Precious Metals Market Timing

HUI, Gold, Silver, Homestake

Ron Rosen

May 10, 2005

"Time is more important

than price; when time is up price will reverse" W.D.

Gann

"There is an appointed

time for everything, and there is a time for every event under

heaven". Ecclesiastes 3:1

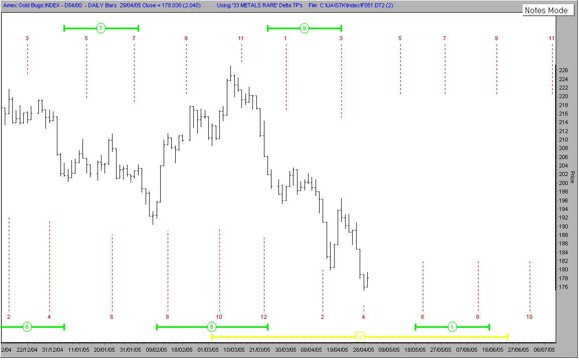

HUI DAILY

MEDIUM # 1 LOW - DUE JUNE 15 MEDIUM # 1 LOW - DUE JUNE 15 HUI WEEKLY

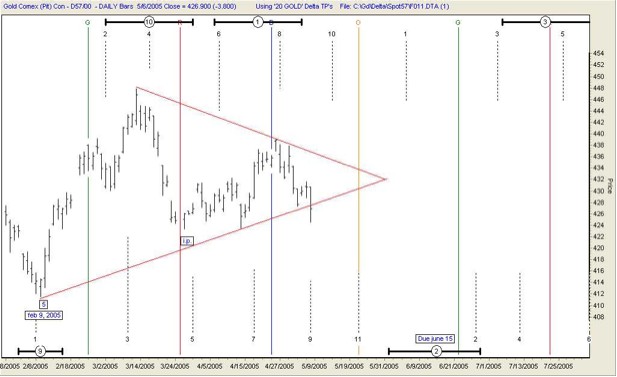

MEDIUM # 1 LOW - DUE JUNE 15 MEDIUM # 1 LOW - DUE JUNE 15 GOLD DAILY

MEDIUM # 2 LOW - DUE JUNE 15 MEDIUM # 2 LOW - DUE JUNE 15

GOLD WEEKLY

MEDIUM # 2 LOW - DUE JUNE 15 MEDIUM # 2 LOW - DUE JUNE 15 HUI MONTHLY

HOMESTAKE

MINING

***** 1967 to 1970***** ***** 1967 to 1970***** FIRST PHASE

COMPLETELY WIPED OUT This report may seem a bit

far out to some but I am going to tell it like I see it, interpret

it might be a better way to put it. First with Delta turning

points the biggest moves tend to come on either side of point

# 1. You will see on the charts above, beginning at the top,

that both the HUI and Gold Bullion are on either side of Medium

Delta points # 1. The HUI is on the left of point # 1 and Gold

bullion is on the right of point # 1. Both of the points they

are approaching (# 1 and # 2) are scheduled to be lows on or

about June 15th.

If you look at the charts of

gold bullion you will see that bullion is scheduled to make a

low at # 2 on or about June 15th. We may be witness to a decline

in both but first the HUI may have to complete a small 4th wave

up. To see this look at the HUI chart that has the ABC corrective

pattern I posted just above the chart. It appears the small 4th

wave may have a bit more to go on the upside. To confirm this

you can see on the daily HUI chart we are headed up to an intermediate

# 5(red). We should be there in 5 trading days plus or minus

a few. Once there we should head down to complete this ABC 18

month long corrective pattern. If the HUI bottoms in the area

of 150 it would have to be considered a flat type correction.

A flat type correction occurs when there is a tremendous amount

of underlying buying potential. The potential buyers start accumulating

before the price can go any lower thus the ABC pattern looks

flat compared to a zig zag which has a lightening bolt appearance.

The last leg down of the zig zag makes a substantial low beneath

the rest of the pattern.

Now for the really far out

interpretation let's look at the chart of Homestake mining.

I am going to suggest that we may witness the "Rule of Alternation"

taking place more then 30 years apart.

