Graceland Updates 4am-7am Graceland Updates 4am-7am

Gold School: Report Cards

are out!

Stewart Thomson

email: s2p3t4@sympatico.ca

May 15, 2009

1. It's Friday! Every Friday

two very important reports come out. The first is the gold market

COT report. The bottom line report card on what the major players

did in the gold market over the previous week. Most traders ignore

it because it isn't "up to date" enough. Which is like

ignoring the fact that a herd of elephants trampled thru

your house a few days ago. You can't ignore the action of the

biggest players.

2. The second important report

card is... Our own! It's very important that investors maintain

a positive mental state. At the end of each week, the markets

have usually either risen or fallen in price. Generally speaking,

if the price of gold has fallen during the week, the COT report

will show the larger players are holding more gold than they

were when the week started. Likewise, if the price of gold has

risen, the "gold elephants" have less gold. Our own

report cards should show the same action, exactly the same. When

the trading week ends, if the price is up, I give myself an "A"

if I'm a little lighter in gold and gold stock. If the price

is down on the week, I must have slightly more gold than at the

start of the week.

3. In all the many years I've

followed the COT reports, never have I seen a single week where

the biggest players as a group take rash action. When I use the

term "biggest players," I'm referring to the bankers.

The weekly percentage changes in position are not that large,

but they are very real.

4. In contrast to actions documented

by the COT reports, I've seen individual investors engage in

market action that can only be termed: bizarre and surreal. Entire

portfolios blown out into the exact bottoms of major bear markets.

Massive loans taken out against homes to buy funds with stocks

with average p/e ratios of 50 to 1. And worst of all, report

cards with straight D's on them. When you buy strength and sell

weakness, you get a D. Let's get focused on the report cards.

First, the bond market. Last posting, I went over the game played

by the primary dealers at Treasury Bond auction time. Many tried

to call the top of the bond market. Did you make any money? Or

did you get cooked on your shorts when the dealers covered, and

the bond lept up for four days in a row? There is a way to make

money shorting the bond, but it requires a daily report card.

5. I personally have no interest

in shorting the bond. My interest is in buying it. Not now. When

it breaks 100 I'll put a microscopic toe in the water. Every

point it falls I'll buy more. It's over 120 now. I couldn't care

less about shorting the bond down to 100. Give me a chance to

grab 6% a year for 30 years, or 8%, or 10%, or 15%... I'll take

ALL of those! It's a cold hard reality that institutions will

buy bonds, and hold them, when the govt bond pays them 8%. They

will transition out of stocks and into bonds. Why? Because 8%

is the number a high net worth individual is satisfied with.

Stocks, with tremendous risk, have historically returned about

8%. If they can grab 8% on a govt of America guaranteed T-bond,

institutions will be buyers in size. And they will be buyers

well before the yield hits 8%. The current moves you have seen

into bonds are moves out of fear. Temporary moves.

6. I don't want to own bonds

now, because the interest is so low that T-bills under the mattress

is arguably safer. I'll show you today how to short bonds, if

that is your game. But you are far better off to focus on professionally

buying and selling gold now, and apply those tactics to bonds

later. After they melt away. Because Mr. Bernanke has the ability

to print unlimited amts of dollars to buy bonds, in theory he

could bid bond prices to infinity, regardless of what any other

players did. Of course, that result in a complete mauling of

the US dollar in the process. Here's the weekly bond chart.

7. Notice the red horizontal

resistance at 125. Bears are focused on this number. I want to

remind the bears of the supposed "cement lid" on the

US dollar index at 80. A lid that was supposed to end the USD

rally. Instead the dollar went thru that resistance like a knife

thru butter. Don't bet your life on the resistance at 125. The

Stochastics have crossed into a buy signal, and the MACD is overdone.

Legions of traders have tried repeatedly to call the top in bonds

and failed repeatedly. If you repeat their tactics, odds are

that you too will fail. Many have lost all their risk capital

with a multitude of stop losses triggered.

8. In your battle against Mr.

Bernanke, who is armed with the world's largest photocopy machine

and his set of chart painting brushes, you need maximum weaponry.

