Goldman

Sachs: Traitors And Con Artists Goldman

Sachs: Traitors And Con Artists

Elaine Meinel Supkis

Oct 16, 2007

Goldman Sachs conspires to

make themselves richer at the expense of the American economy.

I collected a number of articles, most of which were sent by

a group of wonderful readers who send me many links. Thank you!

Goldman Sachs should be raided by the SEC and the Secret Service.

Remember, the Secret Service was set up to go after counterfitters

and fraudsters as well as tax cheats! And Goldman Sachs has taken

over our entire economic and banking systems and are utterly

destroying them and should be arrested and charged with treason.

Alas, they have also taken over our election system via 'campaign

contributions.'

From CNN:

The glitter is already coming

off Goldman Sachs' golden quarter.

Goldman (Charts, Fortune 500)

wowed just about everyone when it reported very strong earnings

for its fiscal third quarter, a period when rival investment

banks did poorly because of the steep downturn in bond markets,

from which investment banks try to generate trading profits.

However, Goldman's blow out

quarter benefited from large gains in hard-to-value financial

instruments, and its trading results in the period were particularly

volatile, according to data contained in a Goldman filing of

quarterly financial results with the Securities and Exchange

Commission.

Goldman Sachs

controls our Treasury and quite a few aspects of the banking

system and has a huge influence on more than one country's central

banks. A Goldman Sachs man took over the banking system of Canada

this week, for example. Just last month, Bernanke had a lunch

with Paulson, the Goldman Sachs head of the Treasury. This meeting

was all about Goldman Sachs screaming at Bernanke, 'There is

BLOOD in the streets!' Bernanke, impressed by the tearful wails

that the world was coming unglued, assented to a huge interest

rate cut via selling securities to itself, thus causing inflation

to rise and the dollar to fall against the euro. Paulson's further

meetings and phone calls that day are not known yet but before

anyone supposedly knew of the big rate cut/inflation creation

announcement, Goldman Sachs drove up the stock market from minus

400 pts to above 100 pts in only one hour. Goldman Sachs

controls our Treasury and quite a few aspects of the banking

system and has a huge influence on more than one country's central

banks. A Goldman Sachs man took over the banking system of Canada

this week, for example. Just last month, Bernanke had a lunch

with Paulson, the Goldman Sachs head of the Treasury. This meeting

was all about Goldman Sachs screaming at Bernanke, 'There is

BLOOD in the streets!' Bernanke, impressed by the tearful wails

that the world was coming unglued, assented to a huge interest

rate cut via selling securities to itself, thus causing inflation

to rise and the dollar to fall against the euro. Paulson's further

meetings and phone calls that day are not known yet but before

anyone supposedly knew of the big rate cut/inflation creation

announcement, Goldman Sachs drove up the stock market from minus

400 pts to above 100 pts in only one hour.

Goldman Sachs has always irritated

me because they are the ultimate insider traders. This is why

they spend so much bribing politicians as well as gaining access

to the very innermost workings of the machinery of the banking

and financial systems. They are not geniuses, they are conspirators.

When Goldman Sachs announced

they had an amazingly profitable summer, I was astounded. Of

course, their blasted stocks shot up in value upon this amazing

announcement. How could there be blood in the streets if Goldman

Sachs was doing just wonderfully? I was quite puzzled when they

announced this so smugly. I decided, to cut to the chase, that

they were lying. After all, these criminals lie all the time.

They are such habitual liars that even if blood WAS running down

Wall Street's gutters and they were standing in in their rubbers

and umbrellas, I still won't believe them.

Misleading people about the

true value of paper assets is a crime. We call this 'fraud' and

people who do this, 'confidence men.' Confidence men take people

into their confidence and then lie. Our entire economic system

has been taken over by such people. Half of their system is self-delusional

and half, plots to conceal and lie. They, themselves, can no

longer see the difference and are now in the process of destroying

themselves along with us all in the US/EU/UK empire.

I was very serious about suggesting

HU of China get the Nobel Economics Prize. He seems to understand

the true meaning of capitalism and is using it quite masterfully.

