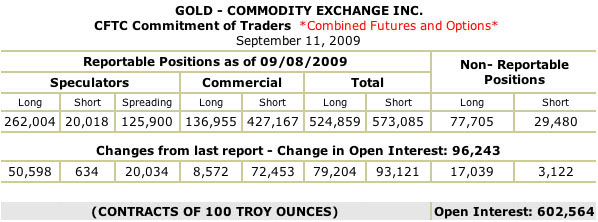

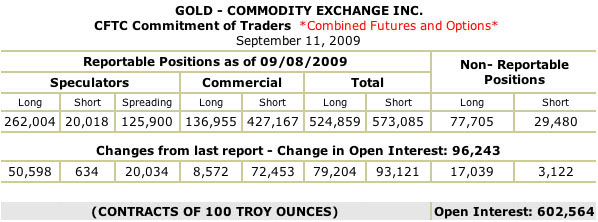

23. The COT report [Sep 11th] shows record shorts being put by the

bankers, and record longs being put on by the funds. Last fall

gold tanked into 680 in a record-size wipeout. The funds busted

out. Now they are back, or at least new versions of them are

back. If gold goes to 1200 rather than falling lower, the bankers

will carry an even bigger position and so will the funds. The

current record size COT positions call for booking profits into

strength, not for top calling or all-out buying. Those giving

you "warnings" that "gold could decline in price,

so bail now!" are mostly market bustouts who couldn't trade

their way out of a wet paper bag if their life depended on it.

24. When gold was rising from

680, did investors care if gold rallied or fell $50? No. On a

percentage basis, a $50 or $100 move in gold now is smaller than

it was then. It's no big deal. What's the hoopla all about? Sell

a little more as gold trucks on up to 1050 to 1100, if it does.

Buy a little more as it eases to 950/900, as it does. The ability

to sell gold professionally is a subtle concept. The key is to

DO WHAT IT TAKES to maintain that separation of your mental state

where the market might go, from booking profit into strength

and buying into weakness. 95% of your focus, at all times, should

be on selling strength systematically and buying weakness systematically.

Most are doing the opposite, focusing 95% of your energy on market

direction.

###

Sep 21, 2009

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: s2p3t4@sympatico.ca

email to request the free reports: freereport1@bell.net

|