Not a popgun. My subscribers who are shorting the bond have an

entire "armed force" with various parts of their risk

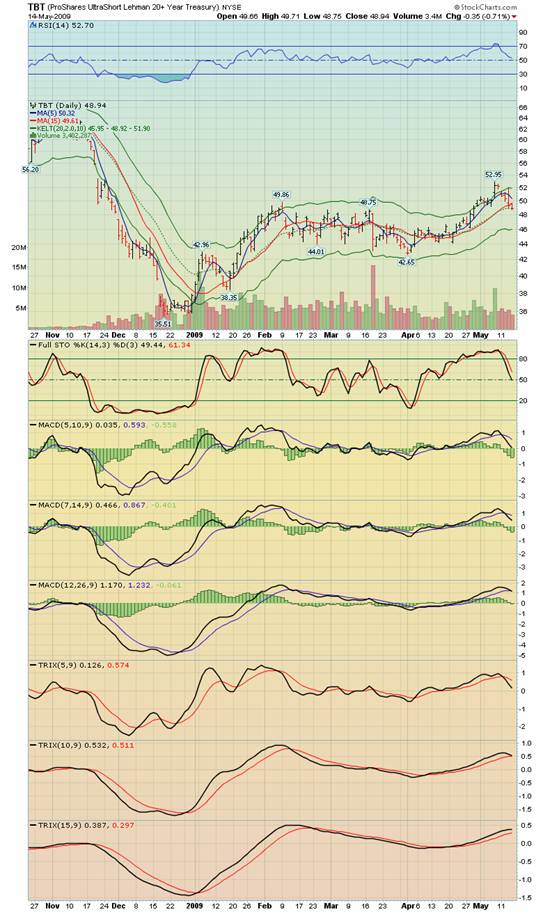

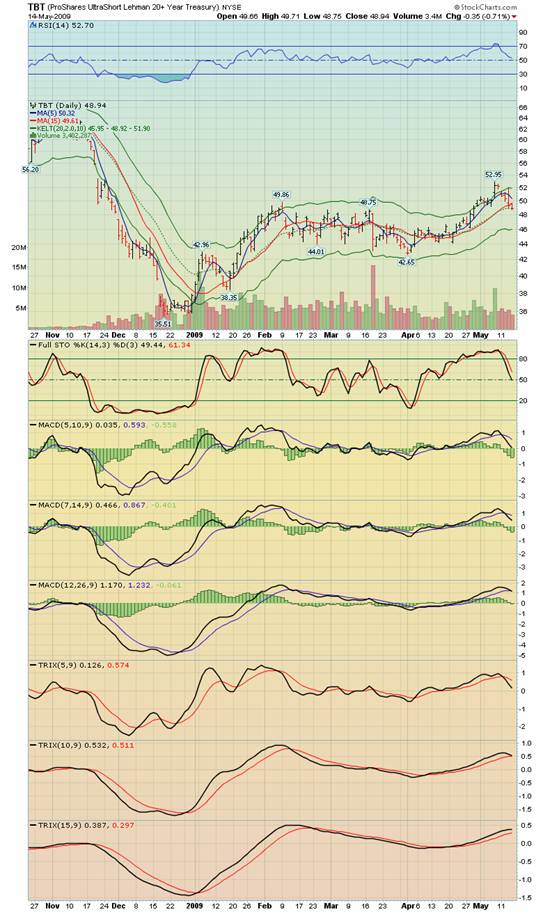

capital doing different things. Here's the TBT-n chart. A leveraged

bear longterm bond fund. The current price is around 48 dollars.

What my Pgen (pyramid generator) does is give you the ability

to be a player at any point on what is really a simple 48 point

playing field. The Pgen systematically allocates your capital

over ALL the points. You are a buyer of TBT right here, right

now. If price moves against you from here, you are a buyer, not

a bailer. Unless TBT goes off the board, you can't be taken out

of the game. And even if TBT went to zero, it's unlikely to do

so in a gap down. You are likely booking dozens, maybe even hundreds

of winning trades, long before that occurs.

9. What could cause bonds to

melt away in a real bear market? Well, memories of the

Lehman bankruptcy are still fresh on investors' minds. Is there

a pile of OTC derivatives under the Chrysler rock? Perhaps another

major company will go under in a surprise, and we have an even

bigger repeat of last year: Down go stocks, down goes gold stocks,

down goes gold bullion (limited), and up goes the dollar and

up goes bonds, right? I'm not so sure about that. Another bankruptcy

equal or perhaps significantly larger than the Lehman bankruptcy

could cause another charge into bonds. But of equal probability:

That event could cause mainstream institutional investors to

believe the system no longer was at risk of failing, but that

it IS failed. That could cause a "bypass of bonds"

as a safe haven, and into physical cash and Gold.

10. The general public is still

largely in the stock market. One of the greatest market errors

made by amateur investors is the belief that because a market

has stopped falling, it must now start rising. The public bought

more stock recently. If the Dow were to break the lows at 6500,

the public would become totally demoralized. Bank and market

closures would become likely, which would also cause many investors

to bypass T-bonds and buy gold. When the doors on your bank are

physically locked shut, and there's no cash in the bank machine,

you want two things: Cash and Gold. The very last thing on your

mind is buying long term bonds because of some libor or ted spread

ratio. The thought is, "Gimme some liquid money, and gimme

it now!" For those of you who have taken zero action to

store some emergency cash outside the banking system, I hope

this picture of reality is enough to cause you to take action.

