| |||

Inflation? Soft Landing? Or?Darryl Robert Schoon

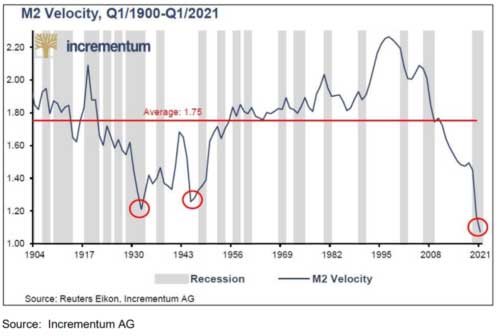

Professor Antal E. Fekete wrote those words in the 2008 financial crisis. Since then, the velocity of money—the measure of economic activity—responded accordingly; plunging in a hyperdeflationary descent to levels lower than even during the 1930’s Great Depression. (Click on images to enlarge) The collapse of two massive financial bubbles—the 2000 dotcom and the 2008 subprime bubble—unleashed deflationary forces beyond the ability of the Fed to reverse. In 2009, the Fed cut interest rates to zero and created trillions of dollars via quantitative easing to replace money rapidly vanishing into deflation’s ever larger black hole. Invented in China in 1024, fiat paper money eventually always succumbs to excessive money-printing and hyperinflation. But fiat money version 2.0, issued by central banks, has an additional Achilles’ heel—hyperdeflation. Both possibilities are now in play.

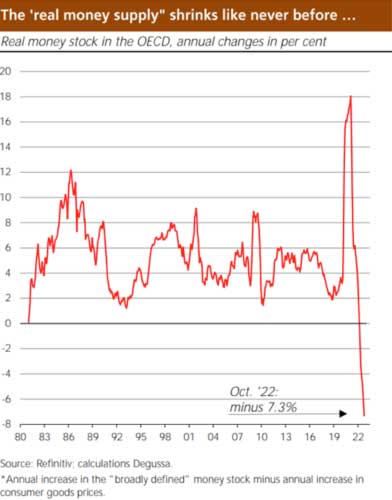

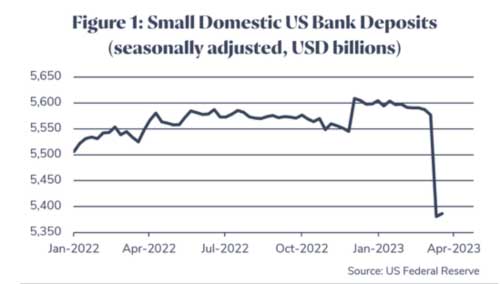

In a hyperdeflationary collapse, aggregate demand contracts, debts default, credit tightens, the velocity of money plunges and money, i.e. circulating credit and debt, disappears. In the 1930s, deflationary Great Depression, money literally vanished. The money supply fell 33%; and it’s happening again today. Today, central bankers are acutely aware current rate hikes have not yet contained inflationary pressures. Even with banks failing, more rate hikes are coming. They will continue because the alternative, i.e. hyperinflation, would render central bankers’ fiat paper money worthless. Today’s investors are desperately hoping for an economic soft-landing; a scenario similar to hardened heroin addicts hoping that withdrawal after lifetime of addiction can happen with little or no pain. While the sentiment is understandable, the possibility is non-existent. Bank Run version 2023 A Fed pivot, if it happens, will result in even more inflation and even more rate hikes. Today, trapped between hyperinflation and hyperdeflation, central bankers have no easy answers. In fact, they have no answers at all. No one is more acutely aware of this than Japan’s central bankers who have been fighting a losing battle against deflation since the collapse of the massive Nikkei stock market bubble in 1990, the greatest deflationary collapse since the U.S. stock market collapsed in 1929. In my book, Time of the Vulture, I described what happened:

To combat deflationary riptides unleashed by the Nikkei’s 1990 collapse, Japan lowered interest rates from 6% in 1990 to a negative -0.1% today. In 2023, however, because of rising inflation, Japan is about to do what it didn’t do in the 1980s—raise interest rates. In 2023, Japan’s rising rates will affect $3 trillion in Japanese investments around the world which would be sold and reinvested in Japanese assets. In the 1980s, the $3 trillion US military buildup would have been affected. Today, it will be the global economy. In November 2016, well before today’s inflationary concerns, I wrote:

Today’s hyperdeflationary collapse was the subject of my talk, The Worst Depression 2009, (sound begins at 0.30) at Professor Fekete’s Gold Standard University in Hungary. ECONOMIES BUILT ON A FOUNDATION OF UNLIMITED CREDIT ARE ABOUT TO BE DESTROYED BY A HYPERDEFLATIONARY DELUGE OF UNPAYABLE DEBT In Time Of The Vulture (2007), I described an economic crisis that most did not see coming. The crisis began in 2008 and is today approaching its cataclysmic resolution. My new book, Docking At The Mothership, predicts a far-better world will emerge, a possibility that appears even more improbable than did the possibility of a severe economic crisis in 2007. In a recent discussion/interview titled, Death of the Evil Empire? (I join the discussion at 33 minutes). I explain why I am certain better times are coming. Buy gold, buy silver, have faith. ### Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later. In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters. In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues. When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148-page analysis, "How to Survive the Crisis and Prosper In The Process." The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues. The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com, has been created to address this interest. |

About Darryl Robert

Schoon

About Darryl Robert

Schoon