In the West, the fondness for using game theory systems is exactly

why we are screwing ourselves. Yes, people play these evolutionary-sort

of games in the dog eat dog world of economic exploitation but

this leaves out the accumulation of raw power whereby there is

no 'game' in the sense that everyone is playing on a level field

and using strategies.

Raw power means ruthlessly

twisting any system to do as one wants no matter what. For example,

whatever systems and customs are used to elect leaders and run

democracies, they are constantly destroyed by raw power as the

military joins with the rich to take over or revolutionaries

make frontal, armed assaults on the system or assassins attack

candidates, etc. I have played power politics in the past and

know how that rather brutal game works. It isn't a mathematical

formula. That works only when systems work.

So it is here: the mathematical

formulas used in game theory and in expressing economic actions

are beginning to fail as we approach those inevitable 'break

points' whereby all systems suddenly shatter and a free-for-all

ensues or a free fall occurs. I have looked long into the analysis

of many such events in the past and so far, have discovered that

no one ever agrees on what really happened. Even with the Great

Depression, there is total confusion as to why this global recession

caused the value of money to rise and prices of all assets and

raw materials to fall. Our present head of the Fed wrote very

astute papers on this very topic and quite frankly, didn't understand

a thing because he looked at it with his microscope rather than

a telescope.

From Bloomberg:

But that view could get revised,

now that it can be seen in the numbers that a large proportion

of its third quarter profits were 'unrealized' - i.e. paper gains,

and not hard cash payments from fully closed out trades - and

came from financial instruments that Goldman values largely according

to its own estimates.

The game theory here is, 'If

someone can unilaterally declare the value of assets, they will

do this in such a way as to profit themselves.' Whenever anyone

tells me something is worth $X, I usually tell them, 'It is worth

only what someone will pay and that varies greatly.' Goldman

Sachs was whining that they couldn't access 'liquidity' within

the same time frame they then claimed they were sitting on a

mountain of very valuable paper that people would be willing

to pay lots of money for! If this were true, all they had to

do was sell some of these papers if they wanted money. If I want

money, this is what I have to do: sell either my labor or my

stuff.

But they couldn't sell a thing.

Since they could only sell at a loss or not at all, this meant

their paper was worthless. Their stocks had been falling for

over a month. They needed to bring the stock market back up and

they needed to make their business look good. So they lied. To

Bernanke. To the US people. To the world. The game theory stuff

is silly if it doesn't include powerful people cheating quite

blatantly and openly and often, violently. The governments of

the world should be purged of all Goldman Sachs conspiritors.

They have bent the world banking and trade systems all out of

whack and they are responsible for the path the empire has taken.

To line their own pockets and fill their own wallets, they have

set up a system that must collapse, therefore, they are the agents

of this collapse. Once Goldman Sachs got their paws on the levers

of power, they yanked them in such a way, they would get richer

no matter what.

Every sane person knows there

are inevitable economic ups and downs. This is due to capitalism

being a dynamic system. There is no way anyone can become constantly

richer and never lose money. The desire of Goldman Sachs to do

exactly that will create a depression. Depressions can last a

very long time. This is when all systems get stuck on a steady-state

that is around 0%. Look at Japan: that depression is entirely

driven by the people at the top wanting to make money no matter

what, while running a 0% system. It literally crushes people

to death under such a regime. Japan's domestic economy isn't

growing, only their export economy and the wealth of the elites

running these Japanese export corporations.

Since Japan's depression is

considered to be a gold mine by Goldman Sachs, they conspire

to keep it going. This is why we never, ever see any calls to

bring up the value of the yen.

From Bloomberg:

Citigroup Inc., the biggest

U.S. bank, said mortgage delinquencies and consumer lending will

deteriorate for the rest of the year after earnings fell 57 percent

in the third quarter.

Citigroup had its biggest drop

in more than a month in New York trading after Chief Financial

Officer Gary Crittenden on a conference call said borrower defaults

are ``accelerating.''