Right now. Prepare today because it's totally impossible to prepare

after the banks are already closed. Just as the public buys stock

after the price has risen, they will seek to prepare themselves

against bank closures... after they are closed! Huge lines will

form in front of banks. Do you want to be one of the bustouts

standing in those lines? Line up now for your emergency cash.

There's no waiting, and since you're the only one in line you

can take out what you need in stages - on your own time!

11. As many of you know, I

consider Richard Russell the greatest living expert on the Dow.

He says he's basically divided his capital between US dollars

and gold. Many think hyperinflation is coming, and perhaps it

is. If it does, the US dollar position will be wiped out, yes,

but gold will soar many times over. An overall big victory. If

deflation roars ahead, the US dollar will soar, but gold won't

collapse.

12. I trade the US dollar.

I trade gold. I don't use stoplosses on either. Gold is the world's

lowest risk investment. Why would I sell it at a loss? If the

US dollar goes off the board, my gold will be far beyond the

STRATOSPHERE. If the US dollar falls to 50 on the index from

the current 82 area, I want to be a buyer. The ideal situation

would be for the US dollar and the bond to be deep in the throngs

of a bear mkt near the USD 50 area. Jim Sinclair, the world's

largest gold trader, believes that a "revitalized"

gold standard via a quoted ratio of gold to USD supply,

will halt the USD bear mkt. Probably around that 50 level. But

if the ratio is not put in place, the USD could spiral lower

and real hyperinflation could take hold.

13. The US dollar chart may

have a head and shoulders top on it right now. Rather than shorting

the USD, which exposes you to unlimited risk, my suggestion is

to BUY a USD bear ETF. Like UDN-n. Here's the weekly chart:

14. UDN has rallied from about

24 to 26. I wouldn't buy it here. Notice the weekly Stochastics

going into the overbought zone. I don't see anything wrong with

buying at 26, but I want to do it on weakness, not on strength.

UUP-n is a US dollar BULL ETF. I think a lot of

gold investors are making a substantial error trying to short

the USD while owning gold. In the 1970s bull market, the USD

mounted a huge rally as gold made its biggest upmove. My suggestion

is to move in and out of bets on the USD itself. While selling

the UUP you are buying UDN. And vice versa.

15. Gold is a separate bet.

I buy gold because it is the world's lowest risk investment.

Not because the US dollar might disintegrate. All paper monies

are nothing more than insults to gold. The average investor has

no clue whatsoever just how low risk gold is. In fact, the average

investor actually believes gold is a high risk investment. Gold

stocks are high risk. Not gold bullion. In the ultimate big picture

of risk, the US dollar is a tiny fly compared to gold. Gold is

the ultimate trading vehicle because it has the lowest odds of

going to zero of anything on the planet. Yet on a percentage

basis, probably more panic losses are booked on gold trades,

than in any other market.

16. If you can't trade gold,

you can't trade anything. Don't focus on how high gold is going.

That will destroy you. Focus on the fact that gold almost "can't"

go to zero. Everything else will look after itself. One well

known analyst says just put 10% of your money into gold and leave

it there as an insurance policy. To me, that's like putting a

block of marble in front of Michaelangelo. And telling him not

to touch it or he might wreck it!

