Imaginary Numbers

Mike "Mish" Shedlock

Friday, March 24, 2006

Some people are not aware of

it but, there are actually two kinds of imaginary numbers.

For a mathematical answer to the question "What is an imaginary

number?" all one has to do is Ask

Dr. Math.

The other kind of imaginary number comes from CEOs, the US government,

and places like the National Association of Realtors (NAR). Today's

lesson is about the NAR.

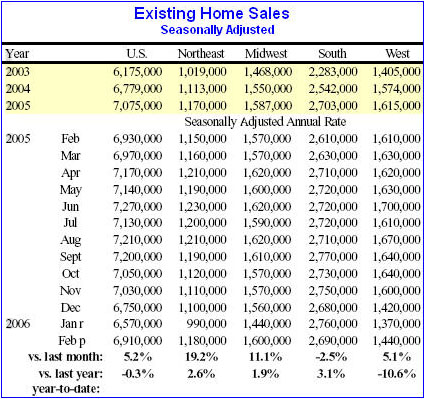

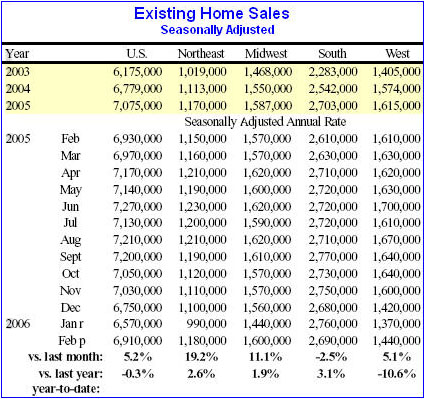

The National Assn. of Realtors reported Thursday that sales of

existing single-family homes rose 5.2% last month to a seasonally

adjusted annual rate of 6.91 million units. The biggest increase

in two years took economists by surprise. They had expected a

drop of about 1% after five months of declines.

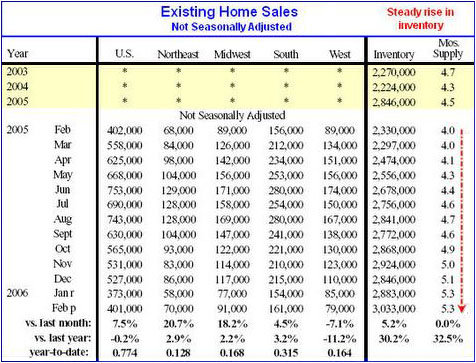

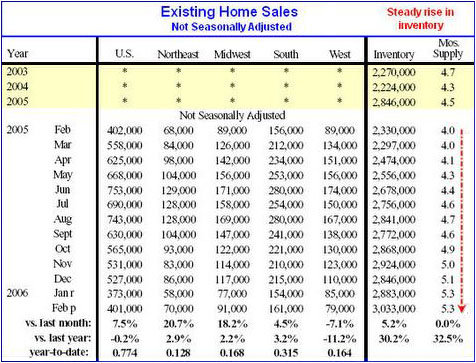

Here are a couple of charts:

Notice the steady rise in inventory.

Notice also that although sales were "reportedly" up

vs. last month, they were still down as compared to the same

month last year.

The telepathic question lines are now open. I am flooded with

two questions.

1) OK Mish so what?

2) Why do you call those numbers imaginary?

Those are both good questions.

Here is one explanation as

to why they are imaginary: The NAR existing home sales numbers

are "survey numbers". The NAR should easily be able

to provide exact numbers by adding up the numbers from all the

local real estate boards. Can this be difficult with today's

computers? Instead they do a quick survey of questionable accuracy.

Let's take our own sample.

California

Sales fell for 5th consecutive month and were 1.7% below February

2005. Inventory is up from a year ago by 40.5%. Nominal year

over year prices fell for 2nd month in a row.

The Orange County Register says: Selling

a home? You're not alone.