There are many economists who

think that 'confidence' rather than 'confidence men' run our

systems. Since money is created via magic wands waving and numbers

appearing, all we need is to think positive. This bizarre idea

mixing up cause and effect shows up clearly in the news this

year: the men at the top are very confident and want to keep

the ball rolling and the ball they are rolling is quite simple.

It is debt. The more they put people into debt, the more money

they 'create' or better still, 'capture' grows. As the capture

more and more FUTURE finances (debt being all about future promises)

the more they make via fees. So filled with confidence, these

con men have shoved more and more future payments onto more and

more payers. Addicted to this easy money, they went nuts and

tried to shove it on everything and anything. It didn't matter

how flimsy.

They ended up shoving it onto

people who couldn't possibly pay in the future. I call these

people 'dead beats.' Dead beats trail after con men, hoping to

score a hit. They love it when con men go nuts and offers them

free money. Since dead beats have no hope or prayer of repaying,

they are quite happy to play with the free money and live it

up even if they lose everything later. Losing everything is OK

with them, the chance to live in a big house and drive a big

car even if only for two years is very tempting.

So here we are: the entire

banking system now rests upon a basis that expects these irresponsible

people to pour future money into accounts held by these bankers.

And this is, of course, failing. Never in my life have I seen

so many people ask for loans and then default in less than two

years. This default climb didn't happen after a grinding recession,

it is CAUSING the recession. Statistics show that the defaults

on these loans are not connected with the interest rates going

up suddenly. They are happening while still under the super-low,

sub prime teaser rates!

Goldman Sachs knows all of

this. But they have to pretend to be clueless in order to sell

their CDOs which are bonds for future payments on housing bought

by dead beats who can't even afford teaser rates. And since everyone

is lying, the buyers and sellers both lying, this leads to the

inevitable collapse in confidence. Ergo: the system isn't based

on people thinking confidently, it is based on TRUST. If everyone

from top to bottom lies, the system collapses because everyone

is cheating each other. This usually happens when the con men

take over the banking systems and end rules set up in response

to previous collapses.

From CNN Money:

In a speech to the New York

Economic Club Monday night, Federal Reserve Chairman Ben Bernanke

said the central bank's rate cut in September has shown signs

of success, but cautioned that lenders and investors must bear

responsibility for financial decisions that caused the subprime

mortgage meltdown.

"Although the Federal

Reserve can seek to provide a more stable economic background

that will benefit both investors and non-investors, the truth

is that it can hardly insulate investors from risk, even if it

wished to do so," Bernanke said, adding that "over

the past few months...those who made bad investment decisions

lost money."

Bernanke is lying, of course.

The only success of the rate cuts was to drive up the value of

stocks while driving down the value of the dollar. Soon, Americans

will be trapped in this country like the Russians under the Soviets

because our currency will be so worthless, we couldn't eat or

drink anywhere but at home. Our demented government hopes that

the dollar will fall so far, the Chinese will cease shipping

manufactured goods here. This certainly is one way to empty out

store shelves but it also creates inflation. This is the trap

we are in: if we make imports more expensive, we get inflation.

This is because, the only way we could deal with energy inflation

has been to import cheaper labor goods and outsource all our

manufacturing jobs!

This is why inflation is now

beginning to rage but mostly in the sector of 'must buy' items

like food, fuel and medicine. To pay for these, people are not

buying manufactured stuff. I do see lots of things on front lawns

now with 'for sale' signs on them. I see more and more 'house

for auction' signs and New York has been dead last in the collapse

of the housing bubble.

Bernanke is also lying when

he talks about creating a system that benefits investors (speculators)

and non-investors. Always, when he can save speculators by tossing

non-investors to the wolves, he does this. As for lenders paying

the price: the president of Countrywide, Mozilla the Gorilla

has not lost a penny. He has made over $400 million selling off

his own stake in the company he is bankrupting! It is all the

speculators at the bottom who are being burned, the ones who

bought Countrywide stocks from him. Dropping interest rates doesn't

fix all these losses. The people who couldn't afford their houses

even at teaser rates and the investors who bought Countrywide

stocks without knowing that the president was dumping them in

order to get maximum profits since he could see the rising defaults

before anyone else (there is a significant timelag difference).