THE RULE of ALTERNATION

"It primarily instructs

the analyst not to assume, as most people tend to do, that because

the last cycle behaved in a certain manner, this one is sure

to be the same."..."Elliott went even further in stating

that, in fact, alternation was virtually a law of markets."

If you will look at the chart

of Homestake Mining you will see that I made some notations at

the bottom of the chart. The first phase of the gold bull market

of the 1970's ended with a vicious zig zag type wipe out of the

entire first phase rise. That first phase ended in 1970. You

can see this clearly on the Homestake chart. It was a Zig Zag

although it does not look like it on that chart.

Our first phase over 30 years

later is coming to an end and looks very much like a potential

flat correction and not a ZIG ZAG. This makes a lot of sense

to me because there is a great deal more institutional interest

in the precious metals market today then there was 30 years ago.

Perhaps the "BIG" money is hiding nearby waiting to

start accumulating or reaccumulating. I doubt that Buffett

or his peers had much interest in precious metals or currencies

30 years ago. Wall Street has created the instruments they think

the public will want if they want to buy gold. Thirty odd years

ago the "house" seriously frowned on any broker that

was dealing in gold or silver shares. They were considered mavericks.

Not so this time around.

It appears to me that we may

be close to the end of this potential 18 month first phase correction.

I am guessing we will see the bottom in June/July. It may be

lower but I doubt it will be a total collapse like it was 30

plus years ago.

I will make a statement that

sounds braggadocios but I don't mean it that way. I actually

found it amazing that I was the only person I could find that

called the top of the precious metals share market back at the

end of 2003. I thought it was very obvious looking at the monthly

chart of the HUI. The HUI made an absolutely perfect 5 wave monthly

move. It could not have been more perfect, at least according

to me. I am sure there were others that saw and acted on this

but they did not go public with the information. If they saw

what I saw then, they probably see what I see now. I expect the

gold and silver bullion markets to spend many more months correcting

while the precious metal shares, the HUI and XAU, are being accumulated

and moving up slowly. Regardless of everything I have just written

I will not recommend buying the precious metal shares until the

market proves it has bottomed. The proof does not arrive with

the bottom it arrives after the bottom. I will be writing more

about this early next week.

The Precious

Metals Timing Letter may be subscribed to at the Delta site.

Charts with the Delta turning points, intermediate, medium and

long term, will be provided with the charts of gold, silver,

the HUI and XAU. Turning points for all gold shares are the same.

The Delta site address is, www.wilder-concepts.com.

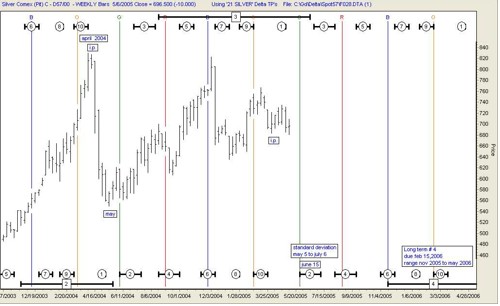

I've left silver for last because

on my hit parade it belongs in last place In spite of all the

hype. I have in the past; I do now and probably always will consider

silver, "The Bitchy" Metal. This goes way back to when

jewelry artisans who were using the Lost Wax Method of making

jewelry never knew if a silver cast was going to be full of gaps

and air holes. They knew that gold casts were always perfect.

Because of silver's characteristics they dubbed it the

"Bitchy" metal. It seems that this characteristic has

drifted down to the trading pits. There is one thing silver can

not fool and that is the Delta turning points. The Delta turning

points are a measure of "Natures" timing. It's just

difficult to predict what extremes those movements will go to.

So the proper procedure is to settle for whatever the price is

when the time arrives.

"Time is more important

than price; when time is up price will reverse." W.D.

Gann

SILVER

WEEKLY

May 10, 2005

Ron Rosen

email: rrosen5@tampabay.rr.com

Subscriptions

are available at:

www.wilder-concepts.com/rosenletter.aspx

Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions. Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions.

The Delta Story

Tee charts reproduced

courtesy of The Delta Society International.

321gold Inc

|