Let's face it. There's only

reason to look at the Realtors' monthly existing-home-sale report:

the dirt on inventories. So here's February's "Unsold Inventory

Index" for single-family detached homes being sold by owners:

* The O.C.: 10.4 months worth of homes to sell vs. 5.7 months

for the same period a year ago.

* California: 6.7 months vs. 3.2 months a year ago.

* U.S.: 5.3 months vs. 4 months a year ago.

Inman News is reporting California

home sales plunge 15.5%.

Unsold inventory levels climb

to highest in several years, trade group says.

Existing-home sales dropped

significantly in California in February, falling 15.5 percent

from the same period a year ago, as inventory levels climbed

and median prices continued to escalate, an industry trade group

reported today.

Closed escrow sales of existing,

single-family detached homes in California totaled 513,745 in

February at a seasonally adjusted annualized rate, down from

608,160 a year ago, according to the California Association of

Realtors. Median prices increased 13.7 percent to $535,470 from

$470,920 a year ago.

Meanwhile, the February 2006

median price of an existing home in the state decreased 2.9 percent

compared with January's $551,300 median price.

Florida

The Florida

Association of Realtors is reporting a 20% decrease in sales.

ORLANDO, Fla., March 23, 2006

Statewide, sales of single-family existing homes totaled 13,539

in February compared to 16,916 homes a year ago, for a 20 percent

decrease, according to the Florida Association of Realtors®

(FAR).

Virginia

Seven out of eight 7 out of

8 areas comprising the Northern

Virginia Association of Realtors had fewer sales. All eight

reported higher inventory levels.

Another telepathic question

just came in:

Mish, do you have any evidence

at the national level?

Yes, actually I do. Here goes:

MBA Applications

The Mortgage Bankers Association (MBA) reports Mortgage

Application Volume Down Slightly In Latest Survey.

WASHINGTON, D.C. (March 22,

2006) - The Mortgage Bankers Association (MBA) today released

its Weekly Mortgage Applications Survey for the week ending March

17. The Market Composite Index - a measure of mortgage loan application

volume was 565.0 a decrease of 1.6 percent on a seasonally

adjusted basis from 574.4 one week earlier. On an unadjusted

basis, the Index decreased 1.6 percent compared with the previous

week but was down 13.8 percent compared with the same week one

year earlier.

The seasonally-adjusted Purchase Index decreased by 2.3 percent

to 393.6 from 403.0 the previous week whereas the Refinance Index

decreased by 0.6 percent to 1574.5 from 1583.6 one week earlier.

Other seasonally adjusted index activity includes the Conventional

Index, which decreased 1.4 percent to 833.4 from 845.2 the previous

week, and the Government Index, which decreased 4.4 percent to

117.4 from 122.8 the previous week.

The four week moving average for the seasonally-adjusted Market

Index is down 0.2 percent to 574.0 from 575.3. The four week

moving average is down 0.4 percent to 401.5 from 401.9 for the

Purchase Index while this average is down 0.2 percent to 1588.8

from 1593.4 for the Refinance Index.

The refinance share of mortgage activity increased to 38.1 percent

of total applications from 37.7 percent the previous week. The

adjustable-rate mortgage (ARM) share of activity decreased to

28.3 percent of total applications from 28.8 percent the previous

week.

Hmmm. Let's see... The

Purchase Index four week moving average is down to 401.5. It

was 470 in October, 448 in December, and 447 in January. Does

that sound like nationally increasing sales? Whatever is going

on with the February numbers, be it real or imaginary, the overall

trend should be clear to all but the most obstinate of real estate

bulls: Sales Lower, Inventories Higher.

Missouri

Let's look at one more item

hot off the press today:

The Kansas City Star is reporting

First

default, then despair.

Rising interest rates and a

cooling real estate market conspire to undermine the financial

well-being of homeowners and feed an increase in foreclosures.

More first-time and lower-income

homebuyers are losing the American dream to foreclosures on the

courthouse steps.

