Gold Charts

R Us

+ WWW (While We Wait)

Bombing The Bears

Harry Schultz GCRU snippet

Dec 12, 2005

The following snippet is from Harry Schultz'

current GCRU, of Dec 7, 2005. Gold Charts R Us: sent weekly

by Email: $US100/mo for 3, 6, 9, or 12-month subscription periods

(fax +$120 per 3-months) - you can subscribe

here. The following snippet is from Harry Schultz'

current GCRU, of Dec 7, 2005. Gold Charts R Us: sent weekly

by Email: $US100/mo for 3, 6, 9, or 12-month subscription periods

(fax +$120 per 3-months) - you can subscribe

here.

2-week trial

of GCRU $45 -- yes, sign

me up!

Welcome to GCRU #188 on Dec 7, 2005. (Into our

4th year) It's Pearl Harbor Day, but the bombing this

time is on the gold bears, govts & central bankers - who

are having a fit at gold's rise --which shows no fear of heights.

••••

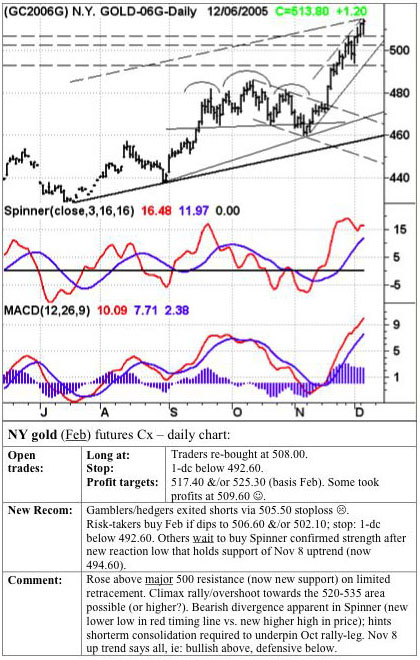

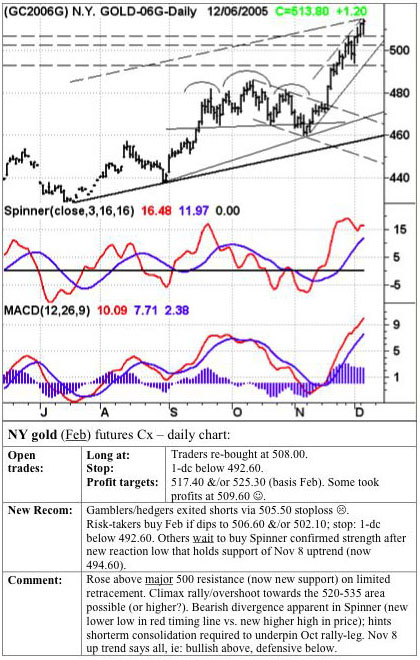

Gold soared through major psychological resistance at $500 on

relatively limited retracement. Spinner's red timing line is

uptrending but nearing overbought extremes on both daily &

weekly charts. But with 500 now likely to act as new price support,

an overshoot towards the 520-535 area is possible. But first

we need to get clear of the barrier reef, which I said lastime

might range "between 495 & 507." As I write this

paragraph on Tuesday AM (Dec 6), before NY opens, gold is 506

for Dec contracts, down 2.10, so we're still stuck on the reef,

despite a Monday over-reach to 509.70. But this feels like

we're going to wash over the reef any minute. ••••

Gold soared through major psychological resistance at $500 on

relatively limited retracement. Spinner's red timing line is

uptrending but nearing overbought extremes on both daily &

weekly charts. But with 500 now likely to act as new price support,

an overshoot towards the 520-535 area is possible. But first

we need to get clear of the barrier reef, which I said lastime

might range "between 495 & 507." As I write this

paragraph on Tuesday AM (Dec 6), before NY opens, gold is 506

for Dec contracts, down 2.10, so we're still stuck on the reef,

despite a Monday over-reach to 509.70. But this feels like

we're going to wash over the reef any minute.

•••• Cell

mate Paul says: "The Schultz Gold Index gained impetus

via a high volume rise above a 2-1/2 month reverse H&S base

that has an 18.15 theoretical upside target. Spinner lines are

on verge of new positive cross above zero. All elements seem

positioned for a sustained rise.

