Ron Rosen Precious

Metals Timing Letter Ron Rosen Precious

Metals Timing Letter

It's getting closer and

closer

Ron Rosen

posted Nov 3, 2006

written Oct 30, 2006

"Time is more

important than price; when time is up price will reverse."

-W.D. Gann

It's getting closer and closer.

It appears that lift off will occur in about 4 to 5 weeks. I

will attempt to pin point lift off as time proceeds. If they

knew what was soon to happen, the "crowd" would be

amazed.

Gold appears ready to break out before the HUI breaks out. However

we must remember that the HUI, when it breaks out, will be entering

a, "third of a third" wave. Gold will just be starting

its third wave. Gold will be entering the first minor wave of

its major third wave. In reality the HUI is ahead of gold bullion

when it comes to the wave count. Gold will most likely decline

to complete the [e] leg of the triangle. Gold is topping at Delta

long term #6 high. The [e] leg low is due at Delta long

term #7 low. We know that every leg of any and all formations

including Elliott waves must begin and terminate at a Delta turning

point. This information is invaluable and extremely important

to traders and investors.

GOLD WEEKLY

GOLD WEEKLY

Silver, like gold, appears

ready to break out right after a small [e] wave is finished.

Silver and gold may start up before the HUI. If they do, you

should expect to read all kinds of reasons as to why this is

happening. I suggest we ignore all of them and concentrate on

the turning points and the difference between a third of a third

and the beginning of a third wave. That's where the differences

exist.

SILVER WEEKLY

SILVER WEEKLY

The weekly pattern in the dollar

index in 2006 is virtually identical to the weekly pattern in

2002.

"The future is but a repetition

of the past. The same formation at tops or bottoms or intermediate

points at different times indicates the trend of the market.

Therefore, when you see the same picture or formation in the

market the second and third time, you know what it means and

can determine the trend." W.D.GANN

DOLLAR INDEX WEEKLY

NOVEMBER 2006

DOLLAR INDEX WEEKLY

NOVEMBER 2002

DOLLAR INDEX WEEKLY

NOVEMBER 2002

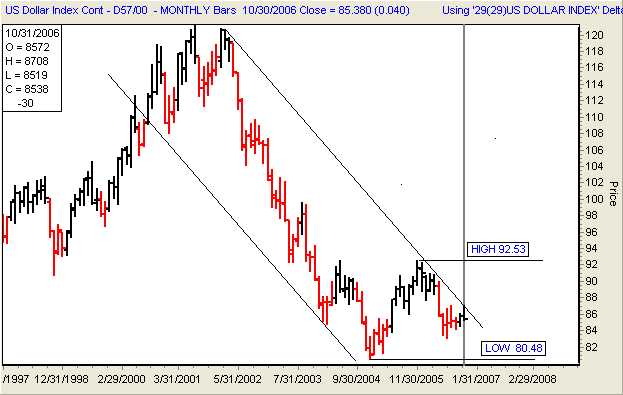

This chart shows what happened

to the dollar after the first pattern and triangle was complete.

It's not a pretty sight for dollar bulls. However, it will be

fuel for the rise in the precious metals complex. The 2006 triangle

is nearly complete. A small rising [e] wave should lead to the

beginning of the next decline.

DOLLAR INDEX MONTHLY

Stay Well,

Ron Rosen

email: rrosen5@tampabay.rr.com

Subscriptions

are available at:

www.wilder-concepts.com/rosenletter.aspx

Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions. Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions.

The Delta Story

Tee charts reproduced

courtesy of The Delta Society International.

321gold

|