Precious Metals Market Timing

Go with the tide, and not

against it

Ron Rosen

Nov 4, 2005

"Time is more

important than price; when time is up price will reverse."

-W.D. Gann

The road less traveled may

be paved with gold but it has a silver lining. The W.D.Gann 30

year Master Cycle points the way.

The following are a few

instructions from W.D.Gann.

"There is a time for everything."

"All the laws of nature teach this. There is a time to sow

and a time to reap. The four seasons of the year teach us that

there is a reaping time and a sowing time, and that we can not

reverse this order of nature's laws. It is the same with the

stock market. There is a time to buy and a time to sell. You

must learn to go with the tide, and not against it."

"It is the same with the

commodity market. The young generations either have inherited

money or they make money, and they want to take a chance. It

is the nature of the young to gamble, to take chances,

and to be fearless of danger. Therefore, the young generation

is anxious and eager to try their hands at speculation."

"When you learn the past

history of a commodity, learn the way it is running, what cycle

it is in, and then make a trade on definite knowledge, your chances

for success are 100 % greater."

"Nothing will help you

more than going over the past history for commodities, and studying

its actions under different periods. If you know what a commodity

has done in the past, you have a better chance to determine what

it will do in the future."

"The farther back you

have a record of a stock or commodity and the more you study

it, the more you will understand its actions and know when it

is making tops and bottoms. You should become thoroughly acquainted

with the stocks and commodities you trade, and by studying them,

you will learn their individual moves which are peculiar to themselves."

"Everything moves in cycles

as a result of natural law of action and reaction."

"Time is the most important

factor in determining market movements because the future is

but a repetition of the past and each market movement is working

out time in relation to some previous cycle."

"By studying time cycles,

you will learn why tops and bottoms are formed at certain times.

In order to be accurate we must know the major cycles."

"30 year cycle"

"This is the main cycle

and the minor cycles are proportionate parts of the 30-year cycle

or circle."

W.D.Gann, thru his massive

studies, discovered the importance of time in the markets. However,

he did not have the ultimate timing tool. We do, and it is called

the Delta turning points. The Delta turning points cover the

intermediate, medium and long term time factors.

Combining the W.D.Gann 30 year

Master cycle and the Delta turning points we can arrive at an

approximate time for a major silver bottom. The charts posted

below will be our guide. One is from the past, 30 years ago,

and one is from the present. Before we look at the charts let's

review the importance of the 30 year cycle.

THE IMPORTANCE OF THE 30

YEAR SILVER CYCLE.

Silver bottomed on November

3, 1971.

30 years later Silver made a double bottom on November 26, 2001.

Starting on November 3, 1971,

silver advanced for 2 years, 3 months and 23 days.

30 years later starting on November 26, 2001, silver advanced

for 2 years, 4 months and 7 days.

Silver topped on February 26,

1974 and had a vicious decline of 43%.

30 years later Silver topped on April 2, 2004 and had a vicious

decline of 45%.

Silver bottomed on January

26, 1976.

30 years later Silver is due for a Delta long term # 4 low on

February 15, 1976.

In addition to Gann cycle studies

and Delta turning points, I have observed that the waves from

Elliott Wave movements always terminate at a Delta turning point.

I have found this to be a most valuable observation when attempting

to project wave movements. We know when the Delta turning points

are due but without Delta we can not know when any Elliott Wave

is due. With Delta we have what Elliott was missing. The Gann

Master cycles, Delta turning points and the Delta turning points

used to project Elliott wave movements are the three most powerful

market tools I have observed. My observations cover a 50 year

period.

On to the silver charts. One

is from the past and one is from the present.

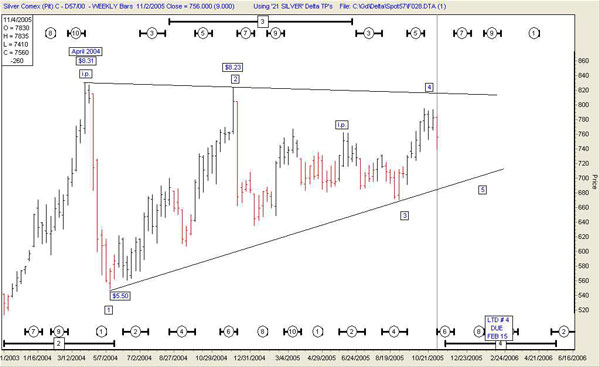

The 30 year cycle in silver

is repeating.

SILVER CORRECTION

1974 TO 1976

SILVER CORRECTION 2004 TO (2006?)

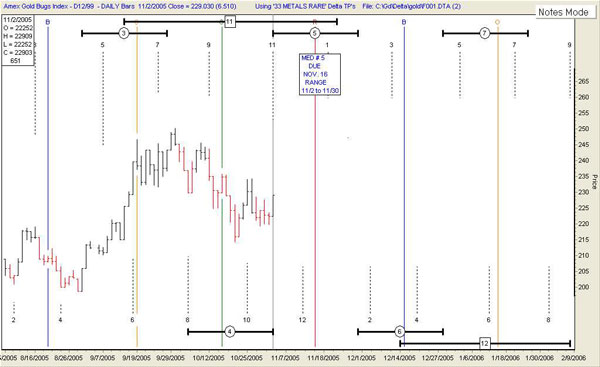

Silver is still headed for

medium # 6 low due November 16th.