••••The

XAU & HUI gold shares indexes have risen above & pulled

back to test new support of their Sept highs. Up ticks in Spinner's

red timing lines hints consolidation action is near to completion."

•••Our SGS

Advance/Decline Line was virtually unchanged Monday, despite

a 5.60 jump in bullion, ie, as many gold shares fell as rose.

It continues to dither below key resistance; needs rise above

4880 (right shoulder peak of poss H&S top) to begin to reverse

negative/neutral bearing & rise above 4920 to confirm. Spinner

mixed with slight bullish bias.

•••••

The general gold share mkt gained momentum as the middle group

of stks listed last week, ie, those struggling to rise above

Sept peak resistance (AEM, CCJ, RTP, & TEKT) all did so excepting

NEM, which has developed a bullish inverted H&S base with

48.00 neckline. With the broader gold share mkt slowly backing

up the lead dogs, this bull leg may develop significantly higher

highs. Spinner action improving across the board with tentative

positive hooks in red timing lines.

•••The eye opener

on Monday was that though as many golds fell as rose, we had

several of our shares hit new HIGHS! Eg, AEM, CCJ, FAL, FCX,

TEK-T, VYE (on vol). Biggest % gains: MDG & YRI. G-T had

a sharp dip.

•••• Volume

is still not great. Mkts can't rise far without it. But IMO,

volume will pick up soon due to TV & press talk on gold -

or anything - which usually marks an overbought mkt. And the

overbought bells are ringing. So, make haste, slowly.  Selectivity is the floating password.

Selectivity is the floating password.

••• Bottom

Line: We took some profits just below pivotal

500 resistance & used trailing profit-protecting stops on

others to lock in gains thus keeping a foot in the door to ride

continued strength - which proved to be a prudent strategy. With

the wind clearly in gold's sails, traders can reduce profit taking

to 1/3 of positions with the aim of letting profits run on the

remainder, but don't be lulled into contentment. Tight trailing

stops must be used (and reviewed/raised daily) to lock

in any new profits as/when they develop. Personally I often take

profits regardless of the chart when they reach levels I am happy

with (regardless of where they may go next week). When this rally

breaks, the fall is likely to be sharp & trailing stops offer

the best safety net/method to exit as near to the top as possible.

•••• The

60min gold tick charts show a bearish up wedge; regard it as

a possible yellow flag.

•••• Goldnami

reflects a mega up price wave that has been underway

for 19 days, only 6 of which were down days, for a net gain of

$50, so we've been on a great roll. Continue to play it cool.

Buy, stop, sell, buy, stop, sell. Cash in on the (tsu)nami. Don't

let it roll U over. Ride it.

•••••

Copper near its high. CRB broke out of the sideways pattern I

mentioned last week. Due mostly to oil & gold.

•••The euro

rose on BIG volume.

••• ALL currencies

rose vs US$. C$ to new high (one of my biggest TD's). NZ$ to

new multi-month high! US$ down but not for the count.

•••US T bonds

in sharp fall. If down today, cancel my forecast for a tech rally

to 114.

••••Oil

broke out of its downtrend & downwedge, headed higher! Resistance

at 64, as said before, but it'll be temp. Oil bears will be wrong

for the 98th time.

••• With gold

over 500, maybe our WWW [While We Wait] stocks

aren't necessary, but let's not spook it by stopping them. Besides

they provide useful diversification. Do U agree?

•••••

Bullish downwedges in SFr & £ are intact. The currencies

are telling a much bigger story than U can imagine. See next

HSL for revelation on US$ future. [Editor's note: You can sign up for

a free copy of HSL if you go and watch the movie, here]

•••• Goldfields

(SoAfr) reports an 8% decline in gold production in Sept qrtr.

•••• As

I write, gold has slipped to 505 in Dec cx, so the reef is resisting,

but not for long, IMO.

•••• Let's

talk in the PS.

Bye til then. Uncle Harry

PS: Gold

share mkt turned around beautifully in the last 2 hours in NY

on Tuesday, reversed early losses into powerful gains. It was

a Hollywood ending after a gloomy start. The 3 gold indexes were

all up: 2.67%, 2.75% & 2.80%. Bellwether Agnico Eagle up

5.09% on biggest volume in years. Newmont woke up, broke out

to a multi-month hi, up 4.08%.

••• CCJ rose

4.68%. MDG woke up with 3.59% gain. Our favourites VYE rose 5.75%

& YRI up 6.50%.