Real estate experts in Kansas

City and nationwide say they are seeing a trend in which homeowners

- often using adjustable-rate mortgages - have been unable to

keep up with fast-rising interest rates, forcing them to balance

higher monthly payments against already soaring energy costs

and living expenses.

Making matters worse, experts

say a cooling real estate market makes it less likely that financially

strapped consumers can count on rising home values and equity

to bail them out.

"Many people are living

on the razor's edge," said Kansas City mortgage attorney

Berry S. Laws III. "When their interest rates go up, they

automatically have to pay more for the mortgage. People are betting

their homes will appreciate, but if the value of their homes

flattens out, they face a deficit."

The warning signs are everywhere:

- The Mortgage Bankers Association

reports that the number of home-loan delinquencies nationwide

in the last quarter of 2005 grew to a 212-year high.

- The association also noted

a growing inventory of foreclosed homes, suggesting that banks

are getting stuck with repossessed homes they can't resell.

- Foreclosure.com recently reported

that the total number of foreclosures listed for sale in December

rose 12.7 percent, reversing a recent trend of declining foreclosures.

The online foreclosure-tracking firm estimated that about 92,000

foreclosed homes were on the U.S. market.

Last year, foreclosures rose

25 percent, according to RealtyTrac of California.

Nationally, bank regulators

worry that mortgage delinquencies and resulting foreclosures

will continue to increase this year.

"Rising mortgage delinquencies

in 2005 apparently mark the end of a period of generally improving

mortgage loan performance between 2002 and 2005," said Richard

A. Brown, chief economist for the Federal Deposit Insurance Corp.,

which insures banks.

According to FDIC statistics, the average 30-day past-due rate

for subprime mortgages - those made to borrowers with limited

or less than perfect credit - rose from 5.4 percent at the beginning

of 2005 to 7.1 percent at year's end, reversing an eight-year

decline.

Missouri and Kansas borrowers

may be faring worse.

Missouri's average 30-day past-due

rate rose last year from 7 percent to 9.2 percent, the FDIC said.

Kansas' rose from 5.7 percent to 7.6 percent.

Myra Batchelder, who heads

the economic opportunity program at Demos, a New York think-tank

on consumer issues, sees an ominous future for many Americans.

"The recent jump in foreclosures is a sign of a much larger

problem: The American household economy is at a breaking point,"

Batchelder said.

Bankruptcy obstacles

Some experts are predicting

that the bankruptcy reform law that was adopted last year threatens

to fuel an additional round of foreclosures.

The idea behind the law was

to make it harder for consumers to shed debts. One big change

requires credit counseling 180 days before filing for bankruptcy.

In the past, consumers who

couldn't pay their debts could go to a bankruptcy lawyer and

immediately stop a foreclosure and at least keep a portion of

their home's value.

Not anymore, said Laws, the

Kansas City mortgage attorney.

If homeowners can't make house

payments during the 180-day period before being approved to file

for bankruptcy, Laws predicted, "they won't be able to save

their house. It's a mess."

Real Numbers

- Mortgage indebtedness grew

by $2 trillion in 2004 and 2005 alone.

- Subprime lending grew 25 percent

annually from 1994 to 2003, accounting for one of 10 home loans.

- Qualifying debt-to-income

ratios for subprime loans have risen from 28 percent to more

than 55 percent.

- U.S. average 30-day past due

rates for subprime loans rose from 5.4 percent to 7.1 percent

in 2005.

- Average 30-day past due rates

for subprime loans in Missouri rose from 7 percent to 9.2 percent

in 2005.

- Average 30-day past due rates

for subprime loans in Kansas rose from 5.7 percent to 7.6 percent

in 2005.

The Sad Truth

"The recent jump in foreclosures

is a sign of a much larger problem: The American household economy

is at a breaking point."

Mike Shedlock "Mish"

email: Mish

http://globaleconomicanalysis.blogspot.com/

321gold Inc

|