SILVER DAILY CHART

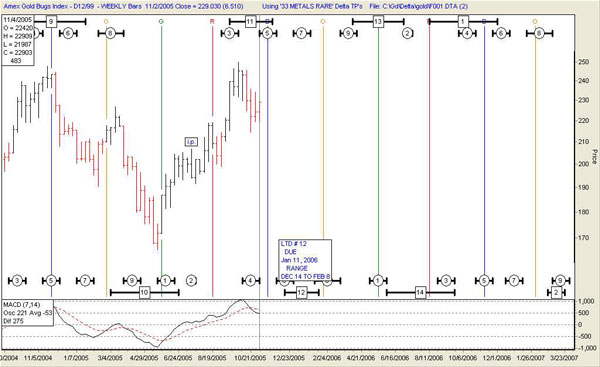

SILVER WEEKLY CHART

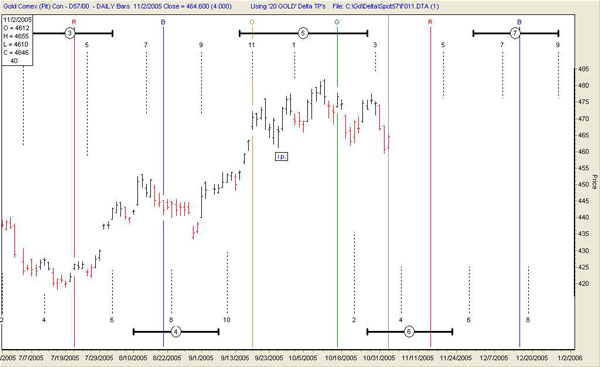

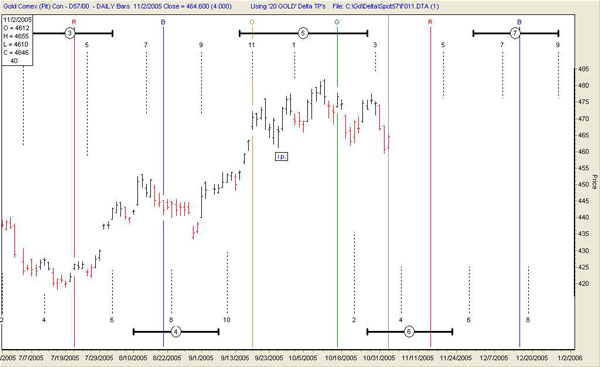

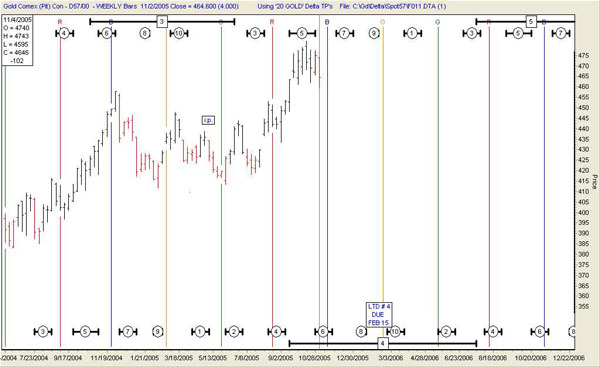

Gold medium # 6 low may be

in or is very close.

GOLD DAILY CHART

GOLD WEEKLY CHART

Medium # 5 high may still be

ahead.

HUI DAILY CHART

HUI WEEKLY CHART

Elliott Wave Theory

CRITICISM

"The theory is far from

universally accepted. Critics deride it as being too vague to

be useful, since there is not always a clear definition of when

a wave starts or ends, and prone to subjective revision."

Wikipedia

Elliott Wave theory would be

of much greater value if you knew in advance when a wave would

top or bottom. The Delta turning points provide the information

that the best of wave theorists have never had. Delta can tell

you when to expect a completed wave. No more guessing, no more

waiting for a pattern to complete in order to know when the wave

will terminate. The Delta turning points are an invaluable companion

to the Elliott Wave Theory. Without Delta the wave theory is

a guessing game. Ralph Nelson Elliott said that the wave theory

is best used to identify a completed move. That information is

valuable but it is not predictive. Combining Delta with wave

theory you will know approximately when the next wave will terminate.

"Time is more important than price; when time is up price

will reverse" -W.D. Gann.

Delta, W.D.Gann and Elliott

Wave Theory combined are the "Trinity" of technical

analysis. Time has been the missing ingredient with the wave

theory. It has been found by using the Delta turning points.

Stay Well,

Nov 3, 2005

Ron Rosen

email: rrosen5@tampabay.rr.com

Subscriptions

are available at:

www.wilder-concepts.com/rosenletter.aspx

Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions. Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions.

The Delta Story

Tee charts reproduced

courtesy of The Delta Society International.

321gold Inc

|