Everyone listening to Bernanke knows that the rate drop is a

bandaid on a gaping wound and stocks will, like they did yesterday,

begin a relentless fall, the con men simply needed some 'up market'

time so they could dump lousy stocks. Goldman Sachs, for example,

was so anxious to sell their stocks off, they openly lied in

order to make it look like their company was healthy and strong

rather than sitting on a mountain of toxic, dead paper that has

little or no present value.

Now they want to shift their

funds into speculating in raw material markets. They imagine

the Asian powerhouse will continue eternally so the competition

for raw materials will continue and they can all earn pennies

on the dollars flowing through commodities. This is pure silliness,

of course. As we go into an economic negative spiral, the value

of all these things will drop, too. So basically, they want to

jump from one escalator going down to one that is about to begin

going down, too.

The entire concept behind banking

from the start is the idea that one can put one's profits or

wealth at the disposal of a banker who would then pay one 'interest'

while re-investing this money as loans to other people who then

pay this 'interest' which the banker shares with the depositor.

This has totally collapsed in the last 35 years. People put their

money in a bank and it LOSES value. And the people making money

are the ones collecting FEES, not interest. And this is entirely

the fault of the central bankers and the Treasury. They have

tilted the playing field to benefit speculators and not depositors.

This was shown clearly by Greenspan and now, Bernanke, deliberately

throwing depositors looking for a fair return on their savings,

under the wheels of Wall Street.

From Reuters:

Central banks which signed

the Central Bank Gold Agreement sold 475.75 tonnes of gold in

the third year of the agreement ending September 26, said a statement

released on Wednesday by the Bank for International Settlements

on behalf of the signatories.

Also on Wednesday, Germany's

Bundesbank told Reuters that it will hold on to the vast bulk

of its gold reserves in the next 12 months, selling only enough

bullion to mint coins.

In March 2004, 15 European

central banks renewed a 1999 pact to limit their sales over a

five-year period to 2,500 tonnes -- with annual sales limited

to 500 tonnes -- up from 2,000 tonnes in the first agreement.

Central banks and the International

Monetary Fund (IMF) collectively hold 30,374 tonnes of gold in

their reserves, but have been gradually reducing their holdings.

It is amazing to see the price

of gold jump from $250 an ounce to nearly $800 an ounce while

the central banks conduct increasing sales. If they didn't do

this, the price of gold would be over $1000 an ounce by now.

Throughout the weak gold prices of the previous 20 years, the

central bankers boasted that gold was worthless and useless as

an investment and everyone should trust fiat paper money instead.

To prove this, they kept the price of gold down by feeding just

enough gold into the system to keep it static. Now, it is out

of control because world inflation is out of control. Suspicious

people are no longer holding fiat currencies.

I noticed this summer, the

G7 dwarves decided to drive down the value of gold drastically.

So they had the irresponsible International Monetary Fund declare

that gold was worthless and even the Swiss decided to sell off

ALL their gold in a mad demonstration that gold was worthless.

So here we are: I suspect this was all aimed at one country and

only one---RUSSIA. Russia is a major gold and energy producer.

If gold climbs in value, Russia's FOREX and Sovereign Wealth

Funds climb and Russia dominates Europe more and more. Instead

of petting the Russian bear and giving it a jar of honey, the

Europeans have been barking at the Russian bear and throwing

missiles at it. So they are playing economic warfare.

This is why charts, graphs

and magic number formulas are so useless. One should heed diplomatic

dispaches and figure out what violent or sneaky imperial or international

games are being played. Decoupling gold from wealth runs alongside

the desire to decouple war and oil from inflation. I read so

many professional commentaries that desperately use various game-based

systems to prove there is no connection between gold and wealth

and oil and war and inflation. For example, China's inflation

is due to the rising cost of energy. And they buy from the same

people who are right next to our oil wars in the Middle East.

