Gold Charts R Us

Trendvesting

Harry Schultz

Archives

September 13, 2004

The

following is an excerpt from Harry Schultz' current GCRU, dated

Sep 8, 2004. The

following is an excerpt from Harry Schultz' current GCRU, dated

Sep 8, 2004.

Gold Charts R Us - sent weekly by Email - $US100/mo for

3, 6, 9, or 12-month subscription periods (fax +$120 per 3-months)

- you can subscribe

here.

2-week trial

of GCRU $45 -- yes, sign

me up!

Welcome to GCRU #128 on Sept 8. Nothing

very bad is happening but also nothing very good, a stagnant

pool. It's the fault of the US$ of course, threatening to break

up from a symmetrical triangle dating from mid-July. A rise to

90.50 (basis Dec futures) in $-Index & above would

be black cloud for gold. A fall to 87.70 would be bright yellow

cloud for gold. So watch those numbers daily.

Under these circumstances I can't advise buying dips this time

as a $-rise would send many golds to the bottom of their

trading ranges & we'd need to see if they hold. Safest strategy

is to buy on 1 day closes over nearby peaks - which would happen

if the $ drops.

Meantime, the world is holding its breath. The euro typifies

the action, also poised in a symmetrical triangle, but also burdened

by a H&S top pattern which is scary -- & troublesome

for gold if it breaks under the 120 neckline. Gold is still in

the trading range we outlined long ago, aprox 380-425. But individual

gold stks are still doing their own thing, as happens in all

trading ranges. Note the bullish wedges & flags to spot the

movers.

While we wait for gold to break & the $ to drop, we have

the energy stocks to keep our cash registers ringing bells. Thank

goodness, we diversified. And they are outperforming crude oil.

Yesterday, with oil down sharply, most energy stks were mixed,

& half rose! See below for new recommendations.

GCRU BREAKING NEWS: Buy & Hold clearly

doesn't pay off. Yet daily trading or even daily monitoring is

not easy for everyone. So, how about invest-&-exit via trends?

Yes - for the non-daily trader (short or medium term) - I've

coined a word for this approach of Investing with Trends: Trendvestors

(T/Vs). It's the middle ground between buy/hold & daily/trades.

So, GCRU is going to offer 1-2 pages of each issue of

GCRU for the Trendvestors. The recom on this/these pages

will be a blessing for those who simply can't find

the time to trade or even monitor every day. For some, a weekly

monitoring via GCRU may be enough. T/Vs can't make as

much profit as daily traders, but far more than the buy&hold

crowd. And it may be the only answer for those with busy schedules

or learner-drivers. Some will probably play both sides

of the street, some daily-acting, some trend-acting. And both

groups benefit from looking at the GCRU charts, especially

the US$ (a compass) plus bullion, the A/D & SGI. We'll launch

this new Trendvesting either next wk or the following

week, after we test it & get the bugs out. The new T/V section

will be greatly simplified, extremely easy to follow, yet still

offer learner-drivers the opportunity to compare those guidelines

with those to traders & study the individual gold charts.

It's win-win-win for U. More work-work-work for us, but the need

seems apparent.

In addition to the energy stks I've recom here for many wks,

all of which are acting well, I found some new ones. Have a look

at these: Denbury Res. (DNR); Westmoreland Coal

(WLB); True Energy (TUI-T); Petrel Res.(LSE) (London);

Centurion Energy (LSE); Transocean Inc (RIG) &

Noble Corp (NE). Gamblers buy toehold longs at mkt; others

buy on pullbacks to support. I haven't space & time to fine-tune

the exact entry&stop prices but IMO they are medium term

buys with small downside risk. U can find the charts on Bigcharts.com

& determine your own entry & stop prices. The point is:

energy & gold are the only clear bull mkts today. U should

have feet in both pools. If the $ breaks upside, gold will drop

but energy stks will rise faster than present pace, IMO. So,

diversification should pay now, as it always has.

