Should I Be

Investing In Australian Mining Stocks? Should I Be

Investing In Australian Mining Stocks?

Greg Silberman

April 10, 2006

About a year ago I decided

to open an office in Sydney Australia. I run a little advisory

business in Atlanta Georgia and my thinking went like this:

We're in a Commodity Bull Market

for sure!

Australia is packed FULL with every commodity under the sun.

There are regions of Australia which haven't even been EXPLORED

yet.

If the action is going to be in commodities and I want a piece

of the action, I need to get a foothold on the Continent DOWNUNDER!

My wife laughed at the idea.

She thought I wanted to Surf and watch girls on Bondi Beach.

My wife is very perceptive!

Needless to say it's been a

tough year shuttling back and forth but immensely rewarding.

Let me save you a year of Trans-Continental travel and fill you

in on the Australian Commodity story.

Here's what you probably

know about Australia:

- Australians are pretty switched

on people. Fiercely competitive and born Winners. There is no

Sport in which they participate and don't totally Dominate!

.

- Australia has a landmass comparable

to the United States yet a population of only 20 million, the

majority live at the coast.

.

- Australia is a First world

country with an extremely stable political system and well established

judicial system. Australia is a VERY Law Abiding country.

.

- Australia is English speaking

(although you wouldn't always think so based on the accent) and

a first class ally of the United States.

.

- Jim Dines of the Dines

Newsletter who calls himself 'the Original Uranium Bug' recently

commented that Australia is about to go through its most massive

BOOM EVER because it holds 40% of the worlds Uranium reserves.

.

- The Australian Financial Review

- a brilliant daily newspaper recently ran an article entitled

- Australia, Number 1 Gold Producer in the World.

.

- Australia is the only English

speaking country in the Asian time zone and geographically on

China's doorstep.

Ok, so much for Trivia.

Tell us something we don't know!

Sure.

Here's what you probably

don't know about Australia:

- Australia is HIGHLY REGULATED.

Society borders on being socialist - Medical is practically free.

The result is that the government meddles in every aspect of

life and one can get tied in knots by rules and laws (much the

same as the USA). Figure this one out, it's a law that you have

to Vote in every election!

.

- Being a socialist country

(well almost) the tax burden is incredibly high. 42% on income

over US$44,000 and 47% on income over US$65,000. The first thing

I did when I opened a branch in Sydney was convert my degree

to become an Australian Chartered Accountant. As with all tax

codes one MUST be aware of the finer points. For example, there

is NO capital gains tax in Australia on Non-residents that buy

or sell less than 10% of a Corporations Capital Stock.

.

- Financial services in particular

are extremely regulated. Legally speaking one cannot even recommend

a stock to a friend without being a registered advisor. The result

is that financial services are dominated by the BIG Banks and

Institutions (not much different to anywhere else actually).

.

- Here's an interesting point

- there is a law that each employer must place the equivalent

of 9% of an employees payroll into a superannuation fund (pension).

This has generated a massive flow of funds, mostly into the stock

market, over the last 10 years. People believe this flow will

support the market forever - yeah right, tell me another one!

.

- Australia was first out the

gate with the Housing Boom. Sydney property prices are still

astronomical even though they've been off the boil for 2 years.

The result is a demographic that looks eerily similar to the

US in that people are up to their eyeballs in debt. The difference

though is that Australians have a much higher debt to income

ratio than the US. A TICKING TIME BOMB IF YOU ASK ME!

Ok, Greg, very interesting!

But tell us what we DON'T know about Commodities in Australia...

With the institutions dominating

the market, it's really the Big Blue Chips like BHP Billiton

and Rio Tinto which have ALL the following. The reason being

that small explorers just don't have the market capitalisation

to interest the Banks.

So who's trading Juniors?

The small exploration companies,

of which there are too many to count, are almost the exclusive

preserve of:-

- Individual Australian investors

.

- Sophisticated foreigners (normally

represented by London based brokers) and

.

- Canadian Mining Companies.

Due to a smaller pool of investors

in Australia, valuations tend to be lower than the US or Canada.

Canadian Mining Companies are

having a field day here. Swapping their high priced paper for

lower priced Aussie stock and getting UNBELIEVABLE resource reserves

in the process.

Of primary importance to US

investors is the return on Australian assets in US Dollars.

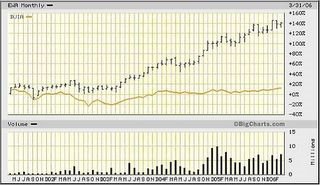

Chart 1 shows how the Australian ETF handsomely outperformed

the Dow Jones since 2002 - I am on record as predicting a major

short term correction however. The Australian ETF is heavily

weighted towards commodity stocks. The returns are even more

pronounced when looking at Aussie Juniors (not shown).

Chart 1 - Australian ETF vs Dow Jones

Here's another important chart

to watch, the Aussie $:

Chart 2 - Aussie $ hitting significant resistance

The Aussie $ has been in a

consolidation pattern since Jan '04 and firmly in a downtrend

since January '05. There is good evidence to support the Aussie

may be forming a bottom as it encounters heavy support at the

bottom trendline (green line), the 50 Month moving average (blue

line) and the prior bottom at 70c (red line).

The Aussie $ yields in the

region of 5% and is shaping up for an excellent place to park

some Cash.

The overall Message is Americans

should NOT BE AFRAID of Investing directly in Australia. This

can be done through any big online Australian broker - try CommSec or

Paterson Securities

(I don't have any financial relationship with these companies).

To fund your account you will

have to Wire money to Australia - your bank should be able to

facilitate.

I know many Americans are unaccustomed

to dealing outside the US which is why I am working hard on listing

a Closed End Investment Fund in the US that invests in Aussie

Juniors (Uranium, Gold, Silver etc.).

The Aussie Junior Resource

Market is WIDE OPEN for a player of medium size to become the

Heavy Hitter. It won't be long before this opportunity is arbitraged

away.

For more information on Investing

in Australia or on my proposed Closed End Investment Fund please

feel free to contact me.

More commentary and stock

picks follow for subscribers...

Greg Silberman CA(SA), CFA

(Retired)

email: goldandoil@yahoo.com

I am a private

investor in the resource sector. Please visit my blog for more

free articles and analysis. Click here: http://goldandoil.blogspot.com/

No responsibility

can be accepted for losses that may result as a consequence of

trading on the basis of this analysis.

321gold Inc

|