Turkey is about to go to war with the Kurds right in the middle

of yet another oil field. The threat of this has already added

another $5 to to price of oil and this causes inflation in China

and the US and nothing seems to be stopping any of this since

the US has decided to use extreme violence when it comes to diplmacy

in the Middle East.

The economists want to decouple

these things from the effects they cause because it enables them

to keep on playing with their beloved formulas which are obviously

falling apart under the hammer blows of history. Just for example,

Europe's long climb out of the perpetual post-Roman Empire depression

was based mostly on the invention of the cannon and then mounting

it on ships and then going out and blasting their way across

global trade, quite violently. It was a material conquest based

entirely on military power. These imperial power plays collapse

when the world's largest naval power goes bankrupt as we are

going bankrupt.

Therefore, the chief chart,

the main graph, the most important formula isn't all those piddling

little things but the one that tracks imperial naval power, tax

revenues and debt levels. The minute a naval empire starts running

in the red, it is inevitable they will collapse within a 100

year time frame. We are now at year 35 of our total collapse.

The Chinese are willing to wait another 35 years for the end

result. I fear the US might push this time frame forwards via

WWIII. This is because all naval powers hammered by bad debts

and a collapsing economy usually lash out and try to lunge at

all rivals and trade partners in the hopes of fending off financial

collapse.

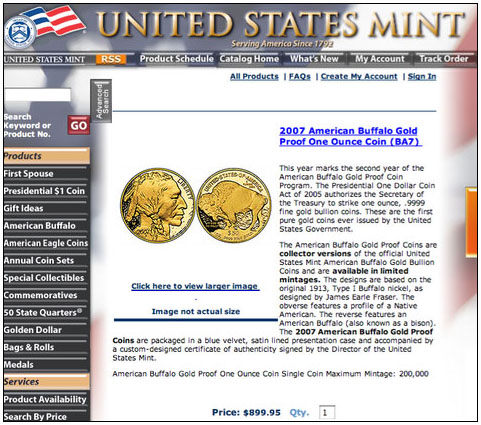

From Coin Inflation:

On September 13th, the U.S.

Mint announced they were suspending Gold Eagle coin sales due

to the recent rise in the gold price. And just recently, the

Buffalo Gold coin series suffered a similar fate and its product

page states, "Due to the increasing market value of gold,

the American Buffalo Gold Proof One Ounce Coin is temporarily

unavailable while pricing for this option can be adjusted; therefore,

no orders can be taken at this time."

Exactly how long does a price

adjustment take?

It's unlikely they ran out

of gold, but it's not impossible. They're going to have a difficult

time obtaining it from the open market at some point. More people

are realizing every day that the U.S. dollar is becoming worth

less and less (or just plain worthless) and are scrambling to

purchase gold and silver. Anyone who quotes government inflation

statistics as a sign "inflation is contained" is completely

out of touch with reality. I mean 2% inflation, are you flipping

kidding me? There has to be a point where U.S. media outlets

stop reporting these numbers.

I went off to the Fed web page

that sells these coins. Note the price! $899 an ounce. They get

a nice overhead cut, don't they? 10% profit. I wonder where this

gold comes from. In the 1960's, the US sold off 3/4ths of the

gold in Fort Knox. We know that Europe is madly selling off its

gold reserves. Is our Fed buying this gold and then turning it

into coins? Or is this only excess gold from mining here in the

US?

From the Chicago Tribune:

Despite potential tax and investment

problems, more investors have been borrowing from their 401(k)

plans or taking hardship withdrawals in recent months, some retirement

plan providers say.

Many in the field expect more

borrowing in 2008, as consumers struggle with tighter credit

and potentially higher mortgage payments.

When I was young, I decided

the baby boom retirement would be pure hell. And so it is. We

are not preparing for the future and this is concurrent with

our collective refusal to face reality today. Congress just voted

record spending not just on our stupid oil war in Iraq but for

all our military. And our tax revenues are now falling as corporate

profits either flee to Elizabethean pirate coves or are reduced

as the economy retracts. And the spendthrift generation isn't

saving much of anything, our gross debts have ballooned lately.