Anglo American (Nasdaq: AAUK) daily chart; US$:

Buy recom: GCRU's bot at 22.25; stop:

20.75. If out, wait for strength after dip that holds

on/above 21.40-22.00 support. Or, buy bit on 1-dc over 23.30;

stop: 21.40. Profit/sell targets: 24.95 &/or 26.00.

Basis weekly chart: neutral. Comment: sym triangle

after breakout from trading range. Spinner neg. Monitor May uptrend.

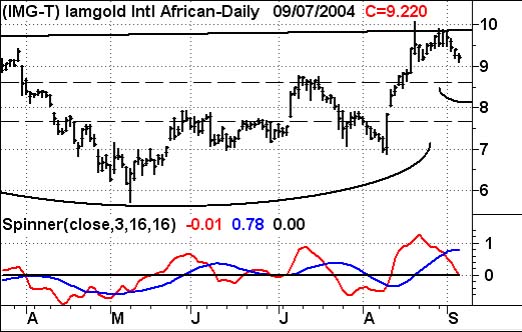

Iamgold Int'l African (Toronto: IMG;

Amex: IAG) daily chart (L/O/C); CAD$:

Trade recom: GCRU's bot bit at 9.15. If

out, wait to buy strength after dip that holds on/above

8.60 support. Or, buy 1-dc over 10.00; stop: 8.50. Profit/sell

targets: 9.85 (if buy low) 10.45 &/or 11.95. Basis

weekly chart: neutral/bullish. Comment: Spinner neutral.

Poss reverse H&S base likely to offer low risk buy on pullback.

Good R/S.

Whew, lots of input, eh? God speed.

From your alchemist gold guru, Whew, lots of input, eh? God speed.

From your alchemist gold guru,

Uncle Harry

Uncle Harry

The following

indexes, mkts & gold stocks are reviewed this week in the

full edition of GCRU:

Schultz Gold Index

Schultz Gold Share Advance/Decline Line

US$ Index

NY gold

Agnico Eagle

Anglo American

Bema Gold Corp

Compania De Minas

Crew Gold Corp

Crystallex Int'l

Gammon Lake Resources

Glamis Gold |

Golden Star Resources

Iamgold Int'l African

Inmet Mining Corp

Meridian

Minefinders Corp

Newcrest Mining

(Sydney)

Newmont Mining Co

Northgate Exploration

Novagold Res

Silver Standard Resources

Tan Range

Wheaton River Mineral |

2-week trial

of GCRU $45 -- yes, sign

me up!

###

Who is Harry Schultz?

Chevalier

Harry D. Schultz, KHC, KM, KCPR, KCSA, KCSS, is the highest paid investment consultant

in the world at US$2,400/hour-US$3,400/hour on weekends (International

Edition Guinness Book of Records 1981-2002).

To keep in

touch with developments around the globe, Harry draws from correspondents

in many countries, plus mountains of international newspapers,

magazines, and other data. At the top command posts of Harry's

elite team are Chief Market Analyst, Paul Griffiths, and Research

Editor/geopolitical analyst Gordon Frisch. Loyal HSL and GCRU

subscribers in 90 nations are much more than simply names and

addresses; Harry and his team consider them part of their cherished

global family.

Harry is regularly

quoted in books, articles, and interviews and by other newsletters

(the "alternative press"). Arthur Hailey, a longtime

personal friend and HSL subscriber, based his character Lewis

Dorsey in the bestseller The Moneychangers, directly on Harry

Schultz.

Harry has lived

for extended periods in 18 nations, and shorter periods in many

others. Knighted five times, Harry is a man for all seasons and

a true citizen of the world.

Contact: E-mail:

HSLmentor@racsa.co.cr

Fax: Costa Rica (506) 272-6261

Fax: Switzerland (41) 21 652 0525

Mail: POBox 622, CH-1001-Lausanne, Switzerland

2-week

trial of GCRU $45 -- yes, sign

me up!

______________

321gold Inc

|

![]()