17. I have an ARMY of subscribers

who trade gold every day using my Pyramid Generator. Who book

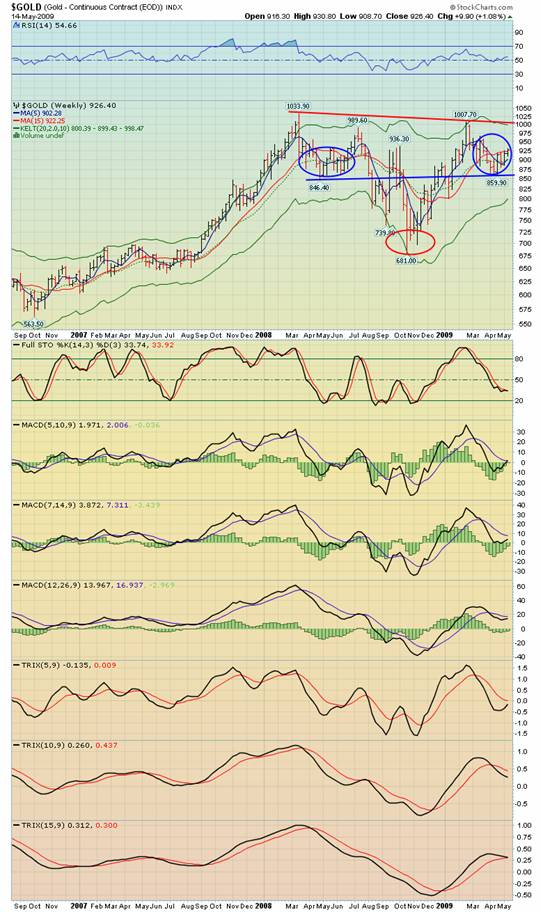

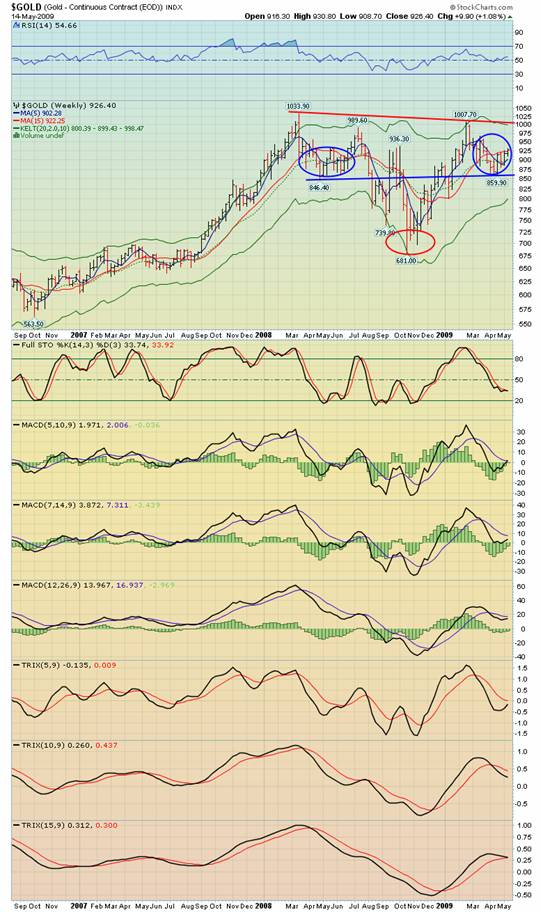

profits all the time and NEVER book a single loss. Here's the

daily gold chart:

18. I don't see anything of

concern here. Stochastics is overbought. Fine, I've been booking

profits into the strength. Stochastics can stay overbought while

prices rises much higher.

19. Here's the weekly chart.

This looks spectacular. Notice the shortest time frame MACD series.

Touching, about to give a buy signal. Stochastics is becoming

oversold.

20. Of course I'll be a buyer

on any weakness. The head and shoulders consolidation looks like

a work of art done by Michaelangelo himelf!

21. Let's sum up the week with

our report card. I demand I end every trading week with Victory.

This week I count multiple wins in Oil, Uranium, Dow, Gold, Food.

Price was generally up this week, so Victory is measured in booked

profits. Your report card should show you carrying a smaller

number of trading positions in these items and more cash in the

accounts. What will next week bring? If price is down, Victory

is measured in more ounces, barrels, bushels, shares. Allocate

your risk capital so you are a player at all price levels. When

the banker paints YOUR stock's chart price down for the week

with a big red "sell now" job, you want to be able

to grab your own gold paint brush and paint in big bold letters

across their sell game with your paint: "Buy here, buy now!"

###

May 15, 2009

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

email to request the free reports: freereports@galacticupdates.com

Tuesday 17th Feb 2026

Special Offer for 321gold readers: Send an email to freereports@galacticupdates.com and I'll send you my free “CDNX Hotties Ready For Fresh Highs!” report. I highlight CDNX-listed junior resource stocks that are poised to leapfrog the CDNX index, and surge to glorious new highs! Key investor tactics are included in the report.

|

Graceland

Updates Subscription Service: Note we are privacy oriented. We accept cheques.

And credit cards thru PayPal only on our website. For your protection

we don't see your credit card information. Only PayPal

does.

| Subscribe via major credit cards

at Graceland

Updates

- or make checks payable to: "Stewart Thomson" Mail

to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario

L6H 2M8 / Canada |

Stewart

Thomson

is a retired Merrill Lynch broker. Stewart writes the Graceland

Updates daily between 4am-7am. They are sent out around 8am. The

newsletter is attractively priced and the format is a unique numbered

point form; giving clarity to each point and saving valuable

reading time.

Risks, Disclaimers,

Legal

Stewart

Thomson is no longer an investment advisor. The information provided

by Stewart and Graceland Updates is for general information purposes

only. Before taking any action on any investment, it is imperative

that you consult with multiple properly licensed, experienced

and qualifed investment advisors and get numerous opinions before

taking any action. Your minimum risk on any investment in the

world is 100% loss of all your money. You may be taking

or preparing to take leveraged positions in investments and not

know it, exposing yourself to unlimited risks. This is highly

concerning if you are an investor in any derivatives products.

There is an approx $700 trillion OTC Derivatives Iceberg with

a tiny portion written off officially. The bottom line:

Are

You Prepared?

321gold Ltd

|