We are no longer net savers and no wonder. Savers have been sacrificed

in order to stop the blood that is running through Wall Street.

Thanks to inflation, we are

now seeing people hollowing out their retirement funds. Many

boomers expect to sell their homes for a profit when they retire

but this is silly. When everyone is selling their homes so they

can move to Florida, the value of homes of baby boomers will

decline in value! So expecting this is fantastical. And our government

should be encouraging savings, savings, savings. Not spending.

And this means, being honest about inflation and then forcing

banks to pay a realistic interest on savings. Whenever this happens,

we have a contraction since rewarding savers for their risks

makes no profits for banks. They want to LEND, not attract savers.

And savers can't save if they are lured into loans.

I just got a letter from Sunoco.

I use a card to fill my diesel work truck. They want me to have

$1,400 and even included a very real check with this letter.

As usual, I read the fine print. It is at a 22.74% rate! Wow!

Wish my savings got that kind of return. And if you have credit

problems of any sort, they can raise it to 31.74% without warning!

Usurious rates coupled with Bernanke dropping interest rates

into the cellar. The differential between this rate and Bernanke's

funny money land is astonishing. These stupid loans from Sonoco

is around 19% higher than the Fed rates. So they figure, even

if someone can't pay this off for years and years, if they default

after 4 years, Sonoco still makes some money. Credit cards are

taking off as desperate debtors juggle more and more debts. I

remember when 21% interest was if one had defaulted on loans

or was in financial trouble, not as an opening rate! Also, I

am furious that Sonoco has sent me a real check in the mail.

Anyone could activate it by various means. This sort of reckless

finances is part of our corrupt system.

They were obviously bottom

fishing and hoping the sight of a check would lure me into signing

it and then getting caught in this impossible financial trap.

In other words, they are con men. Why is Sonoco, an oil company,

needing to do this?

This is because they have oodles

of money, tons of money burning a hole in their pockets. They

can't bank it, that earns no real interest. So they want me to

give them money for their money that they first got from me when

I pump their fuel into my truck!

From the Telegraph:

What the candidates all have

in common is inflation, the ever-higher penalty they pay for

chaining their destinies through currency pegs and dirty floats

to the dollar and the euro, the currencies of two enfeebled blocs

one a fat roué at the end of his credit, the other

a stooped old gentleman with a stick.

The global M3 money supply

is growing at 10.6pc as stimulus from America, Europe and

Japan, through the carry trade leaks out to the vibrant

parts of the world economy.

Money is expanding at 18pc

in Saudi Arabia, 19pc in China, 24pc in India, 36pc in the United

Arab Emirates, 41pc in Russia and 69pc in Venezuela.

The red ink in the US, EU and

UK are flooding the world. And I am glad the British reporter

here connects all this to Japan's .5% interest carry trade business.

Even as I am offered loans at 23-32%, Japan is offering corporate

America loans at 1%. This differential is tremendous and is a

sign of impending bankruptcy. This lending cycle is inflating

all things as money pours into the system via magic. The magicians

at the center of this are not in China, they are in Japan. And

since Japan is a closed economic system, this means they DEFLATE

while they INFLATE the rest of the world's monetary and asset

values. I was one of the very, very few people writing about

economics to talk about this monetary black hole. At Brad Setser's

web site, I was told in no uncertain terms to shut up about Japan

and start my own news service because he was sick and tired of

me talking about the yen when he wanted to discuss only the yuan.

From the Telegraph:

Kuwait became the first Gulf

state to ditch its dollar peg. Others are hanging on, but inflation

has reached 10pc in the United Arab Emirates and 11.8pc in the

gas-rich neighbour of Qatar.

They have balked at cutting

interest rates in lockstep with the Fed. So have the Saudis.

This makes pegs untenable over time. Matt Vogel, of Barclays

Capital, says a riyal "carry trade" has already begun

in Saudi Arabia. Speculative flows are surging into the kingdom.

The Gulf region has $3,500bn

under management in reserves and wealth funds. It has the firepower

to shoot wolves, but does it make any sense to do so? Buying

dollars leads to even more inflation. In any case, Qatar has

already slashed the dollar share of its $50bn investment fund

from 99pc to 40pc. The game is up.

