What's this? What's this?

Richard Russell

Dow Theory Letters snippet

Apr 20, 2009

April 17, 2009 -- What's this? The Financial Chronicle

reports

that China and India want the IMF to sell its entire holdings

of gold to raise money for funding poor nations (yeah, since

when have China and Russia [India?]

been worried about poor nations?). The IMF has gold holdings

of about $100 billion.

A very small part of China's

reserves is in gold. It's obvious that China wants fewer dollars

and more gold. If China went into the open market for gold, they

would probably drive the price of gold up to $2,000 an ounce.

My bet is that China would like to take in the whole $100 billion

of the IMF's gold. And they're working on it.

"'We have been discussing

with China a common position on the subject,' a senior finance

ministry official told Financial Chronicle. Both [Indian] prime minister Manmohan Singh

and Chinese president Hu Jintao will have to clear the proposal

before the representatives of the two countries can take it up

at the IMF spring meeting in June in Washington."

Russell Comment -- China has been on a round-the-world

collecting binge, buying up all sorts of reserves and businesses.

Why would gold be any different? Clearly, China wants to be one

of the most powerful nations in the world, and now they have

the money to do it (and they're building the high-tech

military to do it, particularly their navy).

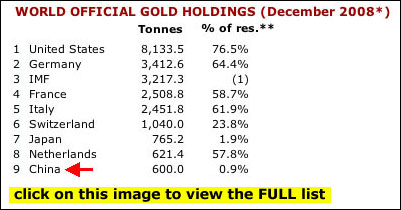

For your interest, below is

a partial list of nations with their gold holdings as a percentage

of their reserves. Note that China has less than 1% of its reserves

in gold.

I've said before that the Achilles

Heel of the US is the reserve status of the dollar. This is what

Russia, China and others (maybe Europe) are chipping away at.

Harry Schultz writes this in his latest mailing:

"The history of reserve

currencies reveals that the position of a country as a superpower

(whose currency acts as a reserve currency) tends to rotate in

a natural cycle of around 100 years. Will history repeat?

From 1450 to 1530 it was Portuguese (80 years). From 1530 to

1640 (110 years) it was Spanish. From 1640 to 1720 (80 years)

it was Dutch. From 1720 to 1815 (95 years) it was French. From

1815 to 1920 (105 years) it was British. And then the US dollar

gradually dominated the scene until 2009 of a period of 89 years."

Now the reserve status of the

fiat dollar is being questioned and actually attacked. The world

wants two things from the US -- it wants the US's help, and it

wants US power off its back. Russia and China want to be the

new world leaders, and the US with its powerful military is in

its way. China knows that the nation with the gold and the nation

with the strongest currency will be the world leader. My question

-- will we see a gold-backed Chinese yuan? I think we may. China,

by the way, is now the world's leading producer of gold.

###

Richard Russell

website: Dow

Theory Letters

email: Dow Theory Letters

Russell Archives

© Copyright 1958-2014 Dow Theory Letters, Inc.

Richard Russell

began publishing Dow Theory Letters in 1958, and he has

been writing the Letters ever since (never once having skipped

a Letter). Dow Theory Letters is the oldest service continuously

written by one person in the business.

He

offers a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was

originally charged in 1958). Trials, please one time only. Mail

your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla,

CA 92038 (annual cost of a subscription is $300, tax deductible

if ordered through your business).

321gold Ltd

|