••Our Advance/Decline

Line was up .33%

•••• The

gold bears & gold price-fixing cartel got well & truly

bombed on the eve of Pearl Harbor day.

••• What do

we do now? Is the mkt overbought? Gold bullion is stretched a

bit but gold shares will, IMO, outperform bullion for the days

just ahead. Buying more golds is fairly safe now, since breakouts

over prior resistances provide a safety cushion. We should get

some pull backs but a few buys at mkt can be risked, depending

on the individual chart pattern.

•••Have added

new gold stock - Anglogold. See Back Burner section & Trend

Investor table.

•••Gold in Europe

this Wed morning opened up 2.40 at 512, so we have frosting on

the cake!

•••• Currencies:

Most were little changed Tues, but the powerful C$ made a new

high. The A-$ was also up strongly. Euro unchanged. US$ almost

unchanged at -.07%.

••• T-bonds

rose 1.18% so my rally prediction is still alive.

••CRB minus 1.40.

••••

Bullish Consensus Svc calls

gold overbought at 86% & subject to correction.

••• Silver's

weekly chart shows a breakout with 9.50 the target. Wkly charts

of natural gas also bullish. Ditto oil. The energy sector is

catching fire again. This time less frantically, but solidly.

••• This is

a happy PS. The gold bull mkt is reinforced. Go for it, but stay

with trading rules to capture & protect profits.

Gold luck from your Uncle

Harry

Gold

Goldcorp

2-week trial

of GCRU $45 -- yes, sign

me up!

The following

indexes, mkts & gold stocks are reviewed this week in the

full edition of GCRU:

Agnico (NYSE & Tor)

Anglo American (Nas)

Cameco (NYSE & Tor)

Coeur D'Alene (NYSE/Tor)

Cvs Corp (NYSE)

Eagle Plains (Toronto)

Fnx Mining (AMEX & Tor)

Gammon Lake (AMEX/Tor)

Gold (NY)

Gulfmark (NYSE)

Lihir (Sydney & Nas)

Manitowoc (NYSE)

Meridian (NYSE & Tor)

Newcrest Mng (Oz) |

Newmont (NYSE & Tor)

North American Gold (Tor)

Novagold (AMEX & Tor)

Orezone Res. (AMEX & Tor)

Perseverance (Oz)

Rio Tinto (NYSE)

SGI - SGS (A/D line)

Sierra Pac Res (NYSE)

Teck Cominco (Toronto)

TREND INVESTORS

USD (NYBOT)

Viceroy Explor. (Tor)

Virginia Gold (Tor)

Yamana Gold (AMEX & Tor) |

All charts created with TradeStation

by Omega Research 2000.

###

|

Who

is Harry Schultz? Who

is Harry Schultz?

Chevalier

Harry D. Schultz, KHC, KM, KCPR, KCSA, KCSS, is the highest paid investment consultant

in the world at US$2,400/hour-US$3,400/hour on weekends (International

Edition Guinness Book of Records 1981-2002).

To keep in

touch with developments around the globe, Harry draws from correspondents

in many countries, plus mountains of international newspapers,

magazines, and other data. At the top command posts of Harry's

elite team are Chief Market Analyst, Paul Griffiths, and Research

Editor/geopolitical analyst Gordon Frisch. Loyal HSL and GCRU

subscribers in 90 nations are much more than simply names and

addresses; Harry and his team consider them part of their cherished

global family.

Harry is regularly

quoted in books, articles, and interviews and by other newsletters

(the "alternative press"). Arthur Hailey, a longtime

personal friend and HSL subscriber, based his character Lewis

Dorsey in the bestseller The Moneychangers, directly on Harry

Schultz.

Harry has lived

for extended periods in 18 nations, and shorter periods in many

others. Knighted five times, Harry is a man for all seasons and

a true citizen of the world.

Contact: E-mail:

HSLmentor@racsa.co.cr

Fax: Costa Rica (506) 272-6261

Fax: Switzerland (41) 21 652 0525

Mail: POBox 622, CH-1001-Lausanne, Switzerland

2-week

trial of GCRU $45 -- yes, sign

me up!

Copyright ©1964-2006 F.E.R.C. All Rights Reserved.

Archives

|

Reprinted with

kind permission at 321gold Inc

|