Further east, Vietnam is throwing

in the towel as inflation hits 9pc. It said it will no longer

hold down the dong by massive purchases of US bonds. Singapore,

Taiwan, and Korea have begun to change tack, slowing dollar accumulation

before inflation gets out of control. "There is evidence

that foreign-exchange intervention strategies are changing across

the region," said Goldman Sachs.

Goldman Sachs notices that

the inflation launched by Paulson twisting Bernanke's arms is

now causing many government banks in Asia to cease buying our

lousy bonds and that this is 'changing...strategies'? HAHAHA.

No kidding! Of course, this is changing, rapidly! Everyone smells

blood flowing down Wall Street and are now taking measures to

protect themselves. The need to fuel speculation here is causing

it to rise rapidly across the planet. This is because anyone

trying to save the old fashioned way is hammered by inflation.

If we got 22% interest on savings, there would be a savings glut

here, not a dearth. And traditionally, the government tried to

encourage and protect savings precisely so people would not do

wild speculation, this was considered TULIP BULB BAD. We know,

not from professors writing formulas based on game theory, that

this is BAD, we know this from HISTORY.

From Bloomberg:

Hong Kong's most expensive

stock market in three years looks cheap to investors at Templeton

Asset Management Ltd. and Baring Asset Management Inc.

The Hang Seng Index, dominated

by Chinese companies, traded at 19.2 times earnings last week,

the highest since March 2004, after the benchmark rallied 41

percent since mid-August. That doesn't faze Templeton's Mark

Mobius and Baring's Hayes Miller, who together oversee almost

$100 billion, because stocks in Shanghai are three times as expensive.

Based on cash flow, Hong Kong is the cheapest among the 20 biggest

markets, data compiled by Bloomberg show.

Everyone rushes off to Asia

to collect loot. They hope that all the systems there will flourish

via the Japanese financial black hole but this is stupid. There

is NO WAY Japan can continue this much longer. If they succeed

in keeping out raging inflation caused by themselves for much

longer, there won't be many Japanese left with a roof over their

heads or children. Already, their birth rate is in full collapse

and the number of children are well below the rate of replacement.

And this is getting worse, not better. Just as Russia's population

collapsed when they went into a depression. The whole reason

we had a baby boom here was the flow of money after the WWII

victory. During the Great Depression, the rate of birth fell.

So Japan's long depression is literally killing the Japanese

people.

Japan's foreign trade markets

soared in the last 15 years. But their stock market did much

worse than all of Asia. And the rush for profits in Chinese stocks

are going to end badly when either Hu or Paulson strangle the

trade between China and the US. Hong Kong is the last frontier.

There aren't too many other stock markets to dump money into

and make huge profits. Everyone needs to make more than 10% profits

to keep up with real inflation.

From Bloomberg:

Reserves of $1,430bn are no

help. They are the problem. As Nomura's chairman, Junichi Ujiie,

told me in Tokyo: "We're all trying to get money into China

any way we can because we know the renminbi has to rise. It's

a one way bet. It's wonderful."

This quote is very signficant.

Japan is trying to pour money into China TO KEEP THEIR OWN DEPRESSION

GOING. They also want the yuan to rise in value so they can gain

more US trade. Japan is now boasting, the huge FOREX reserves

of China are 'useless' and they now have an upper hand on China's

finances.

I see a dragon rising up and

saying, 'So, they thought they conned me when the Bank of Japan

had that secret meeting? I'll show them!' I am betting the Dragon

will make a countermove now that will upset these stab in the

back Japanese plans.

From CNN:

A wide-open presidential race

and a willingness by candidates, interest groups, unions and

corporations to buy TV time will lead to historic spending for

political and issue-advocacy advertising in the 2008 election

cycle, an analysis shows.

The cost to try to influence

the 2008 election could exceed $3 billion, according to TNS Media

Intelligence/Campaign Media Analysis Group, CNN's consultant

on political television advertising.

This is nearly twice as much

than what was spent in 2004 when political and issue-advocacy

television advertising rang in at $1.7 billion. In 2006, $2.3

billion was spent on political and issue-advocacy TV commercials.

Corruption in American politics

is now nearly total. This is disgusting news.

From the NYT:

Much of this money is being

put to work at home. "Now countries like China are generating

enormous amounts of capital," says Felix G. Rohatyn, the

veteran banker who engineered the financial rescue of New York

in the 1970s. "And of course they are going to want a piece

of this distribution and the marketing." China is staging

the initial public offerings of state-owned companies on local

exchanges as a means of building up Chinese capital markets -

the $7.7 billion I.P.O. of China Construction Bank in Shanghai

last month is just one example.

This growth represents a

triumph of everything Wall Street stands for - the ability of

capital to seek returns across borders, the growing integration

of the world's economy and the triumph of market activity in

previously closed areas.

And to a degree, this is good news for New York's asset managers,

as private-equity firms and hedge funds now can raise capital

from fresh sources. Nonetheless, the diffusion of wealth has

unleashed angst among New York's financial elite, who may soon

rue the excesses of recent years as a last-gasp blowout.

Um, there is no triumph of

open markets. Japan is closed. And the US isn't winning, Japan

is winning. The US trade with Japan is all about a growing trade

deficit with Japan and Japan colonizing our industrial base here

at home, not the US colonizing Japan's industrial base.

Like London, NY wants to be

the center of financing forever. London can still preen itself

in this regard but this is only due to them being the servants

of the oil Arabs who now own half of the Footsie and a great

deal of the English banking system. The death of the princess

Diana while in the company and under the protection of Muslim

wealth is a clue as to where this is all going. The muted response

years later to her death/murder are due to the uneasy knowledge

that this woman at the very apex of British society had to turn

to the Muslims for money and assistance. It is always interesting

to see where the British royals go during dynastic disputes.

For example, before WWII, the dynastic dispute centered on the

USA due to the king marrying an American divorcee.

So it is here: Princess Di

was signalling to the British, their shifting dependencies are

now in Arab lands, not the USA.

The NYT:

Like automakers and consumer-products

companies (Coca-Cola derives 70 percent of it sales outside North

America), New York's leading financial institutions are trying

to become global operators less reliant on domestic markets.

In the last few years, the N.Y.S.E., the iconic symbol of Wall

Street, has gone public, hired an aggressive, worldly C.E.O.

(the former Goldman Sachs president John Thain) and merged with

Euronext, which owns a derivatives market in London and stock

exchanges in Paris, Brussels and Amsterdam. In its most recent

quarter, NYSE Euronext derived 44 percent of its revenue and

62 percent of its operating income from outside the United States.

Nasdaq, the second-largest New York exchange, was thwarted in

its bid to buy the London Stock Exchange, but is taking a stake

in OMX, which operates stock exchanges in Nordic countries in

partnership with a Dubai investment firm.

Once again, we see Goldman

Sachs in a news story about money. The NY stock exchange is now

run by Goldman Sachs. They are aggressively moving things so

Goldman Sachs gets richer. Asian powers are manipulating and

luring Goldman Sachs into doing things that are very bad for

the US in order to get rich quick. Note how they cheerfully announce,

the operating income of Wall Street will be outside of America

and so they can kiss us goodbye as they shove us off the cliff!

Note also how Goldman Sachs is trying to buy up other stock exchanges

and how they are working 'in partnership; with the sovereign

wealth fund nation of the UAE to buy up other exchanges! Note

also that Goldman Sachs has taken Wall Street and fused it with

a derivatives market! The very place that is collapsing even

as it seeks to gain traction, buying and selling promises and

playing FOREX markets and who controls that?

Japan! And none of these people

give a hoot about Americans surviving. If the Japanese running

the schemes in the heart of Tokyo don't give a hoot if their

own tribe starves to death, will they be kindly towards us? And

this attitude is part of Goldman Sachs: 'Let them eat NO cake!'

321gold Ltd

|